Record-breaking 2020: the economy in charts

MANILA, Philippines — 2020 was a turbulent year, but apart from public health, the economy probably took the brunt of damage from the unprecedented coronavirus crisis.

From economic growth slowing down, trade grinding to a halt, the stock market falling and even our most reliable migrant workers coming home in droves, economic officials correctly characterized this year as unexpected, something one for the books. Next year, the Duterte administration is projecting a strong rebound, but with large falls across all data points, a 2021 recovery would inevitably be shallow and distorted by this year's record-breaking devastation.

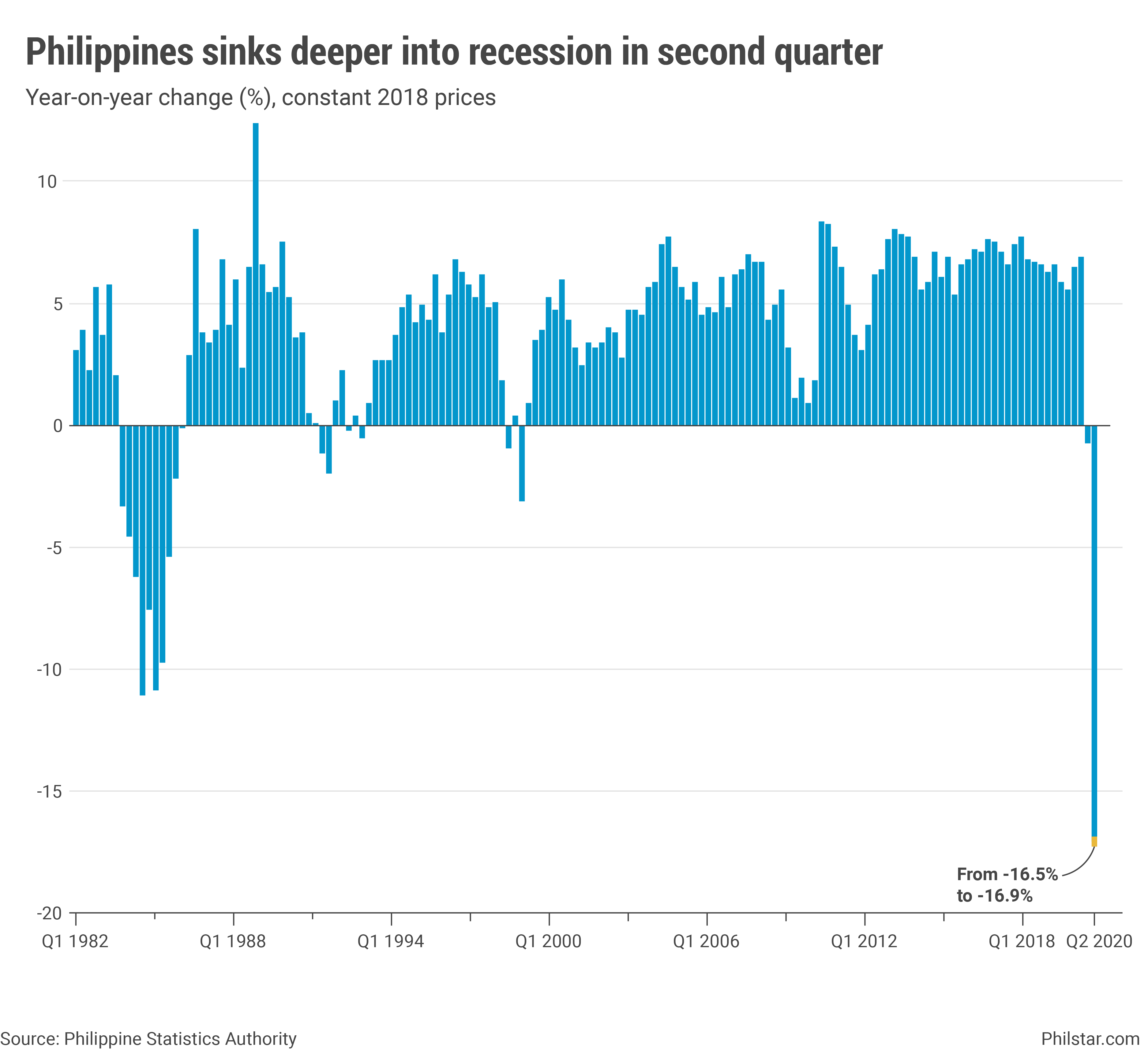

GDP sinks

Probably the most watched gauge of economic health, gross domestic product (GDP) sank 16.9% year-on-year in the second quarter, the worst fall on record, even surpassing the twilight years of the corrupt Marcos administration. It was the clearest evidence of the lasting scars to be left by the coronavirus. Prior to the pandemic last March, government entered 2020 with hopes of notching 7% growth. Now, it expects to cap the year seeing as much as 9.5% of the value of GDP slashed from last year.

