Economy reopens, but big banks slow down in lending in June

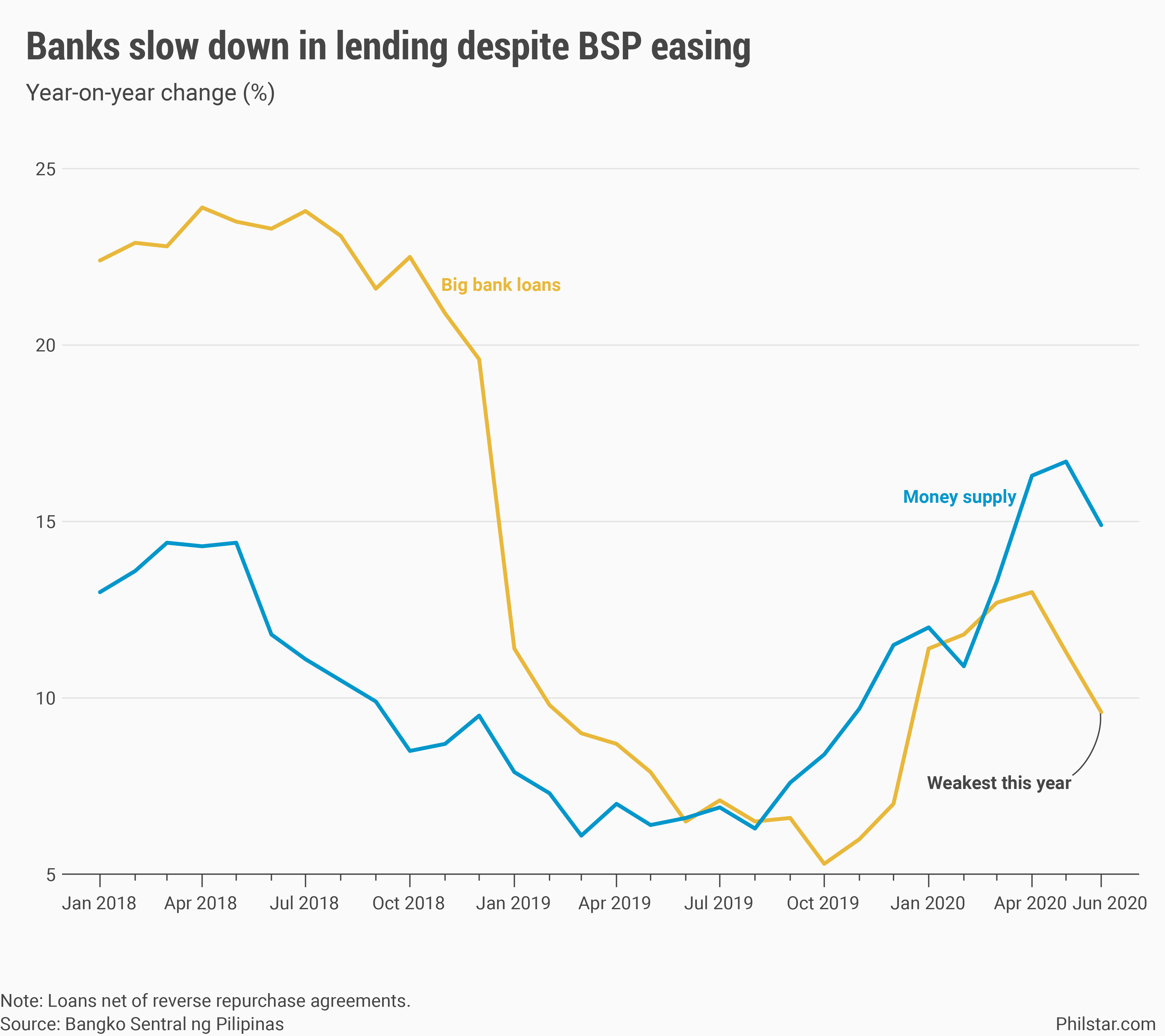

MANILA, Philippines — Lending of big banks grew at the slowest pace this year in June, underscoring the challenge of pushing lenders to extend credit to pandemic-stricken businesses while the economy is in bad shape.

Outstanding loans, net of central bank fund placements, rose 9.6% year-on-year to hit P8.97 trillion as of end-June, slower than the revised 11.3% growth recorded for first five months, the Bangko Sentral ng Pilipinas (BSP) reported on Friday.

As the economy reopened in June, lending even inched down 1.14% month-on-month, data showed.

In a statement, the central bank did not address the slowdown but said lending should “stabilize and pick up in the coming months” once the economy fully reopens from stringent lockdowns enforced in 75% of the economy from mid-March to June.

A recovery in lending would be crucial for economic recovery. Economic managers have relied heavily on liquidity from banks to lend out to enterprises financially battered by state orders for consumers to stay home and businesses to close down. But Acting Socioeconomic Planning Secretary Karl Kendrick Chua recognizes pushing bank to lend is a grueling task.

“We know that banks are risk averse, but if we offer them guarantees, we are sure they will be able to lend out more, to help more people,” Chua said in an online briefing on the economy on Friday.

To encourage banks to lend, the Duterte administration is prioritizing a bill that would not only funnel about P50 billion in fresh capital to state-owned lenders, but also provide government guarantees on credit to be extended by other banks through equity. The bill remains pending in Congress.

For now, BSP is hoping monetary authorities have done enough loosening to prod banks to lend and consumers to borrow, and ensure money supply circling in the economy remains sufficient.

Joining lending, money supply, as measured by M3, also expanded slower at 14.9% from year-ago levels to P13.56 trillion as of June, down from 16.7% the prior month.

A total of 175 basis points had been cut by BSP on benchmark interest rates, while lenders were given more ammunition to lend by lowering mandated reserves by 200 bps since March. The full effects of these actions, however, is not expected to be immediate and the latest lending and money supply reports do not invite confidence.

“The BSP reassures the public of its commitment to deploy its full range of instruments to ensure that domestic liquidity and credit remain adequate amid significant disruptions to economic activity due to the ongoing health crisis,” the central bank said.

Broken down, data showed lending for production activities grew slower at 8.3% year-on-year in end-June from 9.8% in the first five months, data showed. Nearly 87% or P8.07 trillion in loans were considered for production purposes.

Across sectors, bank credit contracted in professional, scientific and technical services which decreased 5.5% on-year, followed by mining and quarrying (-2.8%) and manufacturing (-0.7%).

Meanwhile, loans to households rose 26.7% year-on-year, also down from 30.2% in the same period. Credit card expenses, salary loans and car loans all grew at a slower pace, figures showed.

- Latest

- Trending