Economy down, inflation up in pandemic-stricken Philippines in Q1

MANILA, Philippines (UPDATE 1 11:50 a.m., May 11) — The Philippines stayed in recession in the first quarter as expected, making official intuitions that once Southeast Asia’s fastest growing economy would crawl back to prosperity in the face of soaring prices, more infectious coronavirus variants and sluggish vaccinations.

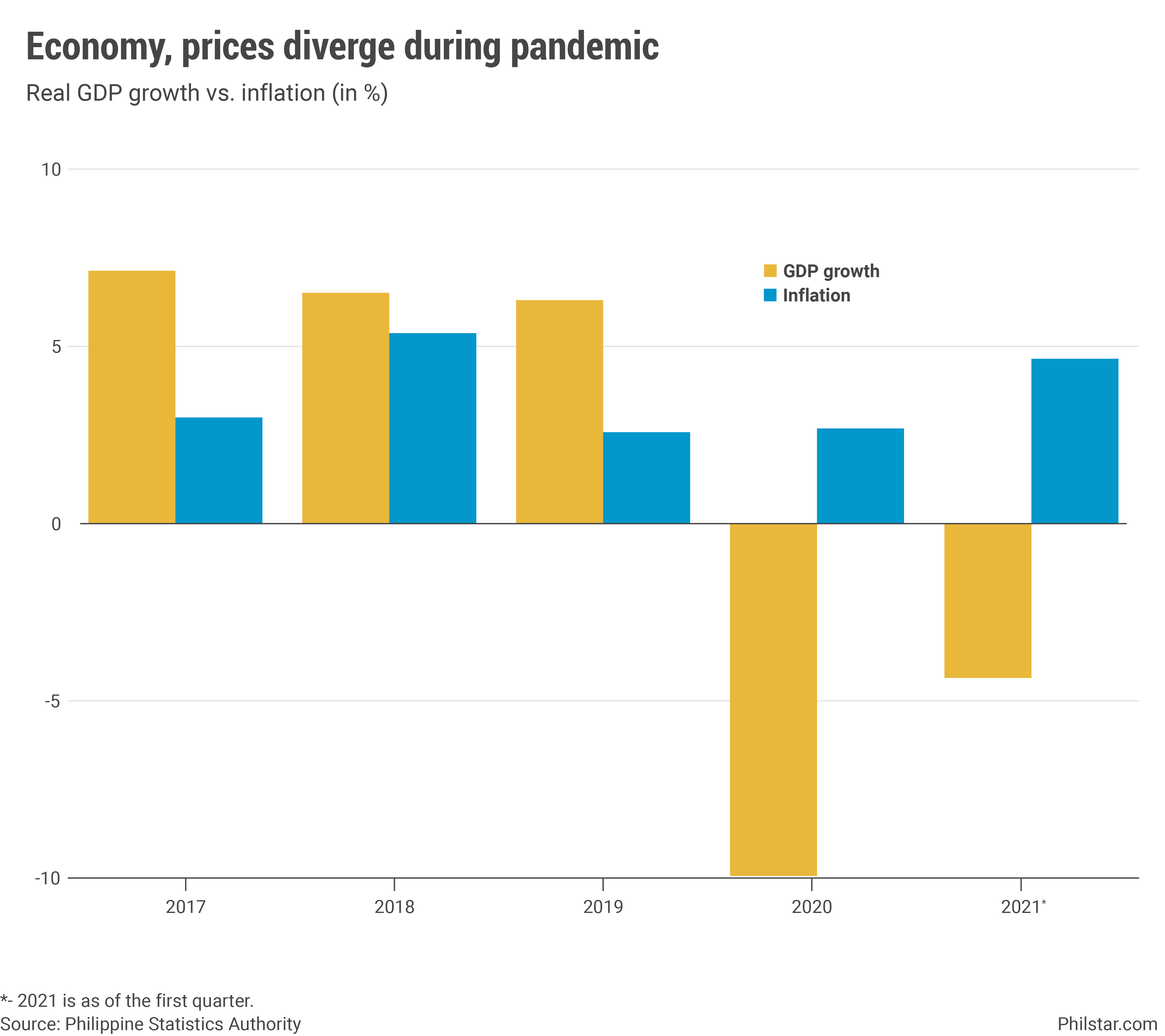

Gross domestic product (GDP) shrank 4.2% year-on-year from January to March, worse than the 0.7% contraction a year ago when the pandemic had just started, government statisticians reported on Tuesday.

A lot of the bad turnout was simply a manifestation of the drastic changes the virus imposed in just a year— while in 2020 the economy was in full throttle in January and most of February before the health crisis emerged, this year businesses and consumers have had to live with COVID-19 and its restrictions, from curfews to capacity limitations in shopping malls and public transport.

Unlike last year as well, inflation is fast becoming a problem in an already weakened economy. Staggering pork prices pushed the price of basic goods and services by 4.5% in the first quarter, running above the central bank’s 2-4% annual target. The combo of stagnation and fast inflation meets the technical definition of “stagflation,” but Socioeconomic Planning Secretary Karl Kendrick Chua would not call it that just yet.

“Our targets are annual so we would not call it (stagflation) until the data justifies it,” he said in a briefing.

To be fair, there are streaks of good data that came out with the already expected year-on-year contraction. First, there was a minimal 0.3% gain from the fourth quarter of 2020. The slump also moderated from 8.3% in the fourth quarter and 11.5% in the three months before that. On plot that looks set for a V-shaped recovery, but analysts, most of whom were expecting only a 3.4% slump last quarter according to Bloomberg, were careful to draw conclusions that the economy is on a mend.

“See, comparing to last year is not fair owing to base effects,” Sanjay Mathur, chief Southeast Asia economist at ANZ Bank, said in an email. “That said, the weakness reflects the frequent imposition of mobility restrictions and interruptions to reopening of the economy.”

Indeed, it will be hard not to see a return to growth next quarter, especially when the economy is coming off from record collapse of 16.7% same period in 2020. That would distort the comparison in favor of better numbers— the so-called low-base effect, which Chua admitted is part of the calculations— but may not necessarily mean that things are actually better.

For one, Ruben Carlo Asuncion, chief economist at UnionBank of the Philippines, said growth drivers have not yet performed at their pre-pandemic levels. Household spending, which typically represents 70% of output, shrank 4.8% year-on-year from around 4-5% growth in normal times. State spending offset these losses with a 16.1% growth driven by a 26.2% jump in construction activity attributed to the government’s infrastructure agenda.

Meanwhile, a 2-year-old African swine fever dragged agriculture by 1.2% year-on-year. However, industries as well as services, home to the Philippines’ large outsourcing sector, collapsed a larger 4.7% and 4.4%, respectively.

That said, Chua expects better numbers in the second quarter, saying that tightened lockdowns in Metro Manila and four nearby urban areas were not restrictive enough to put the economy in a halt. Public transport is operating at half their typical capacity, most establishments are open between 10-30% their usual customers, while a large number of consumers may actually go out.

After contracting a record 9.6% last year, the Duterte administration expects a quick bounce-back to 6.5-7.5% growth this year, although Chua said that target will now be up for review considering the first quarter data.

“We will see downside risks for these past 7 weeks of ECQ (enhanced community quarantine) and MECQ…but I don’t think negative growth in second quarter is possible,” Chua said.

Editor's note: Updates on Chua's statements, other GDP details

- Latest

- Trending