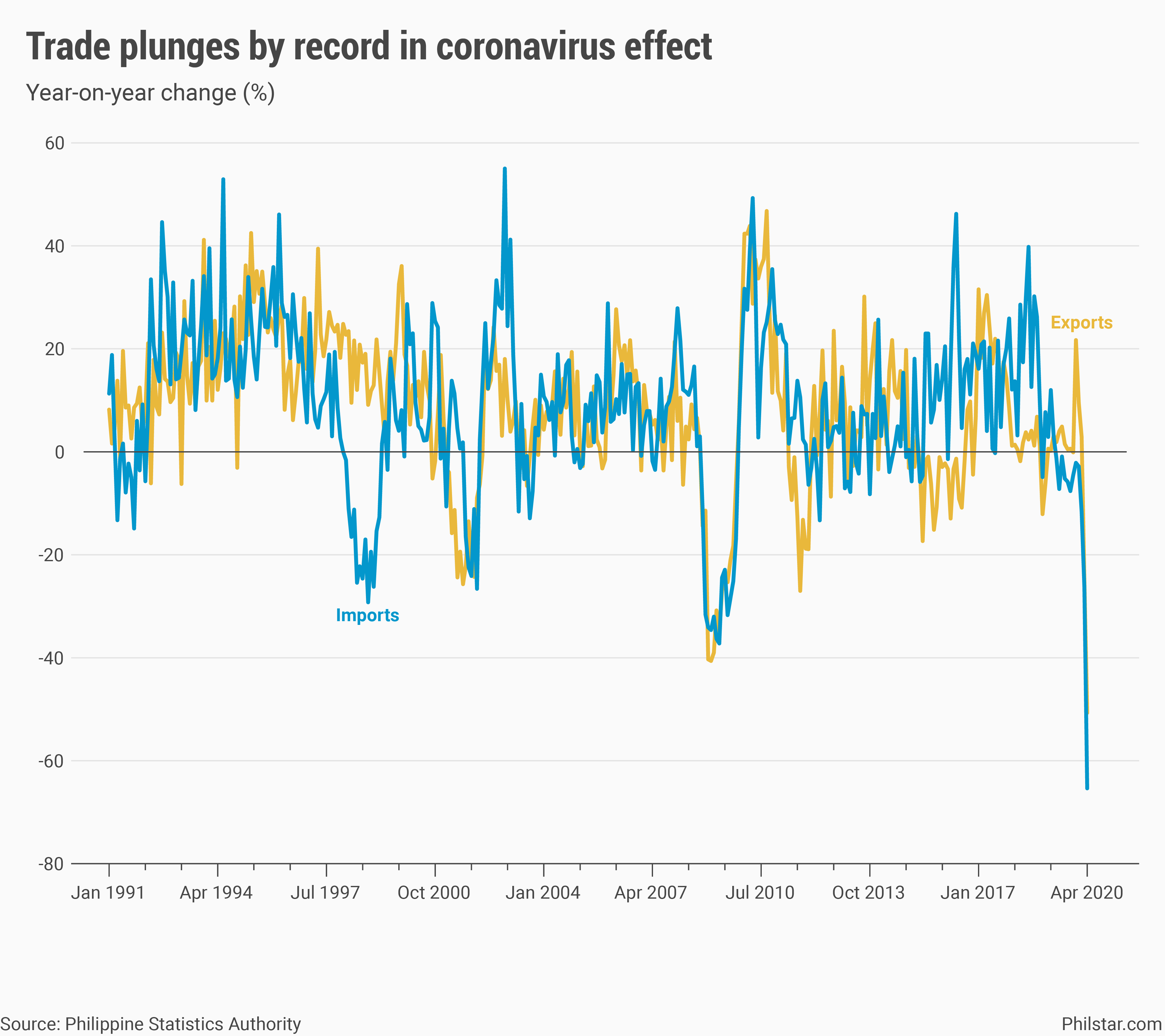

Trade implodes

A slump in GDP, however, was only a summation of dominoes falling elsewhere. Trade, for instance, suffered big this year. Exports and imports plunged by historic levels in April when lockdowns crippled port operations. Since then, some activity has been regained with restrictions easing from June, but recovery remains fragile as exports went back to negative territory in October. Imports, meanwhile, have been imploding since May 2019, a crucial barometer of weak domestic demand.

