Upward pressure on the peso

The Philippine peso strengthened 0.3 percent last week to close at 48.395 vs. the US dollar. This is the highest level for the peso since November 2016. Last week’s move was the result of the strong upward pressure caused by the Chinese yuan on the peso. The Chinese yuan surged 0.96 percent to close at 6.7675 last Friday, its highest level in 16 months.

Peso’s inherent strength

In previous articles, we cited the domestic and external reasons why the peso is strong. Among these are the prudent and proactive management of our country’s finances, resulting in a robust fiscal position, record gross international reserves (GIR) and strong external balances, benign inflation and a healthy banking system. We also discussed the US dollar’s general weakness and the global dearth of yield that boosts the peso’s demand.

OFW remittances continue to recover

OFW remittances continue to defy expectations, recovering with back-to-back 7.6 percent growth in June and July. Remittances from land-based workers grew 12.6 percent in July. This growth more than made up for the 9.2 percent decline in remittances from sea-based workers. The improved remittance figures brought the seven-month total to $18.66 billion, or 2.4 percent lower than the $19.12 billion registered over a similar period last year. OFW remittances have traditionally kept the country’s current account balance contained despite the huge trade deficits. This has contributed greatly to the strength of the peso.

Yuan rises on robust economic data

More recently, it is the strong yuan that is driving the peso higher. The yuan rose on news that Chinese industrial production accelerated the most in eight months, accompanied by strong retail sales growth. Note that China’s second quarter’s GDP expanded 3.2 percent, suggesting that economic recovery is gathering pace. According to a new report by the Asian Development Bank (ADB), China is the only country in the region to register growth this year, expanding by 1.8 percent in 2020. For 2021, ADB forecasts a 7.7 percent GDP growth for the region’s largest economy.

Yuan may strengthen to 6.48

Since hitting 7.18 last June, the Chinese yuan has strengthened by 5.7 percent. A technical analysis of the USDCNY rate shows support at 6.67. If the yuan breaks this level, it can further strengthen to 6.48, which is the “measured move” target from 6.83.

USD CNY weekly chart

Correlation with yuan tightens

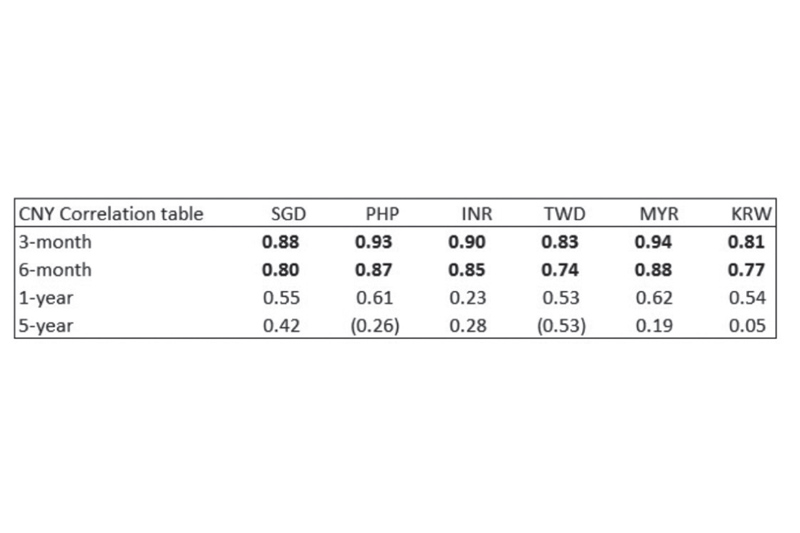

In the past three and six month periods, the correlation between the Chinese yuan and Asian EM currencies has never been tighter. This was the period when the US dollar started to display broadbased weakness. In the past, the peso and the yuan had a weak correlation, equivalent to -0.26 during the past five-year period.

But recently, the peso’s three-month correlation with the yuan strengthened to 0.93. Note that a correlation with an absolute value of 0.9 or greater represents a very strong relationship. Thus, the peso was closely mirroring the movement of the Chinese yuan in the past three-and six-month periods. The same can be said of the other Asian EM currencies as shown in the table below.

USD PHP support is seen at 48

If indeed the Chinese yuan is going to 6.48 longer term, we may continue to expect upward pressure to the Asian EM currencies, including the Philippine peso. But shorter term, significant technical support for the peso is seen at 48, where it is expected to hold and shift to a broader trading range.

USD PHP weekly chart

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending