Flash spike

In our presentations, we have been emphasizing that one of the major risks to the global equities market is a sudden and sharp spike in bond yields. After sailing higher in the past months on the back of a global vaccine rollout, stock markets the world over succumbed to a violent correction as bond yields spiked. The widely watched US 10-year Treasury yield has nearly doubled since the year started, with enormous single day moves in recent weeks.

Bond rout

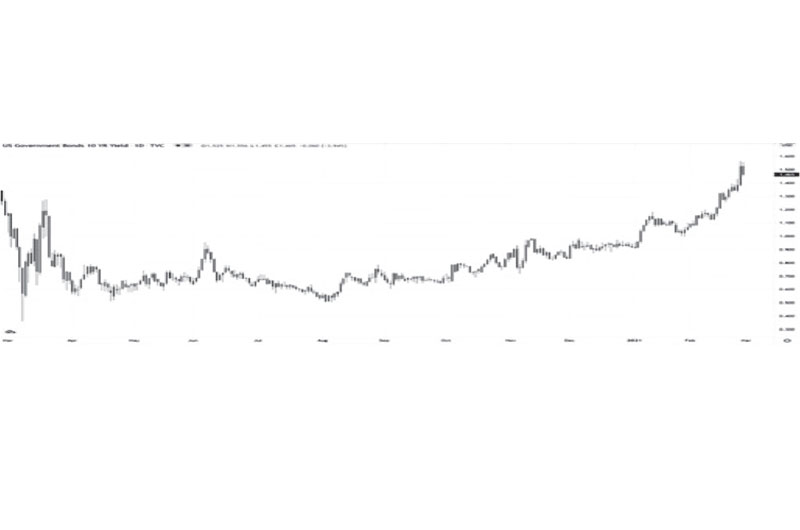

Unlike stocks, bonds are most often quoted in terms of yield instead of price. Thus, if a bond’s yield goes up, it means the price is falling and vice versa. As can be seen in the chart below, US 10-year yields have started moving higher since the peak of the COVID-19 lockdowns. However, majority of the upswing happened this year. From 0.91 percent at end-2020, US 10-year yields spiked to as high as 1.61 percent last Thursday. Note that this huge jump from the intraday low last year of 0.31 percent means that bond prices plunged precipitously.

12-month chart of US 10-year bond yield

Source: Trading view, Wealth Securities research

Why are bond yields rising?

The main reasons behind the sharp rise in bond yields are improving growth and inflation expectations which are being aggressively priced in by bond markets. These were brought about by optimism over the vaccine rollout. Higher bond yields are not necessarily a negative for equity prices because these indicate higher growth moving forward. In the case of the US, higher inflation is also not a near term concern as it is still running below their target. That said, trillions of dollars worth of fiscal stimulus may cause both growth and inflation to overshoot forecasts and increase the chances of the economy overheating in the future. So even if the Fed has indicated that benchmark interest rates are not going to be raised anytime soon, traders jumped the gun.

Record low bids for 7-year Treasuries

As a result of this, bond buyers are now asking for much higher yields than they were accustomed to in the past years. In last week’s auction, US seven-year Treasuries had a bid-to-cover of 2.04, the lowest on record for that tenor. This means that for every $1 of bond issuance, there were only $2.04 worth of bids.

Significant correction in equities as bond yields rise

The swift rise in bond yields sent equity investors scampering for cover. Higher inflation expectations rekindled the reflation trade, to the detriment of technology and growth stocks. In just one day, major European indices lost as much as two percent, the Dow Jones index dropped 599 points, the S&P 500 fell 2.5 perent and the tech-heavy Nasdaq index shed 3.5 percent. Asia did not fare any better as China lost 2.4 percent in a day, while Japan and India both dropped nearly four percent. Fortunately, the PSEi bucked the trend, gaining 0.9 percent last Friday.

US 10-year yield exceeds S&P 500 dividend yield

The sharp upswing in yields was also a crucial turning point for portfolio managers. Ten-year Treasury yields now surpassed the S&P 500’s estimated dividend yield of 1.50 percent. Coming from a period of near zero bond yields, dividend-paying stocks started looking less attractive versus fixed income. Moreover, high equity valuations have been partially justified by ultra low bond yields. With that scenario changing, some investors are now questioning whether equities can continue to trade at historically high multiples.

Central banks step in to calm markets

While rising bond yields are typical of a growing economy, the pace at which they rose unnerved markets. Though the Fed seems to be tolerating this move in bonds, other central banks were more aggressive in stemming the panic. For example, the Reserve Bank of Australia announced more than $2 billion of unscheduled bond purchases, while Korea’s central bank said they would do the same in the coming months. The European Central Bank said more stimulus could be added if the yield spike hurts growth. As was the case in the past, central banks now seem to be at the forefront not only of shepherding the economy, but also of calming capital markets as well.

Vaccines are the most important and strongest stimulus

While fiscal stimulus is positive for markets, its effect may be temporary. Moreover, as we saw recently, too much of a good thing may be a bad thing. Ultimately, vaccines will be the real stimulus for the economy. In his Senate testimony last week, Fed chairman Jerome Powell said that “getting American’s vaccinated is the most important thing to help the economy”. Former Fed chairman and now US Treasury Secretary Yellen wrote the G-20 saying that “a rapid and truly global vaccination program is the strongest stimulus we can provide to the global economy”. With a vaccine, we will be able to see a return to normalcy which will pave the way for sustainable economic growth.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending