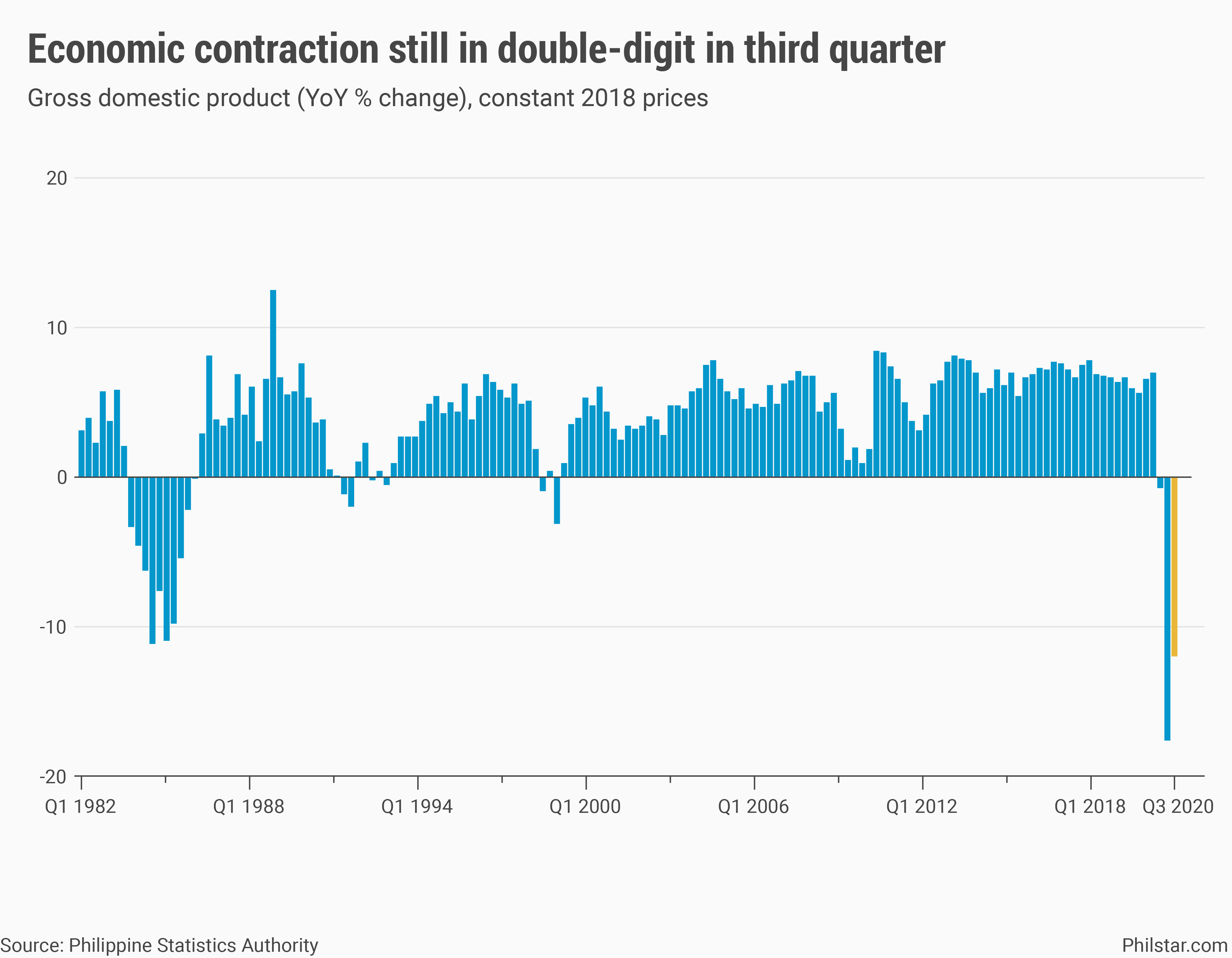

Philippine economy shrinks 11.5% in Q3, easing from record

MANILA, Philippines (UPDATE 11:47 a.m., Nov. 10) — The Philippine economy slipped anew into negative territory in third quarter, but the collapse moderated from a record-breaking plunge the previous 3 months after lockdowns were relaxed, businesses reopened and people were allowed to go out.

Gross domestic product (GDP) sank 11.5% year-on-year in July-September period, a reversal of last year’s 6.3% growth, but a tempered slump from a historic high of 16.9% in second quarter.