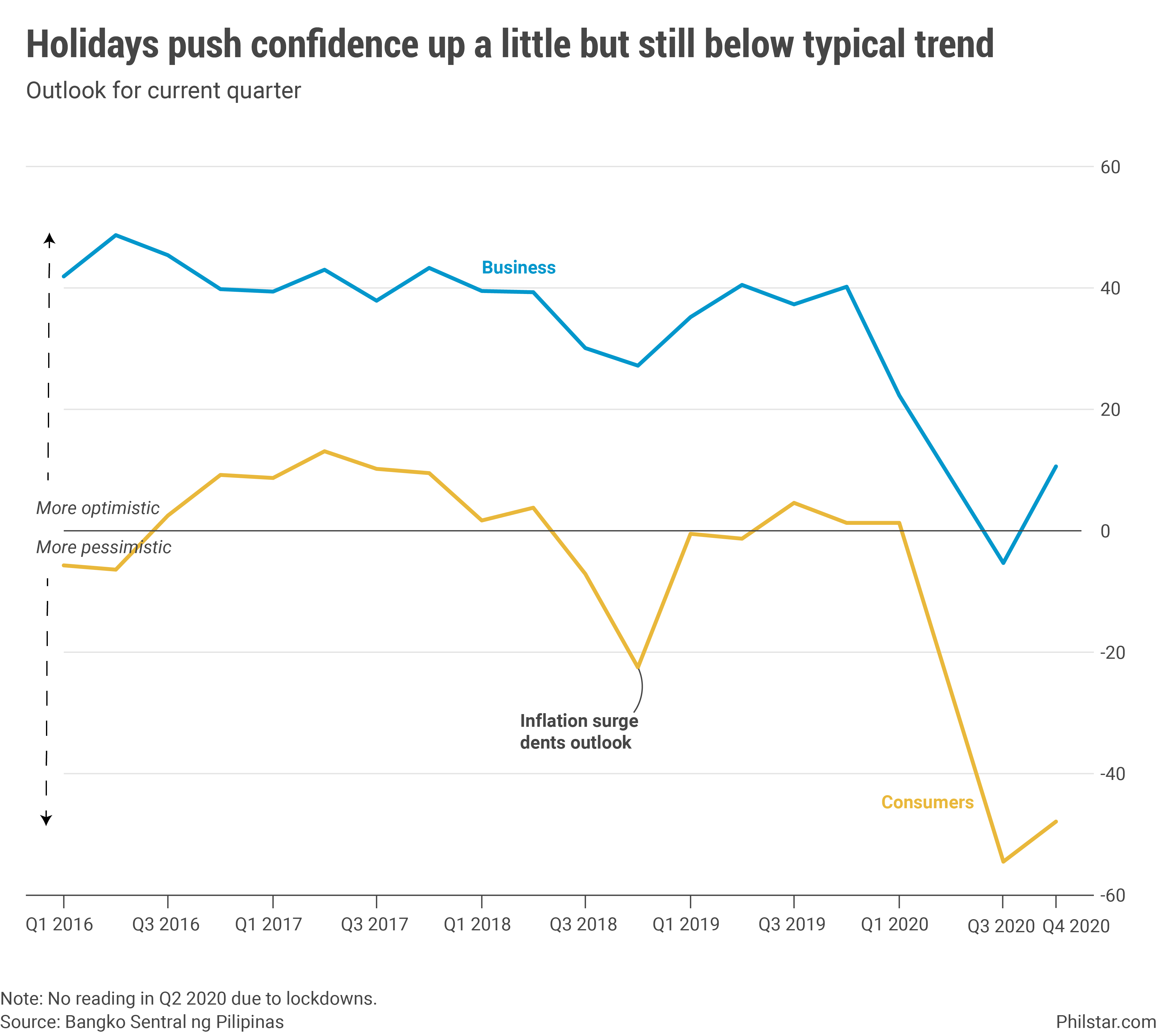

Confidence eroded

Consumer and business confidence also hit a bottom this year because of the pandemic. A bleak consumer outlook alone helped explain the persistent weakness in the economy despite the reopening since June because 70% of GDP is cornered by household spending. In the fourth quarter, central bank surveys showed more businesses turned optimistic about the future, but a large number of consumers did not share the positive sentiment.

Peso strengthens

Not all was bad news in 2020, at least in the eyes of the central bank. The Philippine peso was one of the region’s strongest currency this year, gaining 5% against the dollar as of Monday. The local unit is currently trading at over a 4-year high against the greenback, even flirting at P47 level in some days.

But while the Bangko Sentral ng Pilipinas tried to paint the strong peso as good news, it was also an evidence of lackluster imports driving down demand for dollars, and therefore its strength. Lower imports mean traders do not see a necessity to ship in more goods because consumer demand is weak. Bad news for economic managers, indeed.

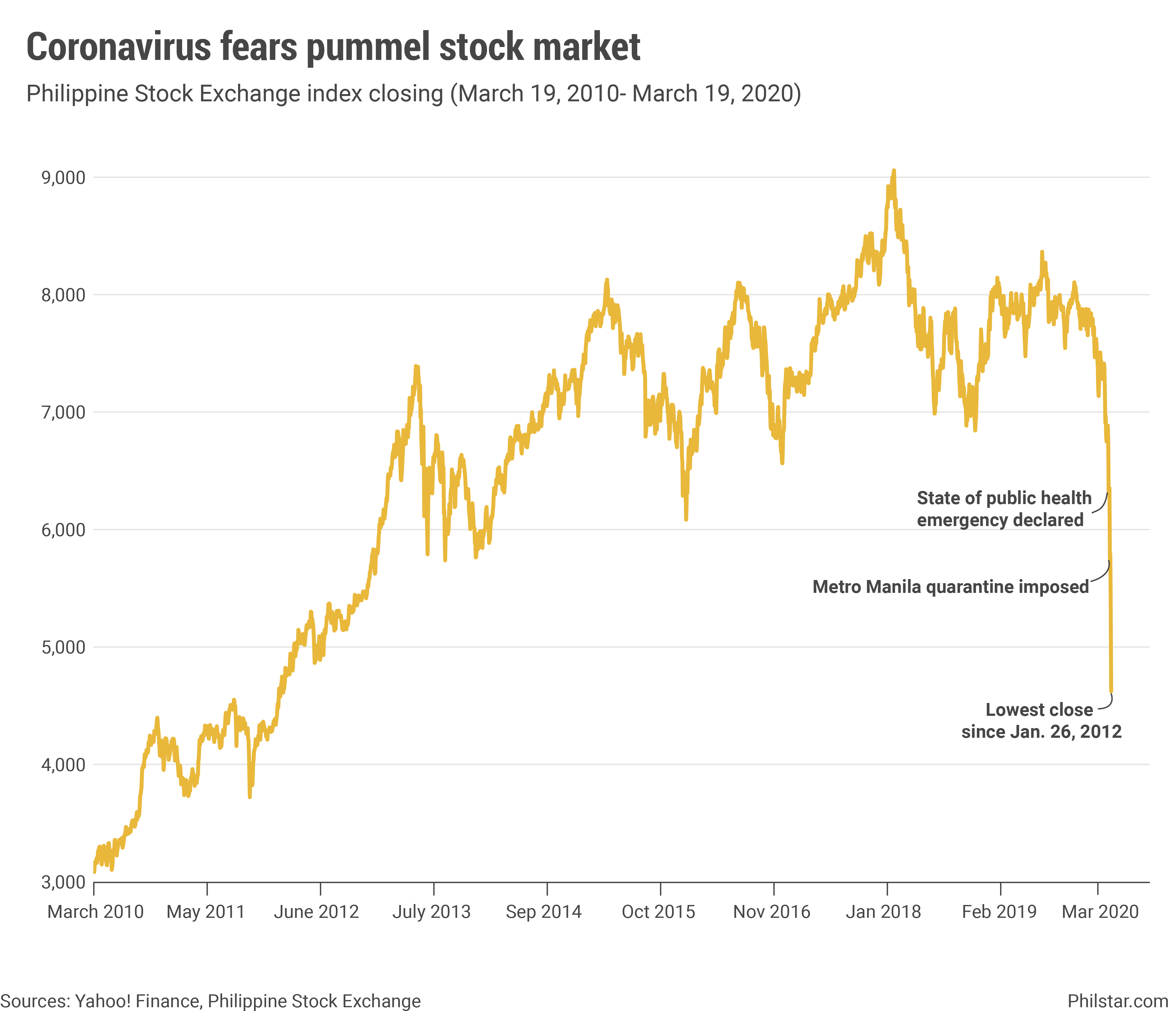

PSEi falls, then bounces back

At the stock market, investors were also grumpy for most of the year. On March 19, following the Luzon-wide lockdown, the benchmark Philippine Stock Exchange index (PSEi) plummeted 13.34% to close at 4,623.42, its lowest level since January 26, 2012. That was the day PSEi started cutting trading hours short because of the quarantine. Essentially, coronavirus fears wiped out P1.14 trillion of the PSEi at the time.

PSEi had since recovered some ground with businesses restarting and on news coronavirus vaccines were being fast tracked. The main index closed at 7,202.39 on Tuesday, although still trading below last year’s close of 7,815.26, with some trading days left in 2020.

