Inflation blows past expectations to 2-year high in January

MANILA, Philippines (UPDATE 12:35 p.m., Feb. 5) — Prices of basic goods and services rose by their fastest level in 2 years in January, overshooting government expectations as the surge in food costs remained unabated.

Inflation, as measured by the consumer price index, accelerated to 4.2% year-on-year, the Philippine Statistics Authority reported on Friday.

The rate was the fastest in 2 years or since January 2019 when annual inflation averaged 4.4%, and even blew past the Bangko Sentral ng Pilipinas’ forecast range of 3.3-4.1% for the month and the 2-4% target for the year. Inflation was worst for the poorest 30% households at 4.9% on-year.

The latest data punctuated growing concerns over a slow but sustained quickening of inflation from October when succeeding typhoons hammered down farmlands, destroying crops and tightening supply.

A lingering African swine fever, which remains unresolved since 2019, exacerbated the problem after a pork shortage that manifested during the holiday season trickled down to this year, prompting government to step in this month with price ceilings.

But many doubt price controls will do the trick without drastically improving supply. Price increases not threaten a fragile rebound from last year’s historic recession that saw joblessness rise to record-levels and poverty all set to worsen from 2018 by this year.

Despite what appears to be a bleak outlook, BSP, whose mandate is to keep inflation under control, reiterated that it is not worried and that inflation surges are “temporary.” The central bank will meet to set policy on February 11, its first for the year, and already Governor Benjamin Diokno signaled there will be no rolling back of last year’s stimulus.

“The sources of near-term inflation pressures are supply-side shocks in nature that do not require a monetary policy response unless they lead to further second-round effects,” Diokno said in a Viber message.

“Currently direct measures are being pursued by the National Government to enhance the availability of affected commodities,” he added.

But analysts are divided as to whether current measures rolled out will have significant impact on prices. Apart from price ceilings, pork imports are being ramped up, but not enough to bridge a 4 million metric ton deficit. A lowering of existing tariffs on pork and chicken is also being studied.

“Inflation is not solely supply side driven…All of this talk of transitory and supply side inflation is only partially true & probably applies to vegetables but African swine flu likely to linger as demand for fresh meat is inelastic,” Emilio Neri Jr., lead economist at Bank of the Philippine Islands, said in a tweet.

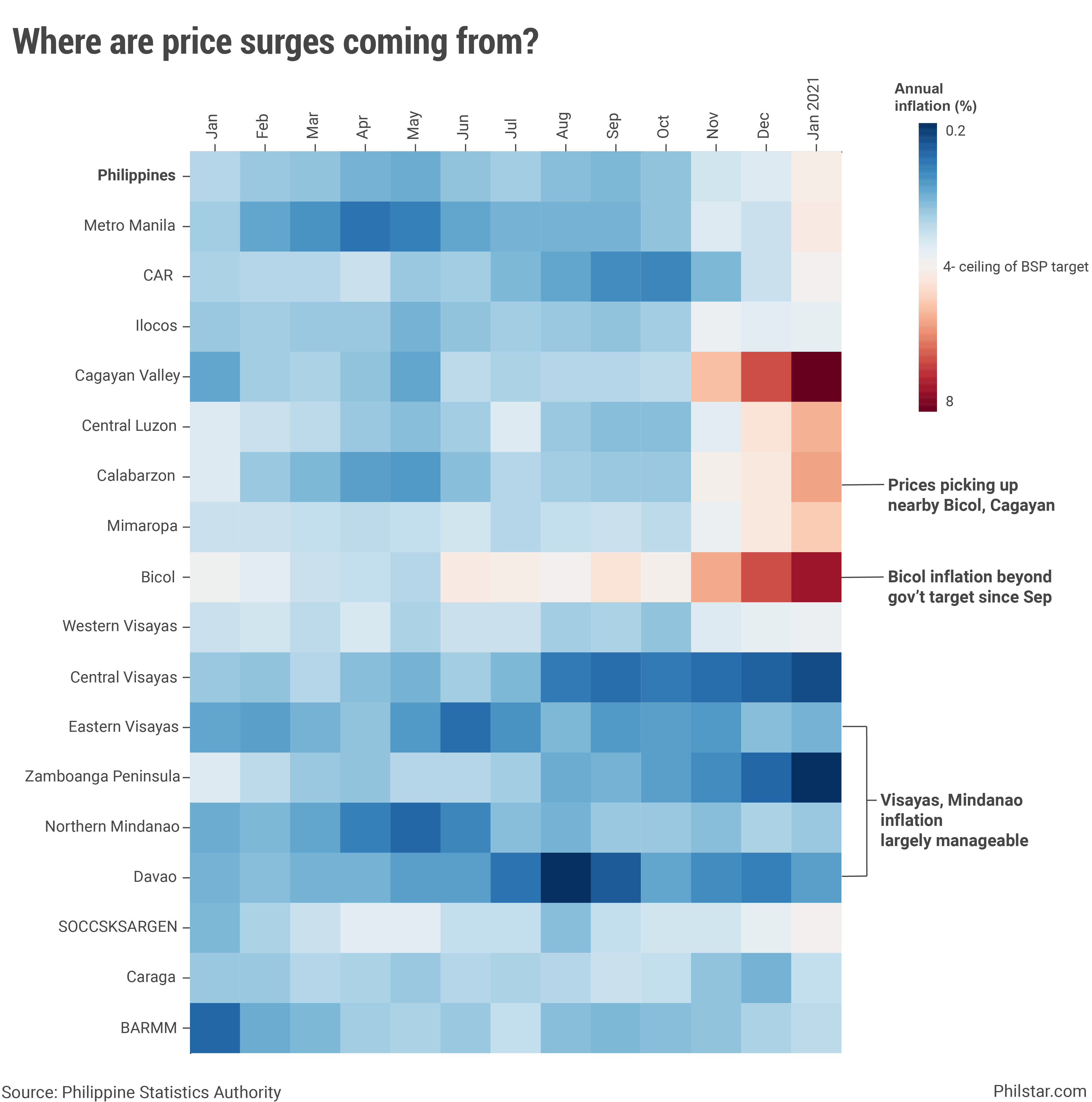

Where inflation is coming from

By area, there indeed some basis not to worry about. Inflation has largely been manageable in the Visayas and Mindanao, treading within the BSP’s annual target of 2-4%. Price increases were most noticeable in Bicol and Cagayan regions where typhoons crash-landed last year.

Similarly though, data showed price acceleration is gaining speed in nearby areas between these provinces such as in Calabarzon and Central Luzon. In Metro Manila, which is largely dependent on vegetable supply from the provinces, residents experienced inflation at 4.3% in January while overall, inflation outside the capital region hit 4.2% year-on-year.

By commodity, meat prices rose 17% year-on-year nationwide from 10% in December. Vegetable costs rose by a massive 21.2% on average from December’s 19.7%. Even fruits just became costlier, with prices up 9% annually from 6.3% in the previous month.

Pork prices alone were enough to fan inflation. For instance, the cost of pork with bones in Metro Manila rose a big 68% year-on-year in January. Outside the National Capital Region, the same prices rose a slower, albeit still massive, 46%.

“The pickup in inflation will complicate the recovery process as it will whittle down further what little is left of Filipinos’ purchasing power,” Nicholas Antonio Mapa, senior economist at ING Bank in Manila, said in a commentary.

Editor's note: Updates throughout

- Latest

- Trending