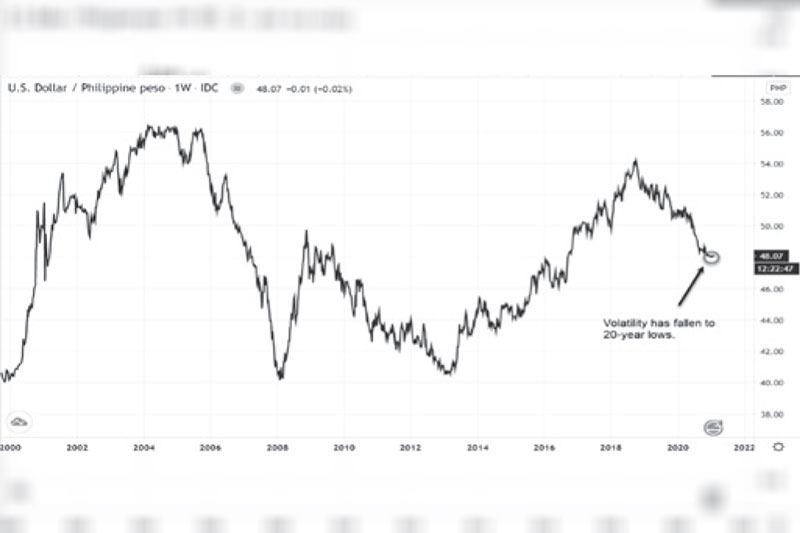

Peso volatility slumps to 20-year lows

Most Asian currencies appreciated strongly against the US dollar since Biden’s electoral win, but the Philippine peso has remained stable. In fact, the peso’s volatility has dropped to its lowest in 20 years. According to Bloomberg, the three-month option volatility of USD/PHP fell to its lowest level since May 2000. The peso has steadily been holding just above major support at 48 the past two months, closing at 48.07 last Friday.

Bollinger bands

In technical analysis, Bollinger bands are often used to measure volatility. The chart below shows a Bollinger band plotted two standard deviations above and below the 30-day moving average. The band expands or contracts as it adjusts for the volatility of price swings. Currently, the 30-day average price is 48.06, with a standard deviation of just 0.035. The price movement is so calm that the Bollinger band is at its tightest in 20 years.

Volatility goes through cycles

If there is one thing that is predictable in markets, it is the fact that price volatility goes through cycles of highs and lows. Every volatility contraction is followed by a volatility expansion phase, and vice versa. Hence, for USD/PHP, we are watching for a decisive break above 48.13 (upper Bollinger band) or a breakdown below 47.99 (lower Bollinger band). Breaking out of the Bollinger band would signal a significant price expansion in the direction of the move.

US dollar bounces off major support

As for the US dollar, further declines from current levels appears limited. The US dollar index (DXY) is bouncing off three-year support at the 89 – 90 range. Watch for a breakout above 91, which would violate the intermediate downtrend line that started in March 2020. This would lessen the chances of the Philippine peso strengthening below 48.

Peso back to 50?

As mentioned above, volatility expansions usually follow volatility contractions. If DXY can rally above 91, there is a good chance that USD/PHP bounces back to 50. A push beyond the upper Bollinger band of 48.12 should result in a significant move that brings the peso back to 49 and possibly, 50.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending