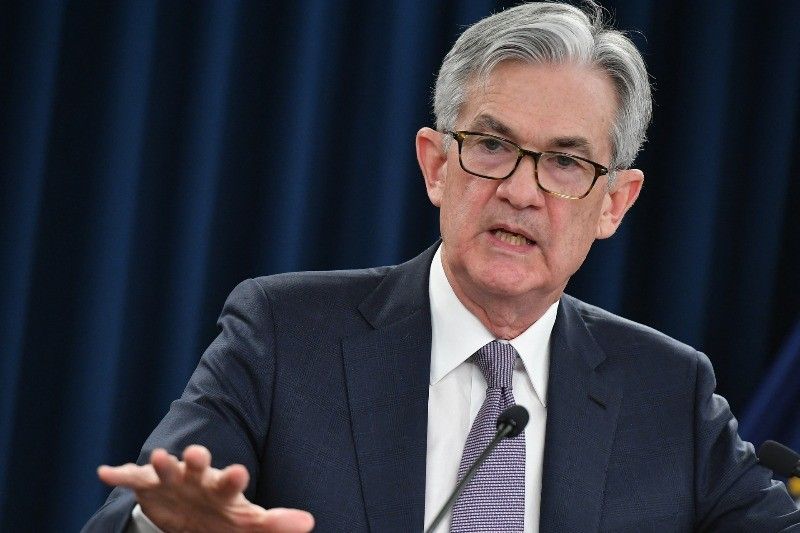

US Fed chief says stimulus to continue despite high inflation

WASHINGTON, United States — Even as US inflation has hit the highest rate in over a decade, the central bank is sticking to its guns, and will continue to provide stimulus until the economy has fully recovered, Federal Reserve Chair Jerome Powell said Wednesday.

Powell acknowledged that the inflation spike was stronger than the Fed was hoping to see, and will remain "elevated" in coming months, but he again expressed confidence the rate will decline once supply bottlenecks and other temporary issues are resolved.

And he reassured lawmakers that the central bank has the tools to deal with inflation and will react quickly if needed.

However, the world's largest economy still has "a long way to go" to return to full employment following the Covid-19 pandemic, Powell said in his semi-annual testimony to Congress.

The Fed "will ensure that monetary policy will continue to deliver powerful support to the economy until the recovery is complete," he said.

The US central bank cut the benchmark lending rate to zero at the start of the pandemic and implemented a massive bond-buying program to provide liquidity to the economy.

As businesses have reopened amid the widespread availability of Covid-19 vaccines, inflation has surged, with the annual consumer price index (CPI) hitting 5.4 percent in June, the highest since August 2008.

Wholesale prices also are soaring, with the producer price index jumping to 7.3 percent in the 12 months ended in June, the highest since the Labor Department began measuring in November 2010, according to data released Wednesday.

But Powell and other Fed officials have stuck to their argument that the rapid price increases have been driven mostly by temporary issues related to the struggles to reopen the economy following the pandemic shutdowns, and are not a reason to pull back on stimulus efforts.

Many private economists agree, saying inflation peaked in June, but Powell nonetheless faced numerous questions about prices from members of the House Financial Services Committee.

Moderating inflation

While the inflation jump was higher than officials expected, Powell said it has been "consistent" with the dynamic the Fed has highlighted, and comes largely "from a small group of goods and services that are directly tied to the reopening of the economy," such as cars and airline fares, he told lawmakers.

The spike was driven by a "perfect storm" of high demand and low supply, he said, pointing to issues including a global semiconductor shortage that has hindered auto production.

He said those factors "should partially reverse as the effects of the bottlenecks unwind."

Powell stressed that the Fed can deal with price increases and will act if there are signs of "troublingly high inflation," but policymakers will not react to short-term increases, since that would mean slowing the pace of the overall recovery.

Too much stimulus?

Central bankers have pledged to maintain their stimulus until inflation holds above their two percent goal and the labor market has recovered, but Powell said "reaching the standard of 'substantial further progress' is still a ways off."

Asked in the hearing to describe what progress the Fed is looking for, he said it was "very difficult to be precise" because there are multiple factors to consider.

He noted that low wage workers, African Americans and Hispanics were hardest hit by the pandemic job losses and "still have the most ground left to regain."

Some Republicans argued that generous unemployment benefits may be keeping workers on the sidelines, but Powell said any impact will be short-lived since the extra aid expires in September.

Fed officials have begun to discuss when they will start to taper the $120 billion in bond purchases they are making each month, and Powell again pledged to give advance notice before making any changes.

Stock markets gave hesitant approval to Powell's testimony, with the S&P 500 and Dow finishing higher but the Nasdaq falling.

Republicans lawmakers pressed the Fed chief -- without success -- to link rising inflation to both massive government spending during the pandemic and the $3.5 trillion budget Democrats have proposed that includes infrastructure spending President Joe Biden is pushing for.

Powell repeatedly dodged efforts to be drawn into the political debate, but said, "I do think it's clear that investments in good infrastructure can add to economic potential, provided the money is well spent."

- Latest

- Trending