Home sector wants delay on TRAIN-era tax in low-cost houses

MANILA, Philippines — Housing regulators backed appeals from homebuilders to postpone levying taxes in low-cost houses next year while the pandemic rages on, a levy that could end up getting passed to buyers through expensive prices that the poor may not afford.

“This will surely have a significant impact on the sales of real properties intended for low-income buyers,” Housing Secretary Eduardo del Rosario said in a letter to Finance Secretary Carlos Dominguez III.

“Housing is a key industry in the economy due to its strong linkages to other industries,” he added.

The letter was sent last July 9 to back up calls from the Subdivision and Housing Developers Association Inc. (SHDA), an industry group, for the delay in lowering the threshold in home prices chargeable with 12% value-added tax (VAT) over the next 3 years. SHDA sent a separate letter last May 16. Copies of both letters were obtained by Philstar.com.

Both letters appeared to have gone unanswered to date. Dominguez did not reply to request for comment on Wednesday.

Under current laws, homes worth P3.2 million and below may be sold VAT free in a bid to attract developers to build, and buyers to purchase homes without worrying about costly amortization. But the upper limit is set to get lower to P2 million by January 2021 under Republic Act 11467 or the Tax Reform for Acceleration and Inclusion (TRAIN) law.

Once in effect, some low-cost homes, currently worth between P1.7 million and P3 million, will be slapped with VAT. SHDA President Rosie Tsai said higher levies would prompt shelter builders to raise prices which in turn can deter home buying. “What will we do with VAT? We’ll pass this on to buyers,” she said in a phone interview.

For developers, VAT is seen further discouraging venture into low-cost shelters. Rising costs in acquiring lands and construction materials have prompted property players to move away from cheaper homes because selling them does not recoup building costs. With taxes looming, low-earning customers are likely to hesitate more from purchasing house and lots.

It does not help that separate regulations also mandate developers to allot 15% of project costs to low-cost housing, or face penalties for not doing so. There is an alternative way to comply by law, such as giving an equivalent amount to cities and municipalities so they can do the job, but this hardly succeeds while a housing gap pegged at 6.5 million continued to widen.

Housing private sector-driven

Worse, the alternative modes of compliance have drawn criticism from the finance department which argued the sector’s tax perks are not translating to more low-cost homes. Tsai said removing incentives altogether will not fix the problem.

“In this regard, it is worthy to emphasize that the price of PhP3,199,200 and below pertain to low cost and economic housing. Buyers of low cost and economic housing are low income earners, who, more often than not, can only afford to purchase one residential unit,” Tsai and Felix said.

“With the reduction of the VAT threshold, low-cost housing prices will go beyond the affordability level of the average Filipino homebuyer,” they added.

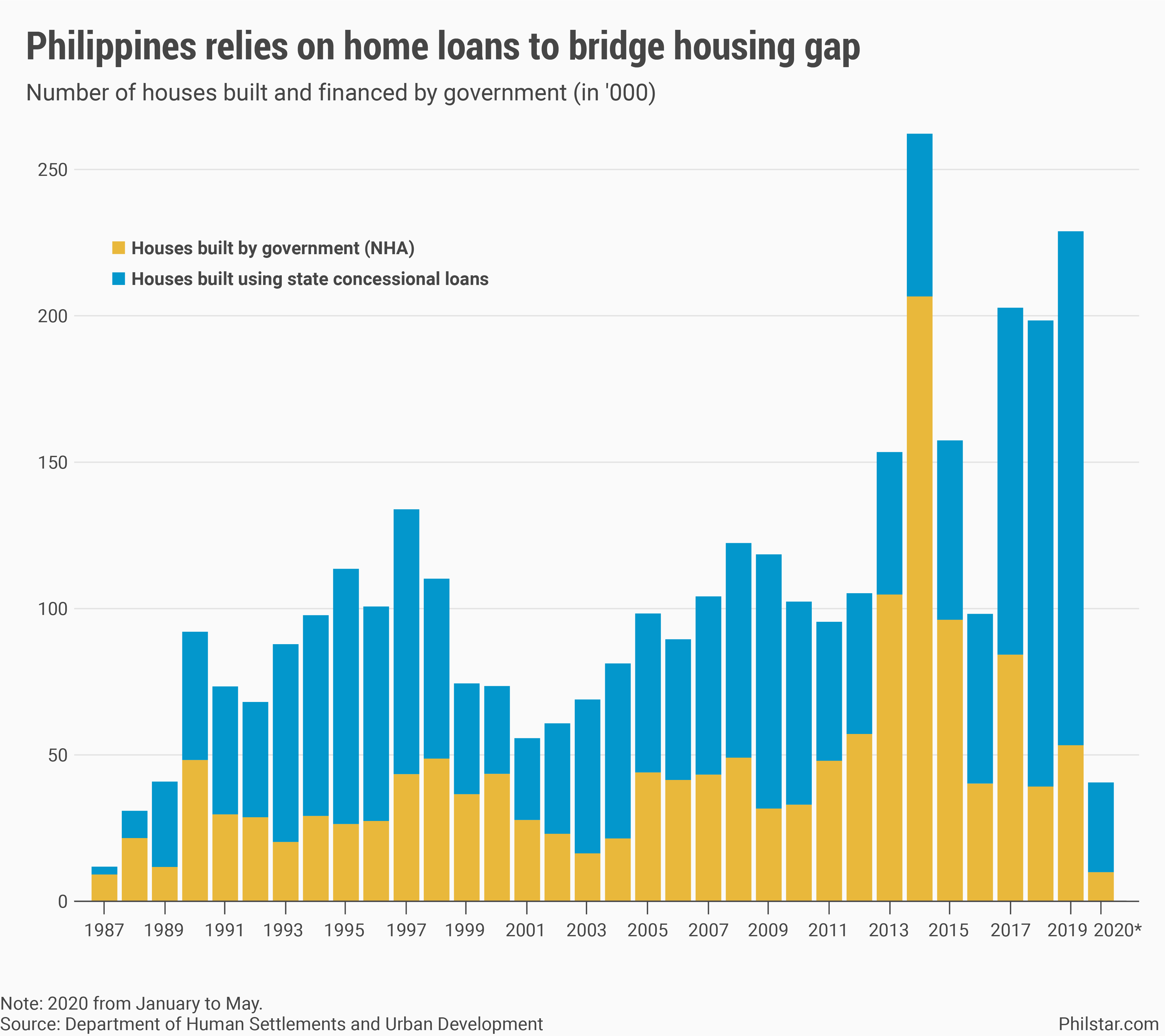

For his part, Del Rosario underscored the private sector’s growing participation in meeting the Philippines’ housing needs. Indeed, housing department data as of May showed that 75.4% or 30,096 of state-funded homes were built by private developers paid by concessional government loans. Only 9,820 were constructed directly by the National Housing Authority.

That has been the case for most of the past 3 decades, but under the Duterte administration the gap between government-built and state loan-funded homes had widened due to low housing budget. Next year, apart from Manila Bay residents, government has not allotted funding to relocate slum dwellers.

“Tax relief and fiscal incentives will boost housing production and will not only address the ballooning housing demand but more importantly, have a substantial economic impact through increased economic productivity and employment all over the country,” Del Rosario said.

- Latest

- Trending