Longest, shortest, sharpest

The year 2020 will be remembered as a life-changing year for everyone. This year, the coronavirus disease 2019 or COVID-19 evolved into a pandemic and caused dramatic changes not only in financial markets and economies, but also with the basic lifestyle of people.

In this lifetime, we have never experienced something like COVID-19. Never before have we seen such strict lockdowns and quarantines which essentially closed down the whole world. These conditions have resulted in the astonishing plunge of the stock market, eventually ending the longest bull market on record.

Shortest bear market

Though the COVID-19 bear was frightening and painful, it also earned the distinction of being the shortest bear market ever. It only took 24 days for markets to move from peak to trough during this bear market. This is much faster than the average bear market, which takes 268 days to reach bottom. Economists, analysts, and medical experts predicted the worst, contributing to extreme pessimism of investors. However, market sentiment quickly turned when the Fed unleashed its monetary bazooka, dubbing it QE Unlimited. The Fed has pushed interest rates near zero, spent more than $3 trillion to stabilize financial conditions, and has instituted a bond-buying program, which includes purchases of high-yield bond ETFs. The Fed’s timely reaction and enormous stimulus program has prevented a credit crunch and a full-blown depression, thus resulting in a quick reversal in sentiment. The US market bottomed on March 23, only a week after the March 16 meeting of the Fed.

Sharpest recovery in history

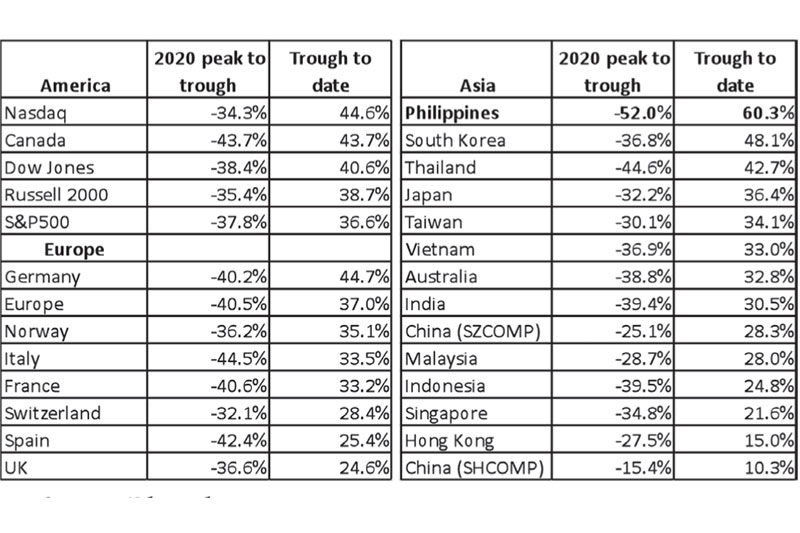

The shortest bear market was followed by the sharpest recovery in history. This was driven by the timely and appropriate action of the Fed, gargantuan stimulus programs implemented by governments, the gradual reopening of key US states, and hopes for a COVID-19 vaccine. After hitting its low on March 23, the Nasdaq has rallied 45 percent and has even touched an all-time high of 10,087 last week. As we show in the table below, the Dow and the S&P 500 have likewise gone up by 41 percent and 37 percent, respectively, since their bear market bottoms. According to LPL research, the S&P 500 recently notched its biggest 50-day rally on record. Meanwhile, the PSEi posted the sharpest recovery among global markets, rallying 60 percent from its bottom after being one of the most battered indices.

Performance of various global stock indices

Source: Bloomberg

The dreaded second wave

The sharpest recovery of the stock market was interrupted by a second wave of infections in certain US states such as Texas, Florida, California, and Arizona. This triggered a 1,862-point plunge in the Dow and a 5.9 percent drop in the S&P 500 last Thursday. Though there are talks about another lockdown to control the resurgence of coronavirus cases. US Treasury Secretary Steve Mnuchin stressed that the US cannot afford another shutdown as it creates more damage to the economy.

Dr. Fauci’s worst nightmare

Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said that COVID-19 has turned out to be his worst nightmare. He elaborated that COVID-19 has a fast transmission rate and a relatively high death rate, resulting in a lethal combo for infectious diseases. He also stressed that the pandemic is not over yet, a clear warning to states and countries which may be rushing the reopening of their areas.

Too fast, too soon

The sharpest rise in stocks has led to overbought market conditions and has caused valuations to become quite stretched. This consolidation may indeed be warranted and is actually healthy. This would allow investors to digest recent gains while also checking the excessive speculation of retail investors on extremely battered stocks. Barring an uncontainable second wave of infections in other countries and an uncontrollable rise in local cases, we believe that the US market carved a bottom on March 23 while the Philippines reached its trough on March 19.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending