Reddit army targets silver

The dramatic rise of online retail trading is changing the market landscape. Millions of retail traders have banded together and are now acting like the largest hedge fund in the world. Completely decentralized and autonomous, but working in unison, these Robinhood traders and Reddit/Wall-Street-Bets followers have snagged, traded, and flipped an array of stocks. These include recovery and reopening plays like airlines, cruise ships, restaurants, retail stores, hotels, banks, casinos, and many other small companies.

Recently, all eyes were on GameStop and Wall Street’s heavily shorted stocks. Under continuous fire from hordes of Robinhood and Reddit traders, these stocks exploded higher, igniting a short-squeeze that resulted in billion-dollar losses in giant hedge funds like Melvin Capital. GameStop skyrocketed from a low of 17.69 on Jan. 8 to an intraday high of 483 on Jan. 28, then precipitously dropped like a rock to 52.40 as of last Frida y. Since then, the Reddit army moved on to other battlefields. This Robinhood throng is now marching towards Canadian pot stocks and silver. Since this is the start of the Metal Ox year in the Chinese calendar, it may be timely to discuss silver.

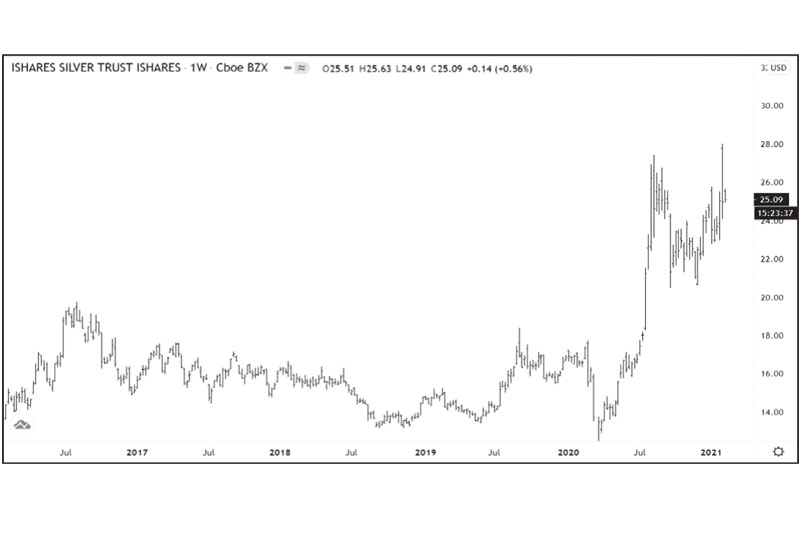

Silver explodes to highest in 8 years

A post titled “THE BIGGEST SHORT SQUEEZE IN THE WORLD $SLV Silver 25$ to 1000$” appeared in Reddit’s Wall-Street-Bets forum. There were comments that the silver bullion market is the most manipulated on earth and that banks have been keeping prices artificially low. As with GameStop, Wall Street Bets encouraged traders to pile into silver. The surge of demand sent the silver futures to an eight-year high of $30.35/oz and led SLV to its biggest daily inflow on record.

Demand for physical silver skyrockets

Blackrock’s iShares Silver Trust (symbol: SLV) experienced record inflows as traders attempted to force a shortage of physical metal and push silver prices higher. Inflows to SLV amounted to $2.6 billion in the first week of February, adding 15 percent to SLV’s $17.7 billion AUM. The idea presented in Wall-Street-Bets is to buy SLV shares and SLV call options to force physical delivery to the SLV vaults. Meanwhile, in the bullion market, dealers are reporting shortages of silver bars and silver coins. There is also little inventory left from suppliers and mints as the buying frenzy took hold in the physical market.

Silver ‘short squeeze’ is difficult

While many investors piled into SLV hoping to see a repeat of the short squeeze engineered in GameStop, boosting a commodity is a vastly different proposition compared to a stock. For one, the silver market is considerably larger and, thus, more difficult to influence. Note that before the short squeeze in GameStop, the average daily volume was only $50 million.But silver’s daily average on the New York futures market is more than $10 billion. Second, unlike GameStop, which had a 140 percent net-short position, SLV had less than 10 percent. Third, the shorts in the futures market are mostly commercial hedgers that hedge their physical deliveries against future price changes. And last, the Chicago Mercantile Exchange (CME) reined in some of the speculative fervor by raising margins on COMEX silver futures by 18 percent.

Growing industrial demand for silver

Silver has surrendered half of the Reddit-spike gains as of Friday, closing at $27.33/oz in the COMEX futures market. However, the attempted short squeeze is only one part of silver’s story. Unlike gold, silver is used for productive purposes in manufacturing electronics, solar panels, and electric vehicles. The solar market is one of the fastest-growing industries. The planned growth for electric vehicle usage worldwide will be exponential, boosting silver’s long-term industrial demand.

Reasons to own silver

Investors are also allocating a significant part of their portfolio into tangible assets to protect against inflation and currency debasement. The record US fiscal stimulus, which includes the government sending checks to its citizenry, global monetary interest rates at an all-time low, Biden’s infrastructure spending plan, plus the worldwide thrust to renewable energy, all bode well for silver.

Will Robinhood strike back?

Because of its inherent strong fundamentals, the game may not be over in silver. The first bout may have been aborted early because of the increase in silver futures margins. But the outlook for silver demand remains bright. Jewelry demand has gradually recovered from pre-COVID levels. There is exceptional demand for American Silver Eagle coins, Canadian Silver Maple Leaf coins, and silver ingots, spurred by the recent retail buying frenzy. This may prompt the Reddit and Robinhood armies to challenge the establishment in the future, strike back, and attack silver again.

May this year of the Metal Ox keep our readers healthy and safe. May they have prosperity, happiness and peace of mind.

Philequity Management is the fund manager of the leading mutual funds in the Philippines.Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending