FDIs clock triple-digit growth in April on low base

MANILA, Philippines — Foreign direct investments to the Philippines posted another month of triple-digit growth in April, with much of the lift coming from base effects from last year’s pandemic-induced slump.

What’s new

FDIs posted a net inflow of $679 million, up 114.4% year-on-year, the Bangko Sentral ng Pilipinas reported Monday. A net inflow means more job-generating foreign capital entered the country against those that left.

However, that was smaller compare to $808 million net inflows recorded in March.

Why this matters

Unlike the so-called “hot money” which enters and leaves markets with ease, FDIs are firmer commitments that provide jobs for Filipinos, so the government wants to attract more FDIs and not only keep existing ones.

Since peaking at $10.26 billion in 2017, FDIs have been on a downtrend and the pandemic only worsened the slump. Last year, FDI net inflows contracted 24.6% on-year to $6.5 billion, the lowest in 5 years after investors postponed expansion plans to keep themselves liquid amid the pandemic.

What the BSP says

In a statement, the central bank attributed the headline-grabbing FDI figure in April to “positive foreign investor sentiment on the country’s macroeconomic fundamentals and strong growth prospects.”

Much of the boost came from low base effects: because the pandemic shrank the FDI figures last year, the 2021 readings would be inevitably larger when compared year-on-year.

But data showed FDIs are indeed on the mend. From January to April, FDI net inflows amounted to $3.1 billion, up 56.3% year-on-year and nearly matching the $3.0 billion recorded in the same period in 2019, or before the pandemic struck.

For this year, the central bank forecast a net FDI inflow of $7.5 billion, albeit still lower from pre-pandemic level of $8.7 billion.

Other figures

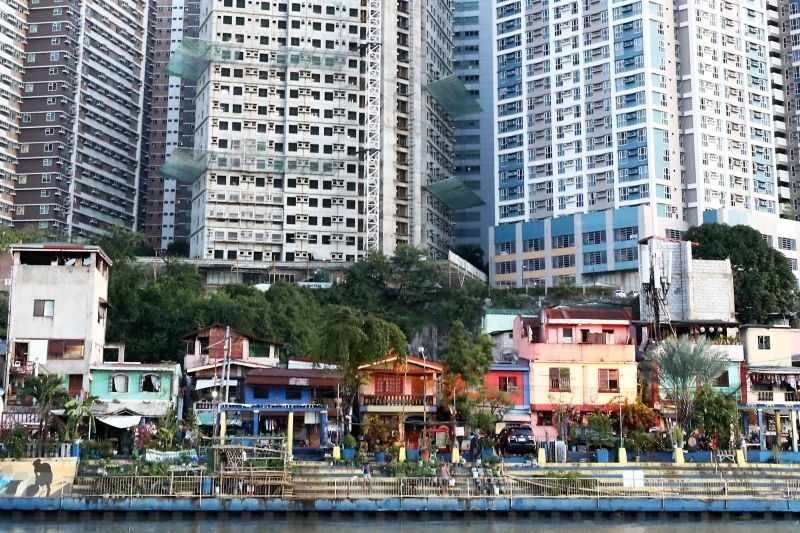

- In April, equity capital placements, a gauge of new FDIs, grew 131.0% to $108 million, with majority of fresh FDIs coming from Japan, the United States and Singapore. These were invested largely in the manufacturing and real estate industries.

- Meanwhile, $11 million FDIs headed for the exit in April, down 75.1% annually.

- Latest

- Trending