MANILA, Philippines — Risk aversion last year reached even the country’s largest economic zone operator where tax perks are offered in exchange for placements, a direct consequence of coronavirus uncertainties.

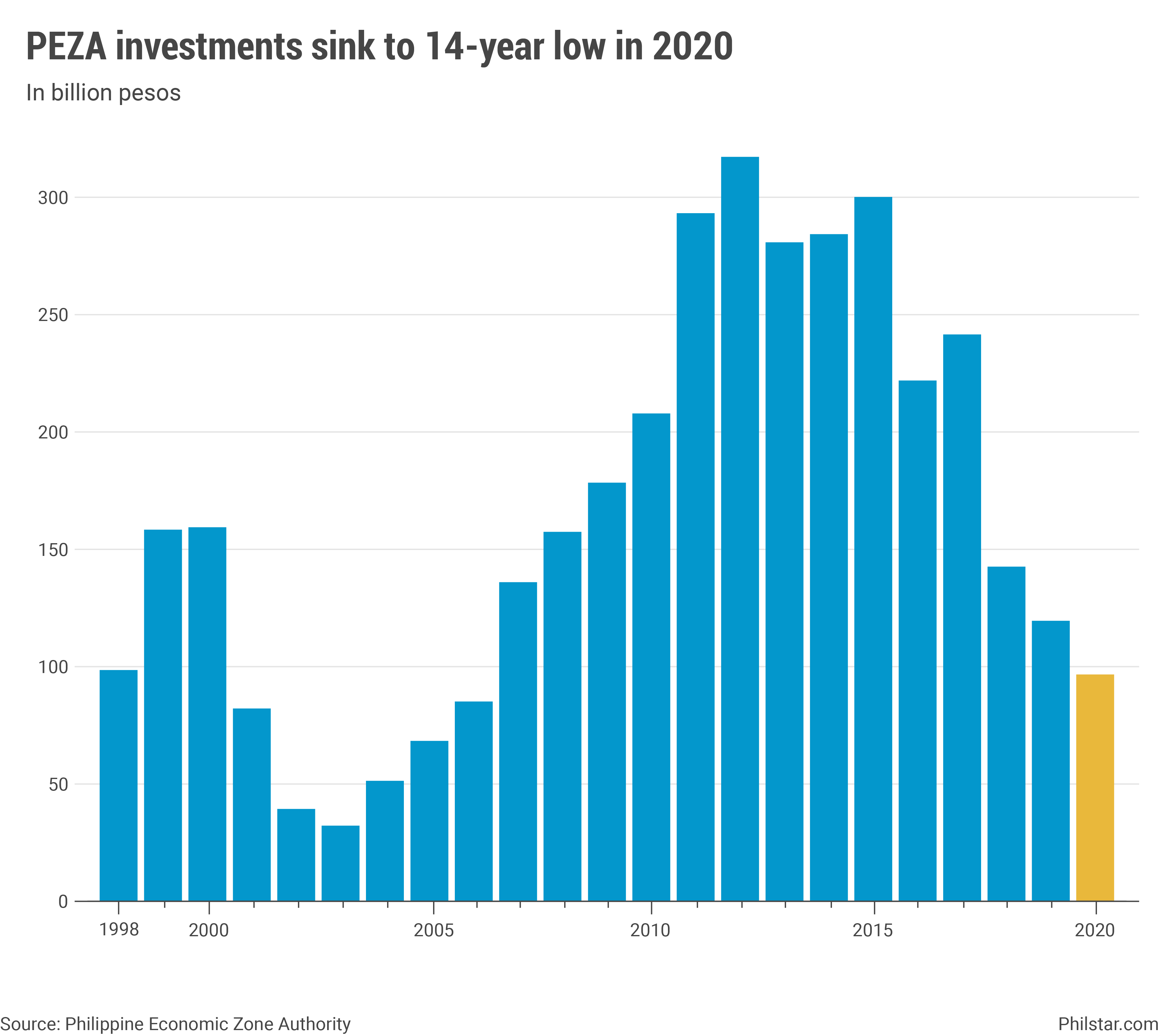

Investment pledges at the Philippine Economic Zone Authority (PEZA) sank 19.2% year-on-year to P95.03 billion, the lowest since 2006 when prospective placements amounted to P83.7 billion. Investments were funneled to 326 projects.

The drop in PEZA placements last year had been expected, as counterpart metrics of investments in the stock exchange to the broader foreign direct investments were likewise on a downtrend because of the health crisis. That said, placements still fell below the P100 billion projected by PEZA Director-General Charito Plaza late 2020.

In a statement on Thursday, Plaza was unperturbed and chose to be optimistic of 2021. “We remain committed and steadfast to attract investments, generate exports, and create employment for our country and the Filipino people,” she said.

But this year is bound to be equally challenging for PEZA. Apart from the pandemic, the ecozone is bracing for the enactment of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill that would reduce tax incentives it offers in exchange for the instant lowering of corporate tax rate to 25% for large firms.

Plaza has consistently opposed CREATE, even under previous names TRAIN 2, TRABAHO and CITIRA, over fears fewer incentives would drive away investments. But economic managers insisted the measure is needed as stimulus for the battered economy, counting on lower taxes to generate savings for firms which may use them to finance hiring and expansion.

Indeed, the full impact of CREATE on business remains to be seen as it undertakes fine tuning from contingents of the Lower House and the Senate. Yet the uncertainty that the bill brings for the past few years had already prompted some PEZA investments to flee.

Data showed that last year was the third straight year of decline in pledges, following a 41% slump in 2018 and 16% drop in 2019.

Despite this, the Financial Executives of the Philippines, an industry group, said Tuesday several business groups support CREATE’s passage, while Acting Socioeconomic Planning Secretary Karl Kendrick Chua touted the need to enact the bill urgently.

For now, despite last year’s overall decline, Plaza touted some small gains. For instance, the manufacturing industry inside PEZA attracted P34.44 billion of the total investments, up 13.4% year-on-year.

This far offset a 0.93% decline in the big business process outsourcing (BPO) sector, which generated P17.41 billion. By the number of projects, 217 were registered for manufacturing, while 109 went to BPOs.

By location, majority of PEZA pledges came from the US, Spain, China, South Korea, Singapore, Saudi Arabia and Taiwan.

PEZA had 531 ecozones in the archipelago as of 2018 and last year, the operator said the bulk of investment pledges were made in Ilocos Region, Central Luzon, Bicol Region, Western Visayas, Davao Region, and Soccsksargen.