This year, three companies namely AREIT Inc., MerryMart Consumer Corp. and Converge ICT Solutions all braved the tumultuous year by going public. AREIT was the first real estate investment trust listed on the bourse, a history 11 years in the making since regulations for REIT were enacted in 2009. Converge, meanwhile, had a record initial public offering, raising P29 billion in October.

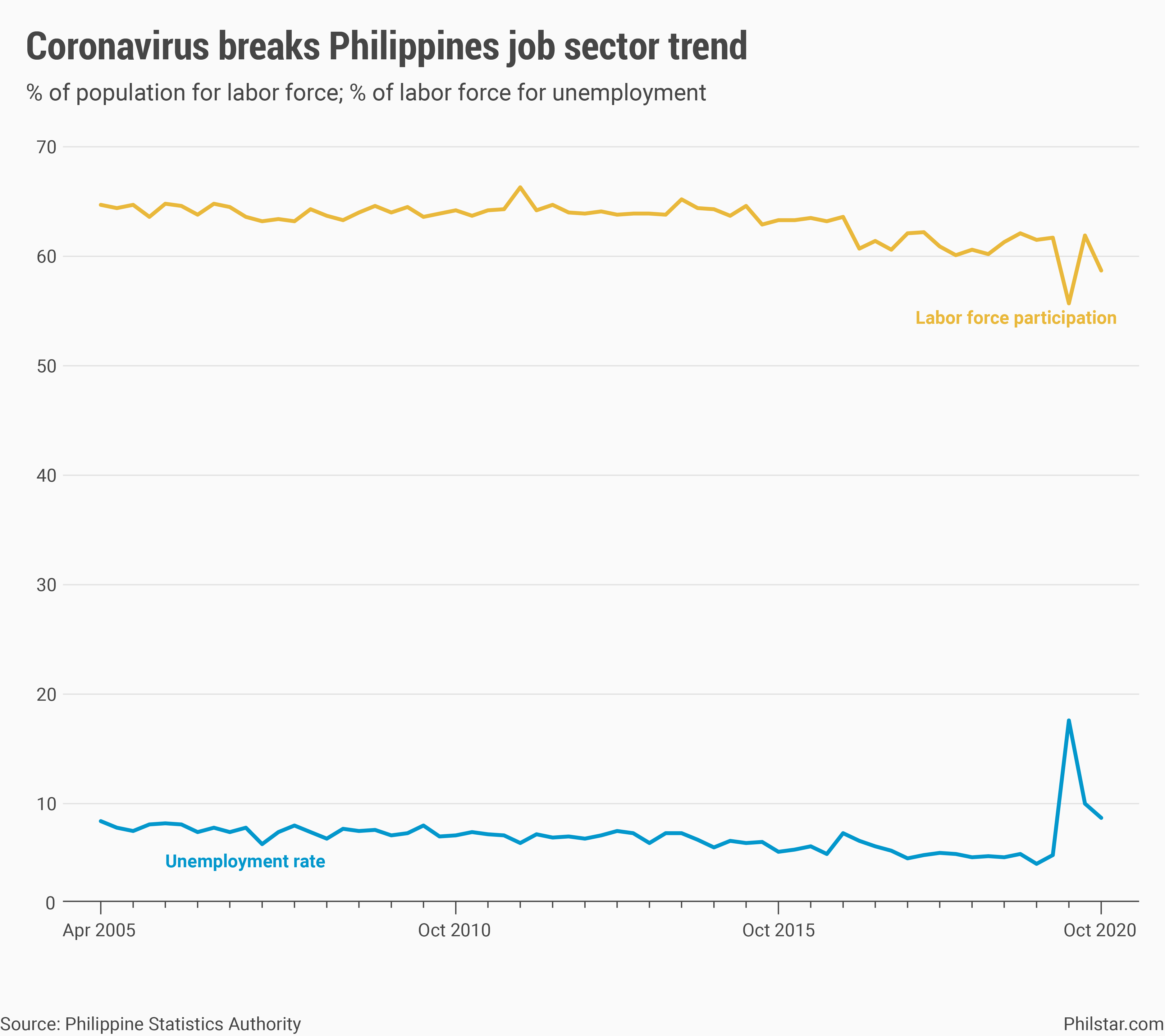

Unemployment slowly eases

With the economy weakening, people lost jobs with some completely giving up finding one. The jobless rate swelled to an all-time high of 17.6% in April, before falling to 10% in July and most recently to 8.7% in October. For all of 2020, 10.4% of the labor force aged 15 years and up were estimated to be unemployed as enterprises shut down. Joblessness was so severe that people were getting discouraged to look for work. The labor force participation rate failed to recover in October despite restrictions getting relaxed.