While the fresh decline was expected, that GDP, the sum of all products and services created in an economy, hovered still at double-digit decline reflected the Duterte administration’s difficult climb back to the Philippines’ envied growth story before the pandemic rolled back economic gains.

The path to full rebound would be challenging. For the first 9 months, state statisticians said GDP shrank 10% year-on-year, way worse than government targets of up to 6.6% slump although economic managers have put that figure under review, following the latest data.

But Acting Socioeconomic Planning Secretary Karl Kendrick Chua was optimistic. “The smaller GDP contraction of 11.5% in the third quarter…indicates that the economy is on the mend. The path is clearer to a strong bounce-back in 2021,” he said in a briefing.

Indeed, quarter-on-quarter, GDP expanded 8% as economic activity restarted, but the figure was also coming from a low base in second quarter, which meant a big turnout hardly compensate from massive losses when lockdowns were enforced.

Analysts interviewed before the data was released on Tuesday painted a bleaker outlook for the economy once considered Southeast Asia’s fastest growing. Rajiv Biswas, chief Asia Pacific economist at IHS Markit, said there remained a “continued high impact of the pandemic and restrictive lockdown measures” in the economy.

Kanika Batnagar, economist at ANZ Bank, agreed. “While the Philippine GDP rebounded in Q3 (third quarter), the pace was slow owing to weak private consumption,” she said in an e-mail. ANZ projected GDP would shrink 10.2% on-year last quarter.

While broad restrictions was relaxed since June, Metro Manila and neighboring areas in Cavite, Bulacan, Rizal and Laguna got pushed back to stricter controls for 15 days in August. As a result, Chua said the double-digit contraction was “not surprising” given that together with Cebu, areas in brief lockdown accounted for 60% of economy.

More broadly, the pandemic’s impact lingered across all economic fronts, albeit moderating. With people still afraid to go out, household spending shrank 9.3% year-on-year last quarter from a record 15.3% slide in second quarter and 6% growth same period last year.

Exports dipped 14.7% annually from last quarter’s 35.8% decline and last year’s 1.8% expansion. Imports dropped 21.7% on-year, down from 0.1% dip a year ago and 37.9% drop in April-June period.

Government spending growth slows

However, an outlier in improving numbers was government spending. While still growing, state disbursement growth slowed to 5.8% year-on-year from 21.8% in previous 3 months. Construction slipped 37.1% on-year, also worse than 36.5% slump in second quarter.

“Our record shows that we can catch up on spending,” Chua told reporters, citing last year’s spending uptick despite budget passage delays.

Problems also existed on the supply side. While agriculture was yet again the lone growth driver with 1.2% expansion, Chua recognizes the trend is under risk four typhoons that battered farmlands last month, resulting into billions of pesos in crop damage.

Meanwhile, industry and services sectors slipped 17.2% and 10.6% year-on-year, respectively, easing from previous quarter.

Last resort

The good news is Philippines is unlikely to revisit widespread lockdowns to control the pandemic. Chua said on Monday such tactic will be a “last resort” if and when cases of the deadly virus surge anew. For the past month, daily coronavirus cases had seen some downtrend, albeit partly a result of low testing after Philippine Red Cross halted diagnosis for days due to unpaid government debts.

At the same time, establishments were permitted to operate between 75 and 100% capacity, subject to health standards. Public transport was restarted as well, but limits on carrying capacity meant some workers unable to report to work despite the reopening of businesses.

That said, the road to recovery would be long and winding as consumers, now permitted to dine out and shop, have stayed home over fears of contracting the virus. Policymakers are betting on a vaccine as a long-term fix, but Duterte’s projection that it would be available later this year has now been proven to be false.

Overnight, Pfizer reported 90% efficacy of its inoculation under development, but Carlito Galvez, the country’s vaccine czar, said immunization is not expected until late 2021 at the earliest.

“Given the very sharp downturn in the second quarter, the loss of many small enterprises and the high unemployment rate, it will take several more quarters to complete the recovery period,” Steve Cochrane, analyst at Moody’s Analytics, said in a separate e-mail.

“We forecast that it could be as late as mid-2022 before Philippines GDP, in real terms, rises back above its 2019 Q4 level,” he added.

Editor's note: Updates throughout including quotes from Sec. Chua, analysts, data breakdown and chart.

- Latest

- Trending