Lower interest, shorter payment terms as COVID-19 debts trickle in

MANILA, Philippines — Government debt is getting cheaper, but payment terms are getting shorter, a direct result of borrowings made to fund a costly coronavirus disease-2019 (COVID-19) response.

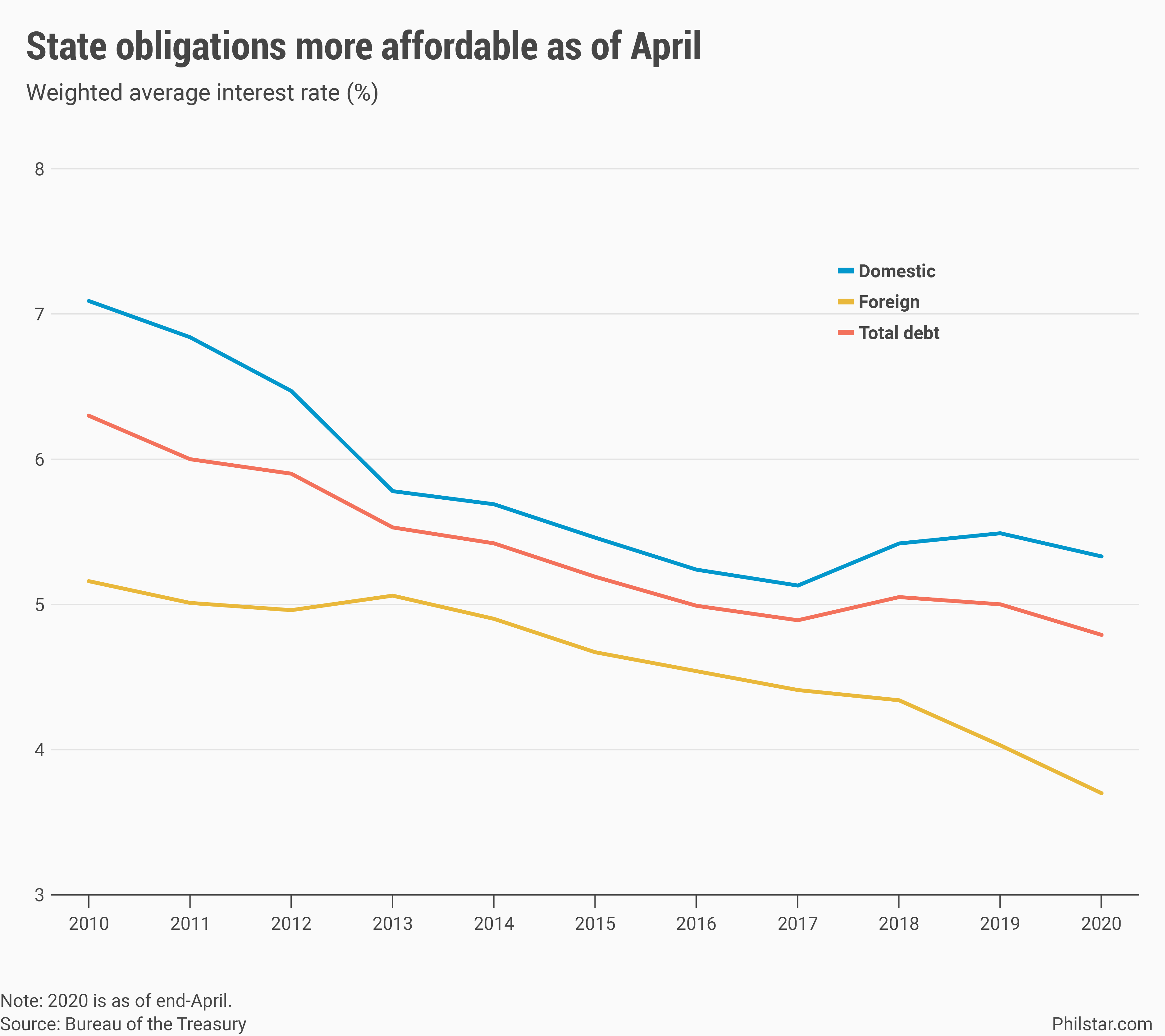

Data from the Bureau of the Treasury showed the weighted average interest rate of the debt pile went down to 4.79% as of end-April, down from 5% when last year ended.

Lower interest rates on our debt means less budget getting allocated for debt payments, freeing up cash for more productive use such as building infrastructure, financing cash aid to the poor, or even health projects.

“When the government can access debt at least cost, so will our private enterprises in need of assistance. The ability to refinance at lower cost will help us recover more quickly and more sustainably (from the crisis),” Finance Secretary Carlos Dominguez III said in a webinar on June 24.

Broken down, local debts, which accounted for 68.2% of the P8.6-trillion debt in that period, appeared more expensive than their foreign counterparts, not counting on foreign exchange costs involved in exchanging pesos for foreign currency to pay for debts.

More specifically, domestic liabilities, on average, carried 5.33% in interest, running lower than 5.49% recorded in 2019. Under this segment, shorter-termed Treasury bills fetched an average of 3.6%, while T-bonds were charged a higher 5.6%.

Foreign obligations, meanwhile, carried a weighted average rate of 3.7%, also down from 4.03% from end of last year. National Treasurer Rosalia de Leon said this was a direct result of new obligations incurred to have standby cash for COVID-19 contingency programs.

Indeed, under this segment, loans from multilateral agencies such as the World Bank, Asian Development Bank and Asian Infrastructure Investment Bank slumped to 2.56% as of April from 3.09% in end-2019.

