A hawkish BSP may come 'sooner and faster' in 2022 — Fitch unit

MANILA, Philippines — The Bangko Sentral ng Pilipinas may start tightening monetary policy "sooner and faster" amid growing pressure from a hawkish US Federal Reserve, recovering domestic demand and elevated inflation.

In a commentary sent to journalists on Monday, Fitch Solutions, a unit of the Fitch Group, said the BSP would likely begin withdrawing the stimulus it provided during the pandemic as early as the second quarter of 2022, much sooner than the initial forecast for a rate liftoff to come in the last quarter of next year.

The tightening is also expected to be more aggressive than previously predicted. Fitch Solutions said the central bank is forecast to raise its key rate by a total of 75 basis points next year, higher than the old projection of a 50-bp rate hike by end-2022.

“We believe the BSP will take a somewhat more gradual approach but note that risks are to the upside, particularly if a ‘taper tantrum’ scenario was to occur over the coming months,” the Fitch unit said.

Should the BSP indeed begin tightening in the second quarter of 2022, it would mean the key rate would go up while the economy likely remains short of where it was before the pandemic struck. The government itself said gross domestic product would be back to pre-pandemic levels “sometime at end of 2022, if not early 2023.”

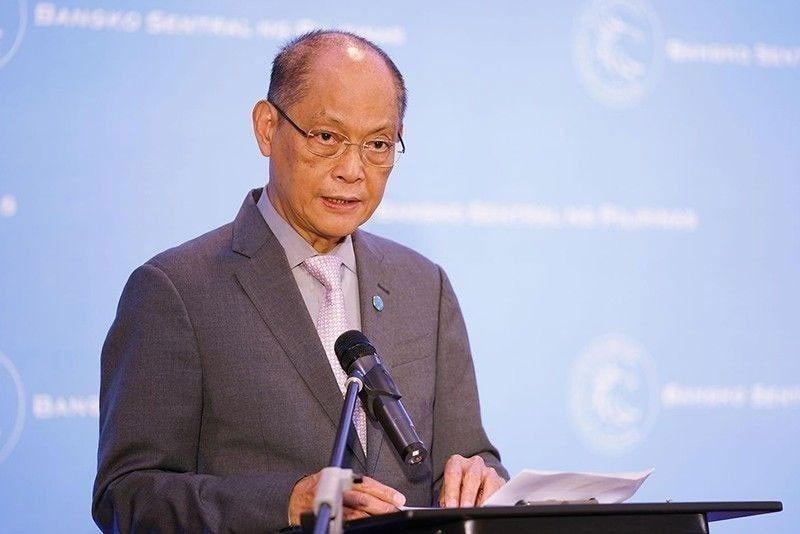

At its meeting last week, the powerful Monetary Board kept the benchmark rate — typically used by banks as basis when charging interest for loans — at historic-low 2%, which Governor Benjamin Diokno described as an “appropriate” move given the “manageable inflation environment and uncertain growth outlook.”

At the same time, the Monetary Board revised its inflation forecast for this year to 4.4%, from 4.1% previously, due to “lingering supply-chain bottlenecks”. Next year, the BSP sees inflation settling at 3.3%, faster than the old projection of 3.1%.

That said, Fitch Solutions believes the BSP’s space to keep its ultra-loose monetary policy is narrowing. Last week, the US Federal Reserve said the US economy has healed to the point that the central bank could slow the pace of its bond purchases "if progress continues broadly as expected," which some observers took as a signal that the first post-pandemic rate hike may come next year.

In turn, Fitch Solutions said the BSP may follow suit and hike rates to avert a deep currency slump and stem capital outflows.

But beyond external pressures, Fitch Solutions said the economy is expected to rebound next year, something that would likely prompt the BSP “to normalize sooner rather than later to anchor investor appetite for Philippine assets and temper demand-side inflationary pressures.”

“On the inflation front, continued supply-side disruptions and a pick-up in domestic demand could see inflation expectations begin to climb, requiring a sooner and more aggressive monetary tightening cycle from the BSP,” it added.

- Latest

- Trending