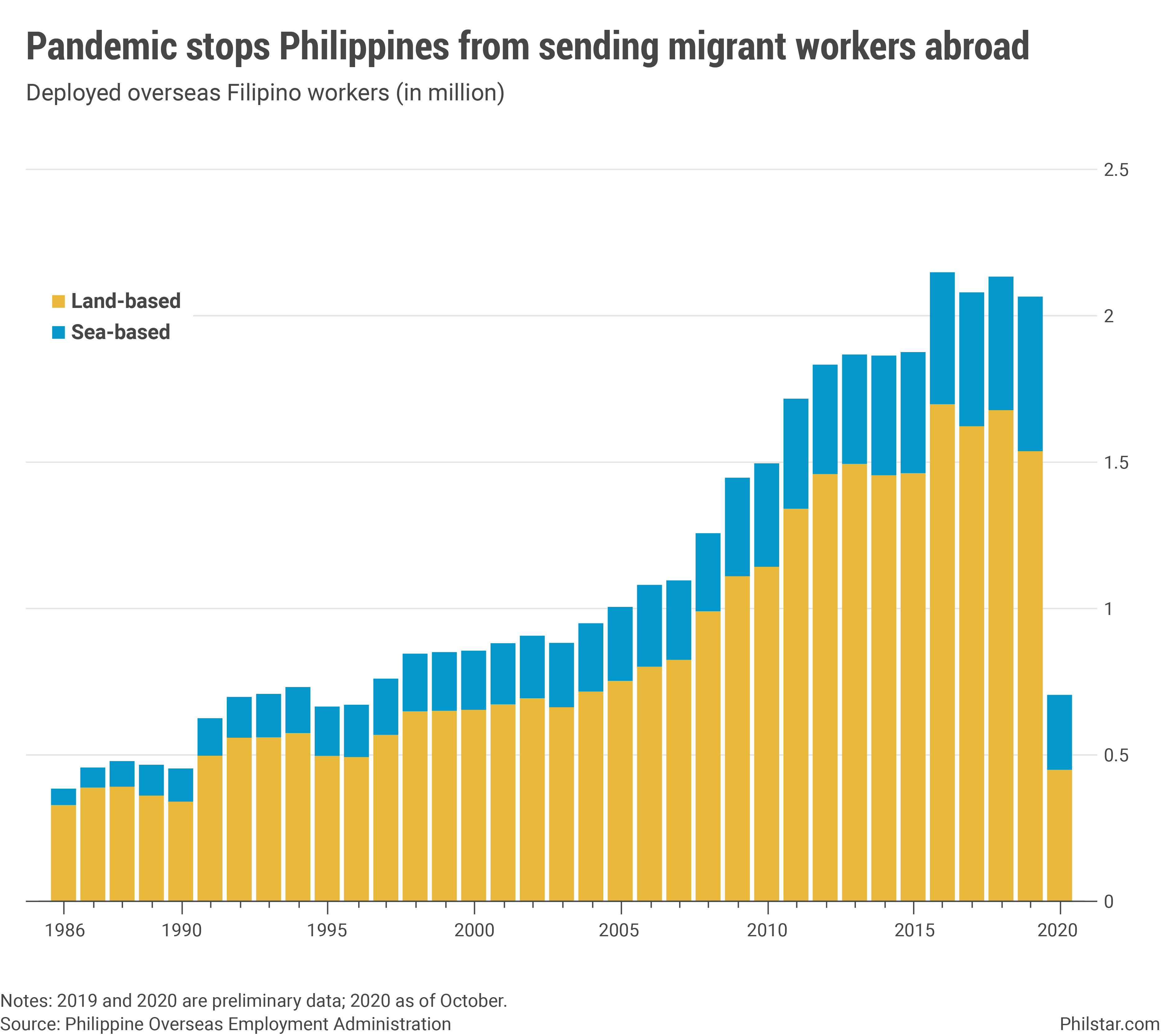

OFW jobs, remittances not left unscathed

Jobs were lost even by migrant Filipino workers. Over 380,000 overseas Filipino workers have returned home as cities globally closed their borders. Deployment of OFWs was likewise running at a 24-year low as of October, indicating a slowdown in remittances would likely persist in the future. Cash remittances declined 19.3% year-on-year in May, the deepest plunge in over 19 years. But inflows had since bounced back, proving their resiliency amid the crisis.

BSP projects a 2% year-on-year decline this year, but as of October, cash remittances were only down 0.9% from year ago.

