Banks stuck at grim trend of shrinking loans, rising unpaid debts

MANILA, Philippines — Banks sustained a grim trend of tepid lending while accumulating unpaid loans, a dangerous combo blocking central bank efforts to bring liquidity to pandemic-stricken consumers and businesses who need them the most.

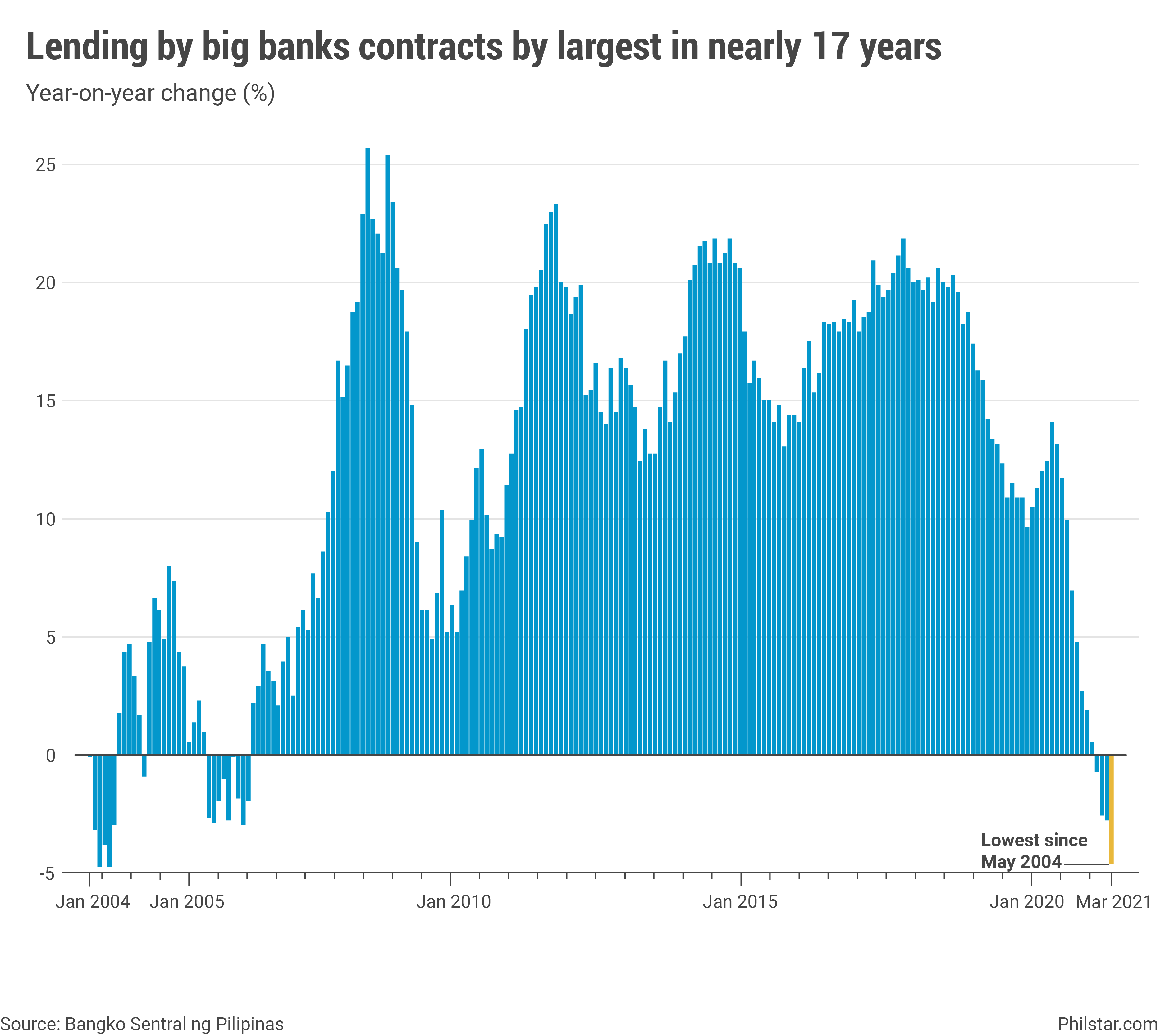

On one hand, big banks have continued to resist on giving out credit with outstanding loans, except lending to each other, shrinking 4.5% year-on-year in March, a report showed on Monday. That was the fourth straight month of worsening contraction and the steepest slump since May 2004.

Part of the reason banks are reluctant to lend is their growing pile of bad debts. Across the broader banking system, gross non-performing loans went up 3.2% in just a month’s time and were already equivalent to 4.21% of entire loan books. That was, in turn, the largest NPL ratio since August 2009 or during the aftermath of the global financial crisis.

Such scenario of decreasing loans and ballooning unpaid credits has been happening at the height of coronavirus lockdowns in April last year, and observers were careful to project an end to the trend this early. If anything, they are only expecting the divergence to worsen as lenders pull back from lending— exacerbated by wary borrowers afraid of getting burdened by debt— while their loan portfolios sour with declining incomes and elevated joblessness.

Even the Bangko Sentral ng Pilipinas (BSP) believes things will get worse first before they get better. Apart from NPL rising as much as “above 5%” this year as banks predicted, BSP Deputy Governor Chuchi Fonacier said the same see their defenses, as measured by NPL coverage ratio, crumbling down to 76% by yearend from over 100% before the pandemic struck.

That means banks are not only anticipating hard times to persist, but are seen tapping on capital they raised during the rainy days to keep them afloat. In March, the coverage ratio already slid to 83.09%, the lowest since February 2009.

Meanwhile, lenders are not differentiating between consumers and enterprises in terms of lending. Loans to large production activities including infrastructure building and those that fund company operations dipped 3.2% year-on-year in March even as they are more likely to have sustainable cash flows than households. Lending to the latter, who may just be looking to augment income through loans, plummeted by a tenth, the worst on record.

In a broader scale, this is becoming a huge roadblock to a much-criticized government strategy of relying on banks for recovery. The Duterte administration has rejected persistent calls to step on the spending accelerator, banking on lenders instead to provide funds to jumpstart an ailing economy. That has not happened, and the first quarter data on gross domestic product out Tuesday may show the severe consequence of such tact.

Worse, the impact may go well beyond just a delay on return to growth path. While the world battles a raging coronavirus, in the Philippines the pandemic is compounded by an African swine fever epidemic that killed pigs and tightened supplies of a major protein source, stoking inflation. Apart from pork imports, the administration rolled out P40-billion in loans from state banks to hog raisers as a quick fix, but appetite to borrow is low because businesses do not see their profits improving.

Some have argued that a looser fiscal policy is warranted at this time simply because banks will only lend if brighter economic prospects are expected. "New coronavirus strains/variants that are more contagious could potentially slow down the economic recovery...that could also slow down any pick up/recovery in loan demand," Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said.

BSP had said that its aggressive easing last year, which brought key rates at record-lows, have released over P2 trillion in liquidity to the financial system, but with banks not confident that the worst is over for the economy, cash is only circling back to the central bank which would need to consistently absorb excess funds to keep inflation under control. The result is slowing money supply growth of 8.5% year-on-year in March, the weakest in one and a half years.

With the government sticking on its fiscal guns at the moment, analysts agree the end to this cycle is not yet in sight.

- Latest

- Trending