Coronavirus foreign financing balloons to $8.1 billion in August

MANILA, Philippines — Foreign debts incurred to help foot the bill for the government’s costly coronavirus pandemic response sustained their uptrend in August, breaching $8 billion, data from the finance department showed.

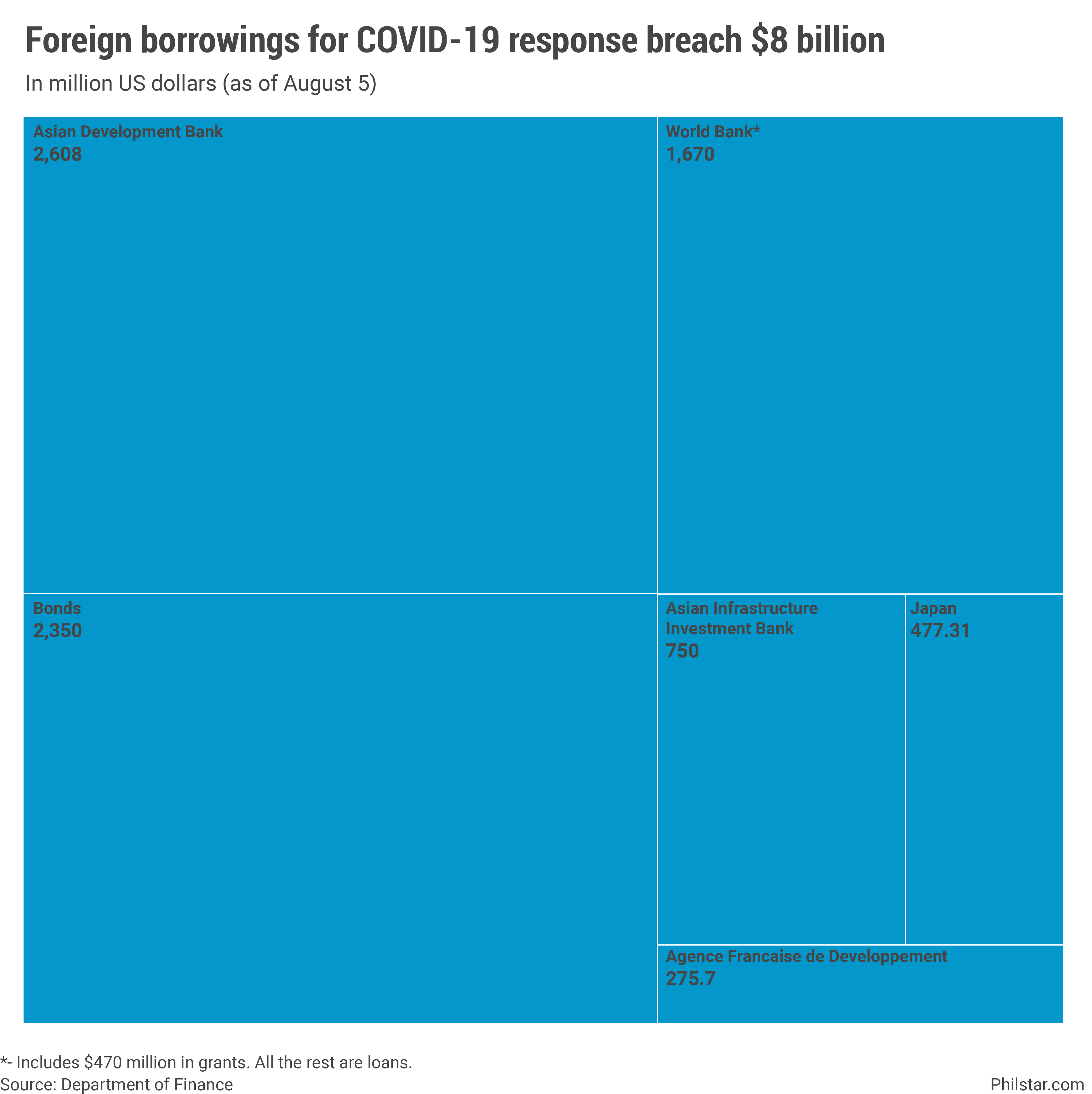

As of Aug. 5, a total of $8.13 billion in foreign loans, grants and bonds had been issued or signed with multilateral and bilateral partners. The amount was up 4.8% from $7.76 billion last July 1.

The running tally represented agreements already signed, but whose proceeds may or may not be credited into state coffers. The data did not indicate which of the funds were already received by the government.

Broken down, the Philippines’ largest foreign creditor for the pandemic response remained the Asian Development Bank, the Manila-based lender, which so far lent out $2.61 billion.

Earnings from the US global bonds issued by the Duterte administration followed at $2.35 billion. Another multilateral agency, the World Bank, was third in the list, having extended $1.67 billion.

China-based Asian Infrastructure Investment Bank gave out $750 million, while Japan, through its government and development agency, Japan International Cooperation Agency, disbursed $477.31 million.

Agence Francaise de Developpement, a German lender, was at the bottom of the list with loans worth $275.7 million.

Of the total $8.13 billion, only $470 million were in the form of grants and no longer need to be paid. The bulk were in loans, charged with interest, and payable in tranches. The bonds will mature in 2030 and 2045 and are also payable between 2.5-2.9% interest.

Borrowings to deal with the COVID-19 pandemic are slowly getting reflected on the government’s debt pile which stood at P9.05 trillion as of end-June, Treasury data showed.

- Latest

- Trending