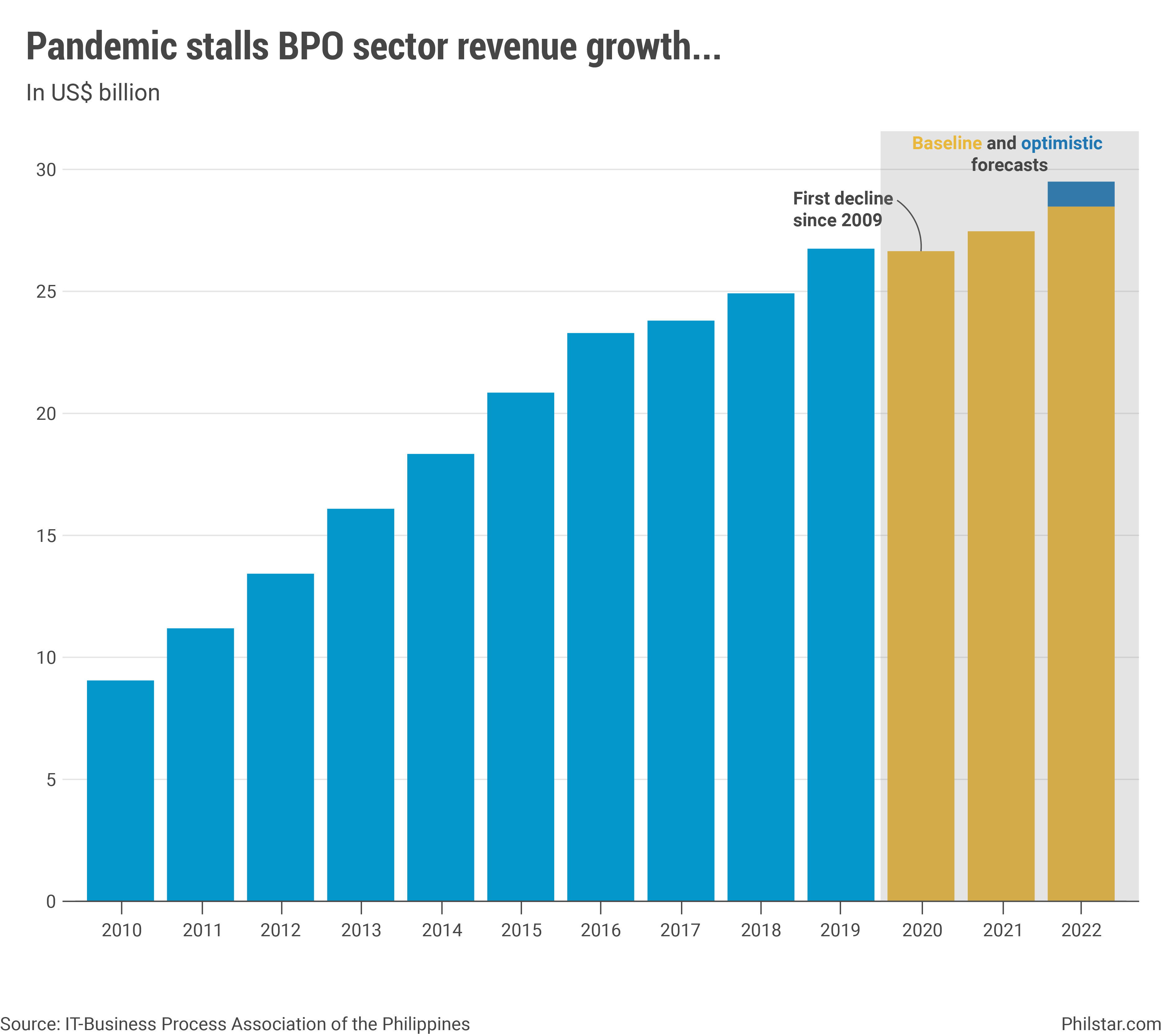

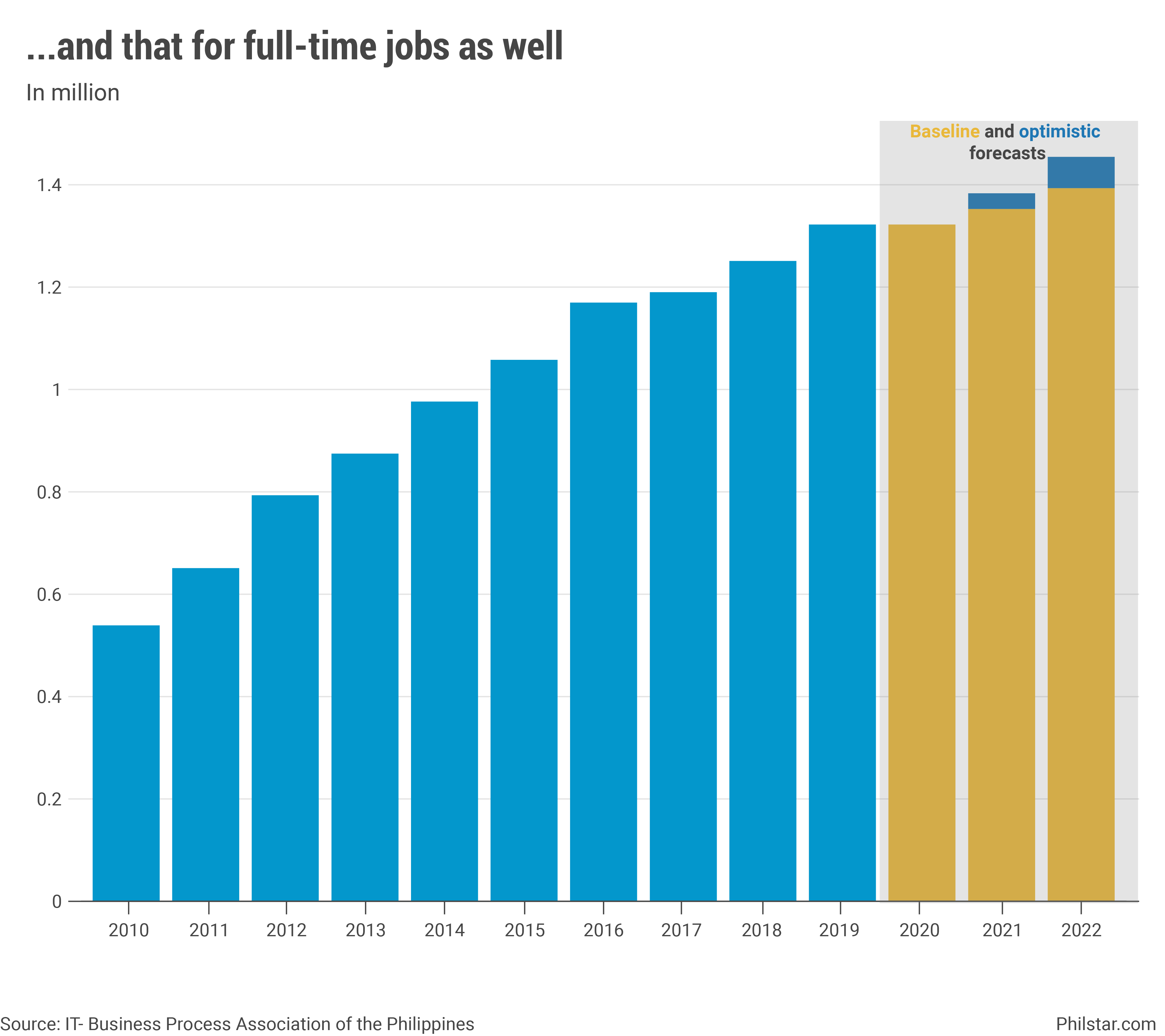

BPOs suffer

The Philippines’ other main dollar earner, export receipts from business process outsourcing operations, however, were not so lucky. The umbrella industry group sees revenue inching down 0.5%, the first decline in 11 years while job generation in the sector is poised to stagnate. BPOs have struggled to operate even while exempted from lockdowns. Firms were required to pay for their workers’ accommodation and shuttle services during the quarantines.

Including those outside the group, BPO receipts are seen dipping 1% this year, according to the central bank.

