Post-pandemic budget repair to outlast Duterte government

MANILA, Philippines — Repairing the pandemic’s damage on the government’s hard-earned strong balance sheet will go beyond the Duterte administration, a consequence of the health crisis and a necessary shift in priorities from achieving historic fiscal ambitions to saving lives and addressing people’s needs.

“Revenues will normalize in about 4 to 5 years as what happened in previous crises,” Finance Undersecretary Gil Beltran, finance department’s chief economist, said in a text message on Monday evening.

“The speed at which revenues recover depends on how successful the recovery program will be, how the private sector will respond to credit assistance, and how speed the government will implement and reprioritized ‘Build, Build, Build,’” he explained.

Beltran, a member of the Executive Technical Board (ETB) advising the economic managers on macroeconomic targets, said the group opted for a “conservative” approach on amending the assumptions that consider both the pandemic’s impact and the inadvertent disruption caused by lockdowns to contain the virus.

Budget Undersecretary Laura Pascua, also ETB member, agreed. “The plan is to return gradually to normality,” she said in another text message. The economic managers eventually adopted ETB’s proposals.

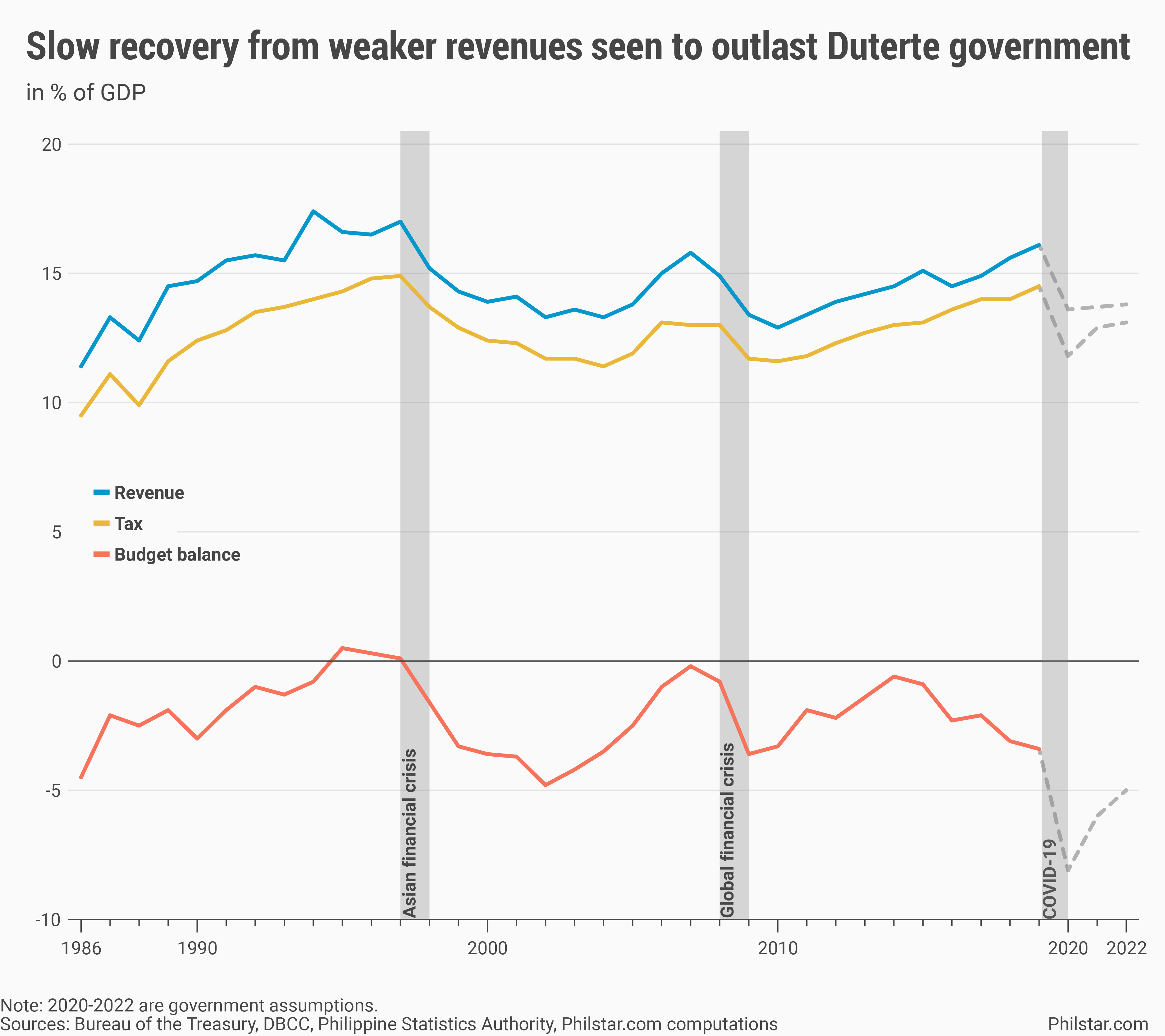

Concerns of a fiscal slump post-pandemic are valid. Before the Asian financial crisis in 1997, the government enjoyed a budget surplus meant to reduce a heavy debt pile incurred during the Marcos era. The crisis disrupted this, and it took nearly a decade to return to a narrow deficit before a bigger financial meltdown emanating from the US happened.

Amid the country’s growing needs, it became more impractical to sustain a budget surplus, but the Aquino and Duterte administrations were left on to fix the damage done by the 2008 global financial crisis. The fiscal repair went on by enacting tax laws to raise revenues while bringing down debt to sustainable levels. In turn, the country's credit ratings improved.

With rainy days over for now, Nicholas Antonio Mapa, senior economist at ING Bank in Manila, said he understands what appears to be the government’s “reluctance” to unleash a bigger fiscal bazooka as a stronger fix to the outbreak, but he insisted this might be necessary for now. “I believe that the Philippine economy can bounce back from the current downturn but much of this is determined by the type of stimulus we can muster to counteract the fall,” he said in an e-mail.