This week, Dominguez revealed the Duterte administration has signed up $4.83 billion in loans and grants for its COVID-19 response so far, of which $2.26 billion was already credited to the Treasury.

On top of loans, the government also issued bonds to foreign creditors, such as the $2.35-billion global bonds issued last April, fetching an average of 1.78% interest, down from 2.36% in the previous year.

Shortened maturities

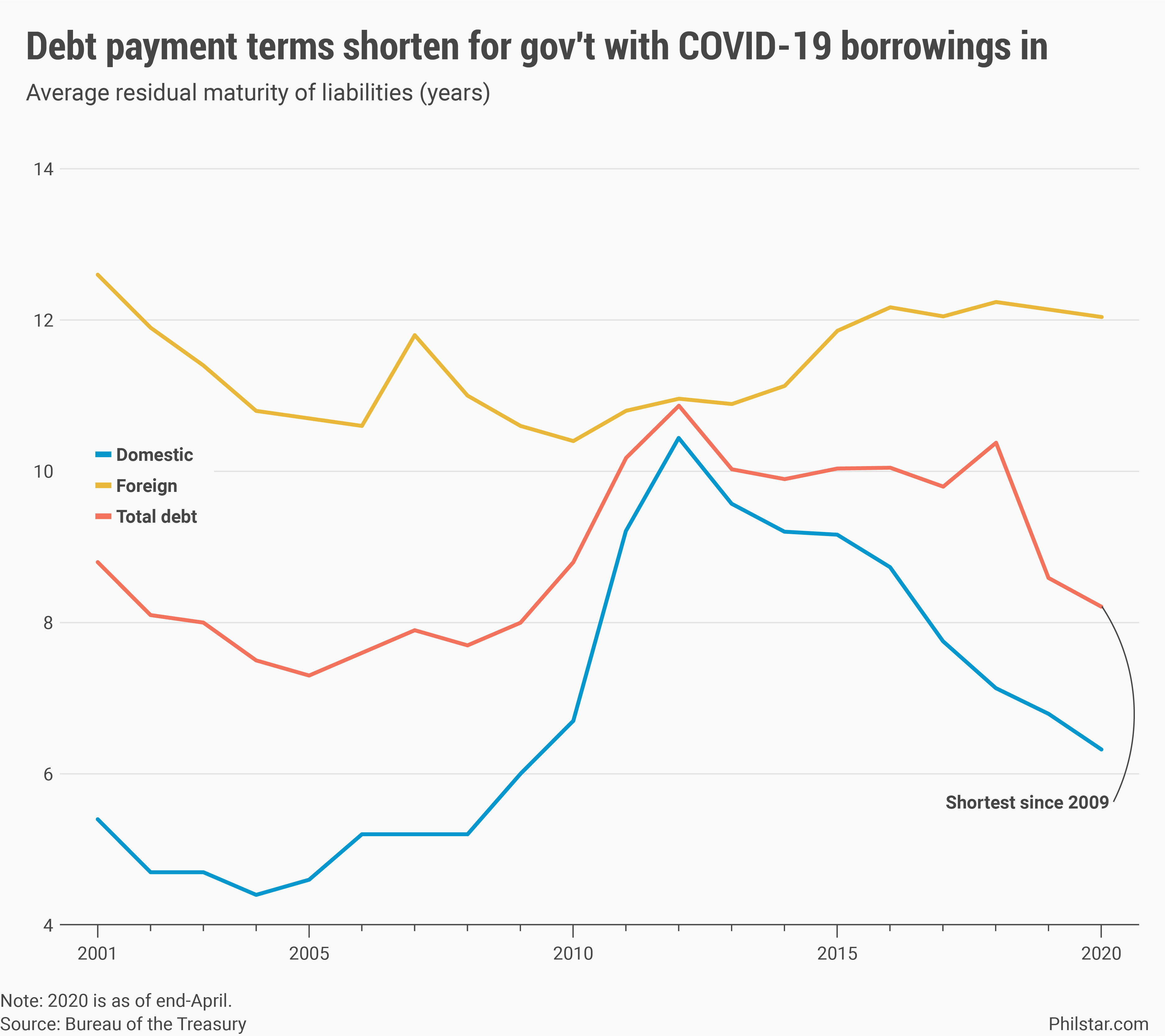

While it was good news that interest rates are going down, more debts are actually falling due, potentially offsetting the benefit of having to pay lower borrowing costs, data showed.

Average residual maturity of debts shortened further to 8.21 years as of April, running at its lowest since 2009. Broken down, payment terms were taking a hit from much shorter maturities of existing peso liabilities even as those of foreign debts have remained stable.

But De Leon is unfazed. “No problem with repayment,” she said in a text message. It was unclear how much debt is falling due this year.

Broken down, foreign debts were payable within 12.04 years on average as of April, slightly down from 12.14 years in end-2019. Under this, funds incurred from multilateral agencies may be settled within 10.97 years, down from 11.09 years.

Outstanding bonds held by foreign creditors, meanwhile, would fall due within 1.52 years, figures showed.

On the flip side, maturities of local debts continue to get shorter, now just averaging 6.32 years from as high as 8.73 years at the end of the first six months of the Duterte government.

“The shortening of average maturity is somehow expected as the COVID-19 pandemic grows deeper and its impact slowly showing. At this point, I do not think the government will have repayment problems,” said Ruben Carlo Asuncion, chief economist at UnionBank of the Philippines, said in a text message.

“Recovery will help both average maturity and interest rates to move to the opposite direction (vs. downturn),” he added.

- Latest

- Trending