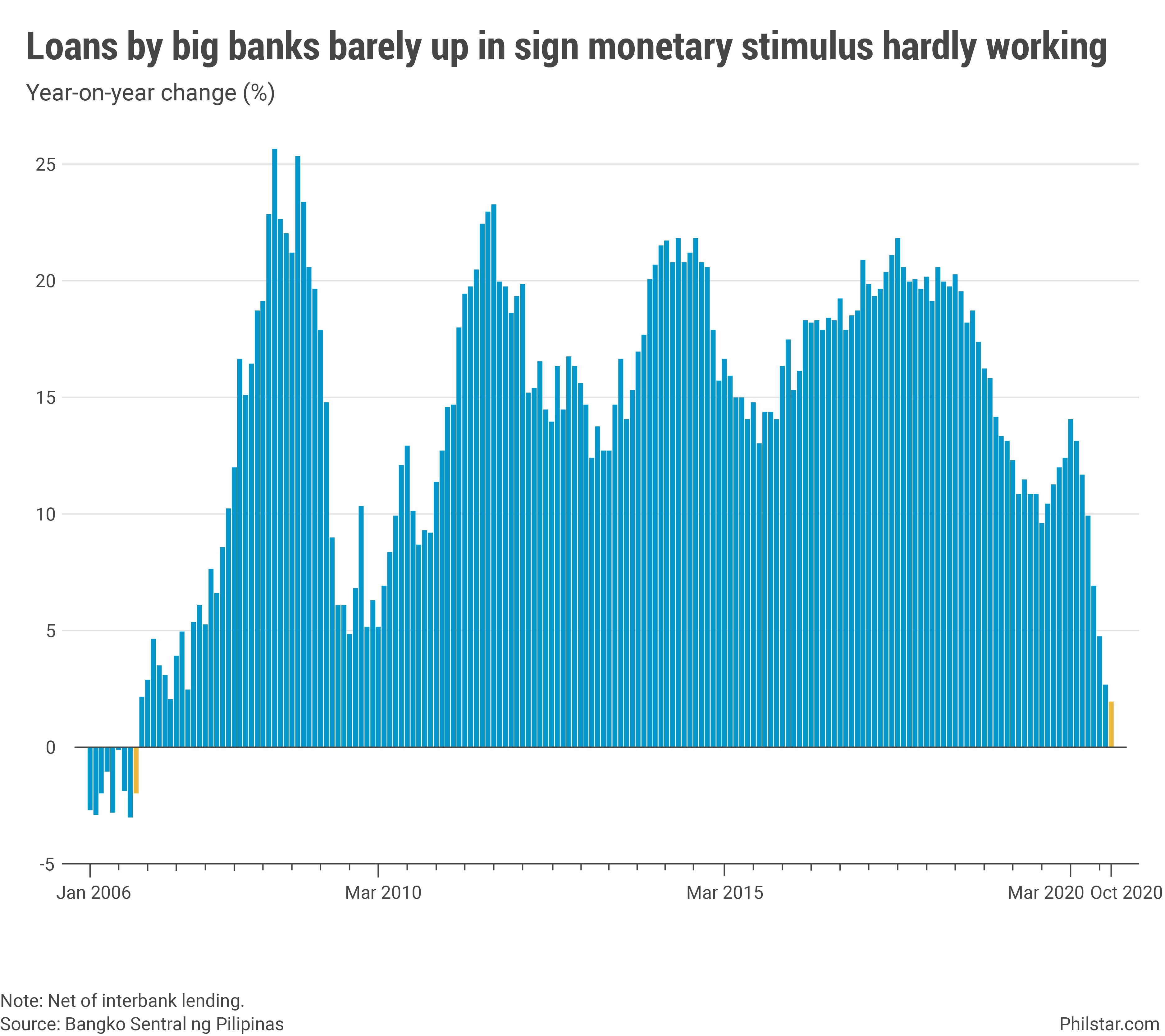

Banks refuse to lend

The record-breaking economic damage prompted the Duterte administration to heavily rely on banks to provide cash to people and businesses. But this strategy has so far failed. Banks, afraid of getting beset by unpaid loans, shunned from lending even with BSP giving them more cash to extend credit. Loans went up a measly 1.9% year-on-year as of October, the weakest in 14 years and monetary authorities expected this to further slow in the last two months of recording.

This presented a challenge for a government hesitant to spend on its own over fears doing so, with revenues shrinking, would cost it its investment grade rating. An investment grade rating allows borrowers to borrow funds at low costs.

