Phoenix Petroleum returning to pre-COVID-19 performance

MANILA, Philippines — Phoenix Petroleum Philippines Inc. expects to hit near pre-COVID-19 numbers starting April as it focuses on high growth businesses while economic activity continues to pick up.

“April is looking like it’s going to be our first month very close to pre-COVID levels, if not pre-COVID levels already. So, I’m quite pleased with what we’re seeing in our April monthly performance,” Phoenix president and CEO Henry Albert Fadullon said during the company’s annual stockholders meeting.

Phoenix registered a net income of P415 million in the first quarter of 2019 but logged P215 million in net losses in the same period last year due to volatile global oil prices and the impact of the COVID-19 pandemic.

This year, the company’s first quarter performance registered quarter-on-quarter improvements, Fadullon said.

“January was a slow start for the year, but we had very strong February, March results, such that our first quarter is looking much better than fourth quarter of 2020,” he said.

Despite the oil price and demand crash due to the pandemic, Phoenix registered a full-year net income of P63 million last year, after posting a net income of P158 million in the fourth quarter which “effectively reversed prior losses.”

Phoenix said full-year volume rose 32 percent year-on-year due to improving market conditions as global oil prices recovered and economic activities picked up in the fourth quarter and as overseas sales volume more than doubled last year.

As uncertainties remain, Phoenix will continue to be cautious by identifying key strategies, such as developing customer centric offers, increasing efficiency in existing assets, and pursuing capital light strategies and partnerships.

Phoenix said it would harness the potential of e-commerce through its app-based lifestyle rewards program called Limitless.

To strengthen its balance sheet, Phoenix will continue to refinance portions of its short-term debt to lengthen maturities.

“More importantly, we will deleverage and bring down debt by raising free cash and unlocking value of some of our assets. This sets a path towards a well-capitalized company,” Fadullon said.

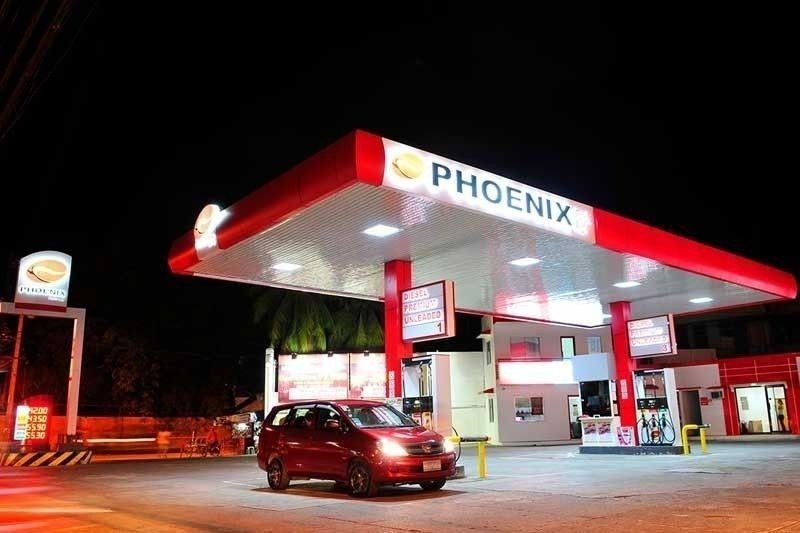

Established in 2002 in Davao City, Phoenix has a market capitalization currently valued at P15.5 billion and with over 670 retail stations across the country.

It also expanded to complementary and related businesses such as liquefied petroleum gas under Phoenix LPG Philippines Inc., asphalt, and convenience store retailing under Philippine FamilyMart.

Phoenix Petroleum has also been aggressively expanding its network overseas, particularly in Singapore and Vietnam.

- Latest

- Trending