Bank deposits up in June as Filipinos hold on to cash

MANILA, Philippines — Bank deposits bucked a projected decline in June, but a growth pick-up and decline in smaller accounts were seen also suggestive of hard times driving Filipinos to either save up or spend cash.

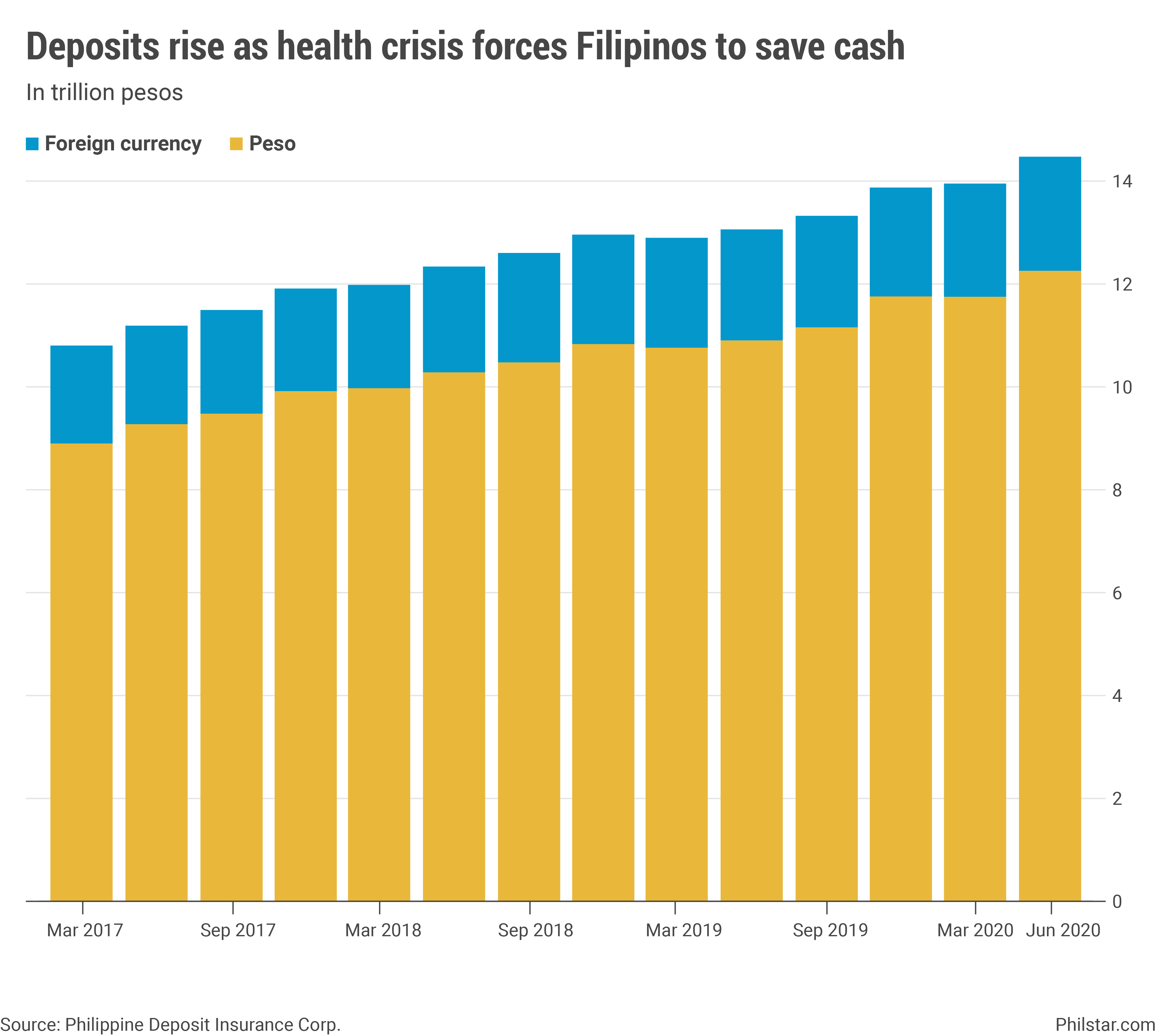

Total deposits rose 2.5% quarter-on-quarter to P14.24 trillion as of the end of second quarter, latest data from the Philippine Deposit Insurance Corp. showed. These were contained in 76.3 million accounts.

Broken down, peso deposits, which accounted for 84.7% of deposit liabilities, rose a faster 2.9% in the same period to P12.05 trillion, while a slight decline in foreign currency deposits put them at P2.18 trillion.

Ruben Carlo Asuncion, chief economist at UnionBank of the Philippines, said the most recent figures suggested depositors are trying to remain liquid with no end in sight yet for the coronavirus disease-2019 (COVID-19) pandemic. “This reflects the general trend of people not spending,” he said in an online exchange.

In the previous 3 months, Asuncion forecast savings may go either up or down in the coming quarters depending on how Filipinos cope with the economic hardships brought by COVID-19 lockdowns. On one hand, rising joblessness may force many to exhaust their savings and cope with the bills, while on the other, people may try to maintain a certain level of cash for future expenses.

PDIC's June data appeared to show both. While cumulatively deposits rose, a breakdown also reflected a drop of over 2 million deposit accounts containing P5,000 and below. The amount they held plummeted P3 million to P30.03 trillion.

Cash kept in accounts in the P5,001-P10,000 and P10,001-P15,000 segments also decreased in the second quarter.

“This is likely due to the layoffs and dried up savings of the lower income classes who work in the non-essentials sector, something we saw consumers feared in the last BSP consumer survey,” Emilio Neri Jr., lead economist at Bank of the Philippine Islands, said referring to the Bangko Sentral ng Pilipinas.

Another reason however may be a shift to cashless transactions. Asuncion said depositors likely transferred their money from banks to electronic wallets to adopt in digital times. Apart from that, some depositors may have simply increased savings, which meant their accounts now fall into brackets containing larger deposits such as within the P15,001-P20,000 range.

On top of a typical consumer, Neri also said larger deposits may have been a result of BSP's purchases of debt and US dollars, proceeds of which were parked in banks.

Deposit insurance cap under study

As of September, 96.6% of all deposits were considered fully insured, which means they fall within the P500,000 mandated limit per bank, per account which would be completely settled by government in case of bank closures. Lenders have lobbied to double the insurance amount to boost confidence in the banking system during crisis since deposits are critical liquidity source for lending.

“The initial study has been completed and will be discussed first by the Board Risk and Management Committee for any further instruction,” PDIC President Roberto Tan said in a text message, declining to provide details.

By type of deposits, savings cornered 92.8% of accounts at 70.7 million. These bank accounts contained P6.62 trillion as of end-June, 46.5% of total deposits.

There were also 1.01 million time deposits which cannot be withdrawn until a particular period of time, equivalent to 1.3% of total. These bank accounts contained P3.5 trillion or 24.6% share, data showed.

On the flip side, demand deposit accounts which can be withdrawn anytime numbered to 4.6 million as of end-June, host to P3.73 trillion or 25.2% of deposits amounts.

The balance of 105,537 accounts were long-term negotiable certificates of deposits, which were all in pesos, amounting to P217.93 billion.

- Latest

- Trending