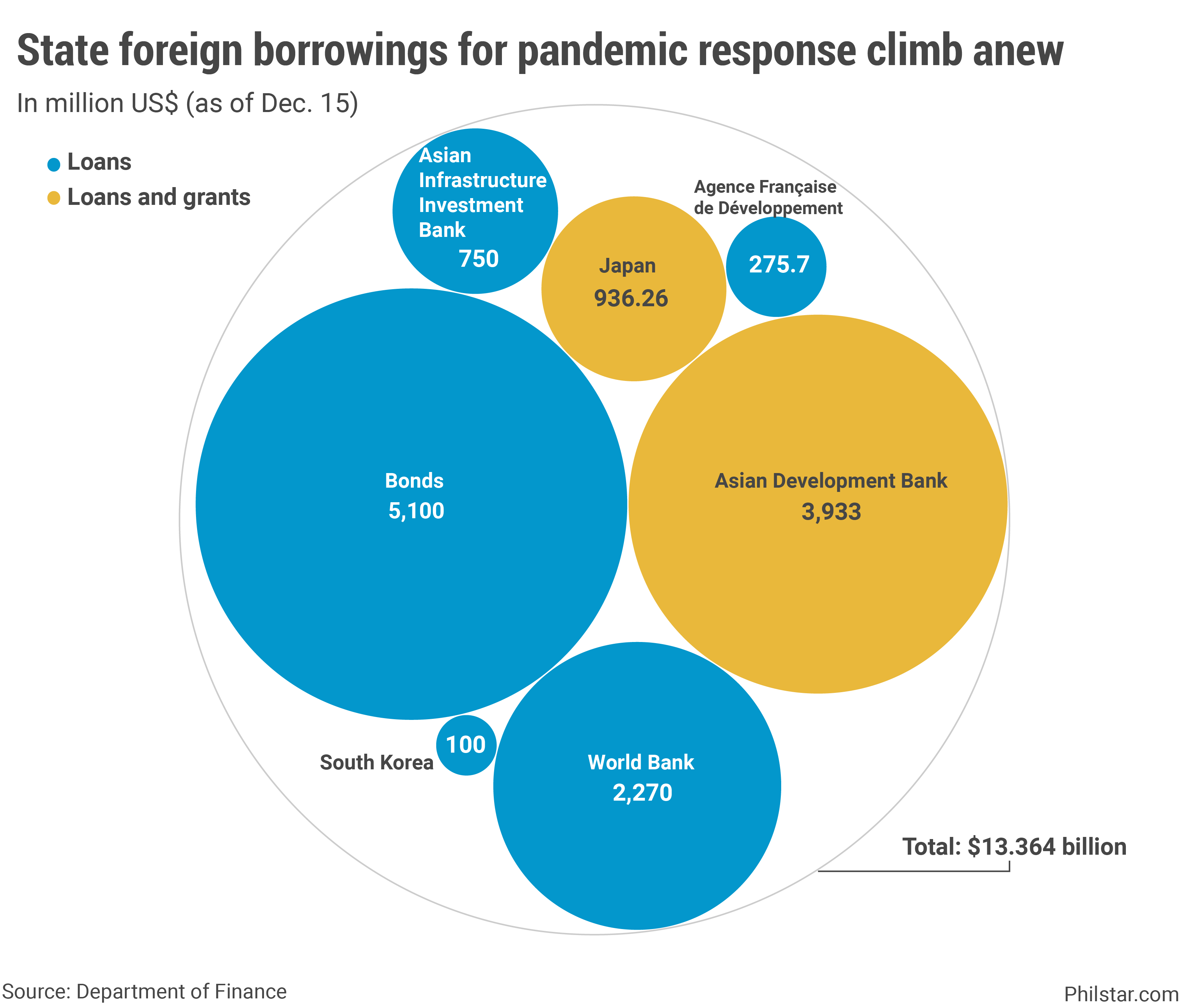

Foreign borrowings spike

With consumers staying home and many out of business, tax receipts fell. This, and the bill required to pay for coronavirus response, prompted the Duterte administration to incur more debt. Loans and grants were secured from multilateral agencies like the World Bank and Asian Development, but the biggest component of foreign liabilities for COVID-19 response came from bond issuances.

As of December 15, finance department data showed foreign borrowings rose to $13.3 billion with no sign of abating. The government, for one, had said it would rely seek ADB funding to procure coronavirus vaccines once they become available.

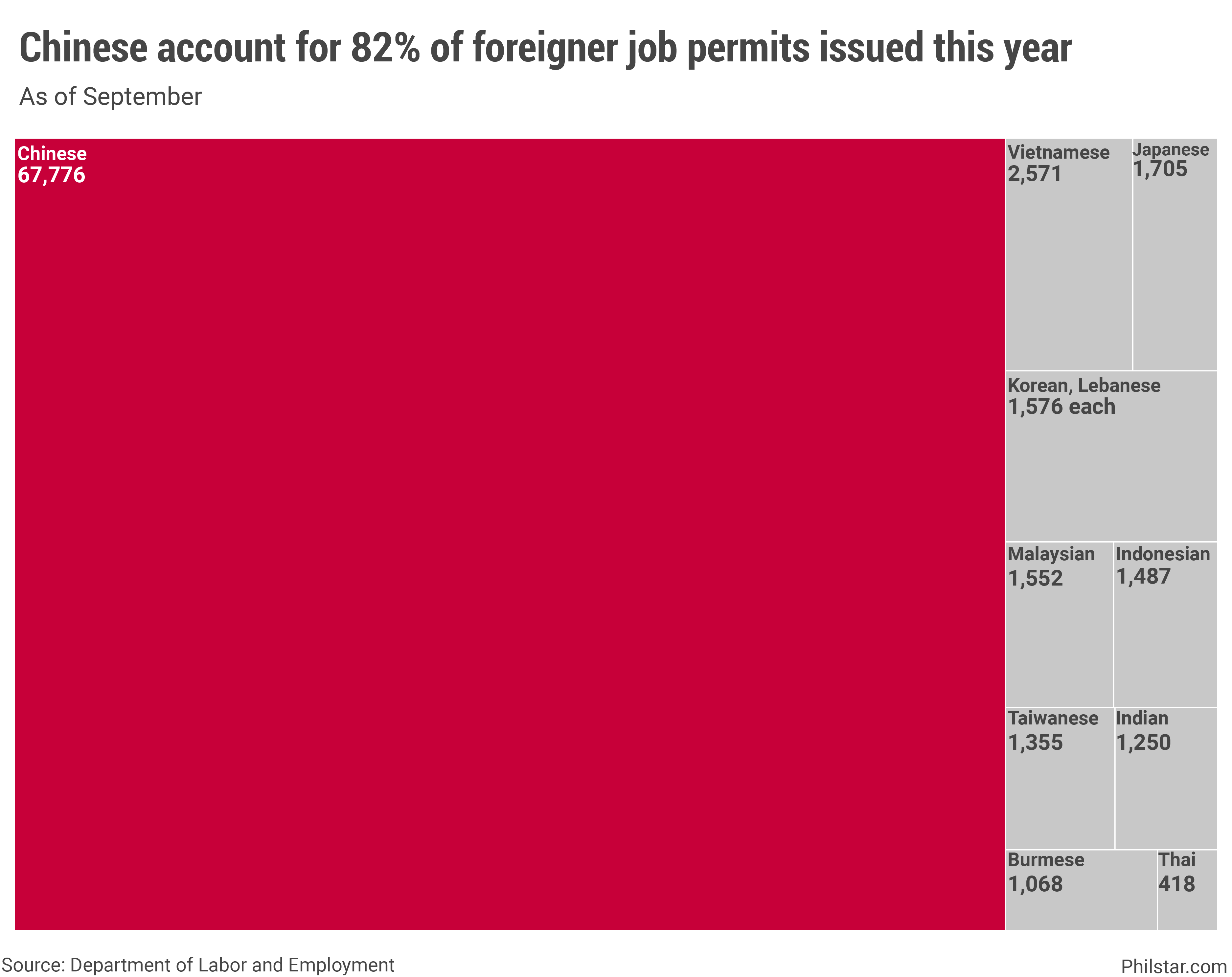

Foreign workers still up

Despite travel restrictions, Chinese workers continued to find work in the Philippines. The number of alien employment permits issued to all foreign workers, regardless of nationality, as of September inched up slightly to 83,204, mainly because of a surge in the first quarter when lockdowns were just imposed. Of that figure, 81.5% went to Chinese nationals.

Labor officials said while some offshore gaming firms have closed shop during the pandemic, not all of them did and some workers have stayed. A surge in Chinese workers in the Philippines under President Rodrigo Duterte has become a political issue because of allegations they are stealing work from Filipinos and anecdotal reports of misbehavior of Chinese citizens. This has only exacerbated Filipinos’ aversion to China.

Vietnam poised to surpass Philippines

A drastic economic underperformance for the Philippines means its people is set to become poorer than their Vietnamese counterparts this year, at least according to the International Monetary Fund. GDP per capita, which measures how economic wealth is distributed among people, would hit $3,497.51 for Vietnam, higher than the Philippines’ $3,372.53 under current prices. Analysts said getting coronavirus infections under control spelled the difference for Hanoi.

- Latest

- Trending