Philippine peso, a standout in Asia

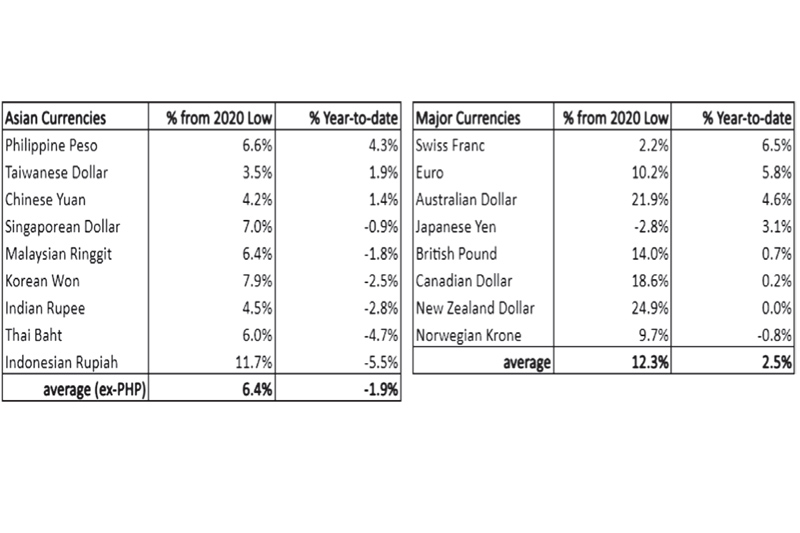

Despite the continuing rise of COVID-19 cases and the weakening economy, the Philippine peso remains strong. In fact, its performance is a standout in Asia. The peso closed at 48.485 against the US dollar last Friday, its strongest level in three in half years. It has gained 4.3 percent year-to-date, significantly outperforming other currencies in the region, which averaged a return of –1.9 percent.

‘The peso is free to determine its level’ - Diokno

Showing his confidence in the Philippine peso’s performance, BSP Governor Benjamin Diokno said that the peso is free to determine its level and should reflect prevailing demand and supply conditions in the near term. He also attributed the peso’s resilience to weaker inflationary pressure, a robust banking system, a prudent fiscal position, a low foreign debt service costs, a healthy international reserve level, and stable credit ratings. These have offset the drop in OFW remittances and the weaker exports and reduced tourist receipts brought about by the pandemic. The benign inflationary environment has given the BSP ample policy space to support economic activity.

Fed’s dovish move signals rates ‘lower for longer’

During the Jackson Hole conference of monetary policymakers held last week, Fed chairman Jerome Powell unveiled a new framework known as “flexible average inflation targeting.” Rather than maintaining its primary objective of keeping inflation below two percent, the Fed will now tolerate inflation moderately above its two percent target, especially after periods of inflation running persistently below target. This strategy may lead to the Fed, keeping its fed funds rates at 0.00 - 0.25 percent for up to five years. The Fed’s dovish move will continue to support risk assets, steepen the Treasury yield curve and further weaken the US dollar.

Broad US-dollar pressure continues

The US dollar index (DXY) fell to 92.30 last Friday, its lowest weekly close in two years. Most major currencies have now recovered from their double-digit declines registered early in the year. Led by the Swiss franc (+6.5 percent YTD), the euro (+5.8 percent YTD), and the Australian dollar (+4.6 percent YTD), developed currencies have rallied 12.3 percent from their year-lows and are up 2.5 percent YTD on average against the US dollar. As can be seen in the table above, it is the US dollar’s general weakness that has caused most currencies, including the Philippine peso, to appreciate.

Chinese yuan, Asian currencies strengthen

The Chinese yuan, considered the barometer for the region, is up 1.4 percent against the dollar year-to-date. China is the first country to bounce back from the pandemic as businesses, schools, and life in many parts of the country are going back to normal. As China’s recovery gains momentum, the yuan has broken below the all-important 7.0 level. In a previous article, we discussed this level’s significance as technical and psychological support (see seven is significant, Nov. 11, 2019). The move below 7.0 confirms the reversal in the yuan’s trend, leading to further gains in regional currencies, including the peso. The yuan closed at 6.8655 last Friday.

Peso’s next support lies at 48

In a previous article, we mentioned that 50 and 49.20 are critical support levels for USD/PHP (see Breaking 50 leads to stronger peso, July 13). It is worth noting that the peso’s appreciation accelerated when these levels were breached. After 49.20, the next key support level lies at 48, where USD/PHP is expected to hold and shift to a broader trading range.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email ask@philequity.net.

- Latest

- Trending