Sliding revenues, low debts

Already, revenues plummeted in April, a glimpse of bleaker things to come when they are expected to drop 16.7% by year-end. As a proportion of economic resources, revenues will account for 13.6% this year, the weakest since 2011, before moving slowly up to 13.8% in 2022.

Tax collections are also seen falling to 11.8% of gross domestic product (GDP), down from 14.5% last year, as the lack of business and consumer activity hampers government revenue-raising efforts. The ratio would recover to 12.9% in 2021 and 13.1% in 2022.

Low revenues, with higher spending due to the pandemic, mean wider deficits. The budget gap is seen to hover at post-Marcos record-levels of 8.1% of GDP in 2020, 6% in 2021 and 5% in 2022, a level debt watchers that awarded the Philippines an investment-grade rating since 2013 may not view favorably. An investment grade allows the Philippines to borrow funds at lower interest from investors.

But Mapa is unperturbed. "Credit ratings can take a backseat for now. We have an economy to get back on track," he said.

For Ruben Carlo Asuncion, chief economist at UnionBank of the Philippines, however a bright spot in the health crisis may prompt credit raters to think twice before downgrading. Unlike previous crises, the Philippines is facing the pandemic with a stronger debt profile characterized by a record-low debt-to-GDP ratio of 39.6% last year. In 2006, two years before the financial crisis, the ratio was at a higher 65.7%.

The low debt ratio means the government has leeway to borrow and spend more to fight the pandemic without risking its healthy fiscal standing. For 2020, officials project debts to rise to 49.8% of GDP.

"I do not personallly think that we are throwing in the white fiscal towel. I sort of agree with our economic managers that this health crisis hit the Philippine economy at a position of strength, and if you compare our situation in the past, the ghost of our fiscal past would not have utterly survived the pandemic's viral attack," Asuncion said.

Beltran is likewise optimistic. " There is a probability of normalizing quite fast if we implement our recovery plan very well. We are confident we can weather this," he said. —with Prinz Magtulis

- Latest

- Trending