FDI inflows drop to four-year low in 2019

MANILA, Philippines — Foreign direct investments (FDI) slumped to their lowest level in four years in 2019, and the outlook for this year remains bleak as investors await clarity on the future of their incentives and for governments to put the coronavirus outbreak under control.

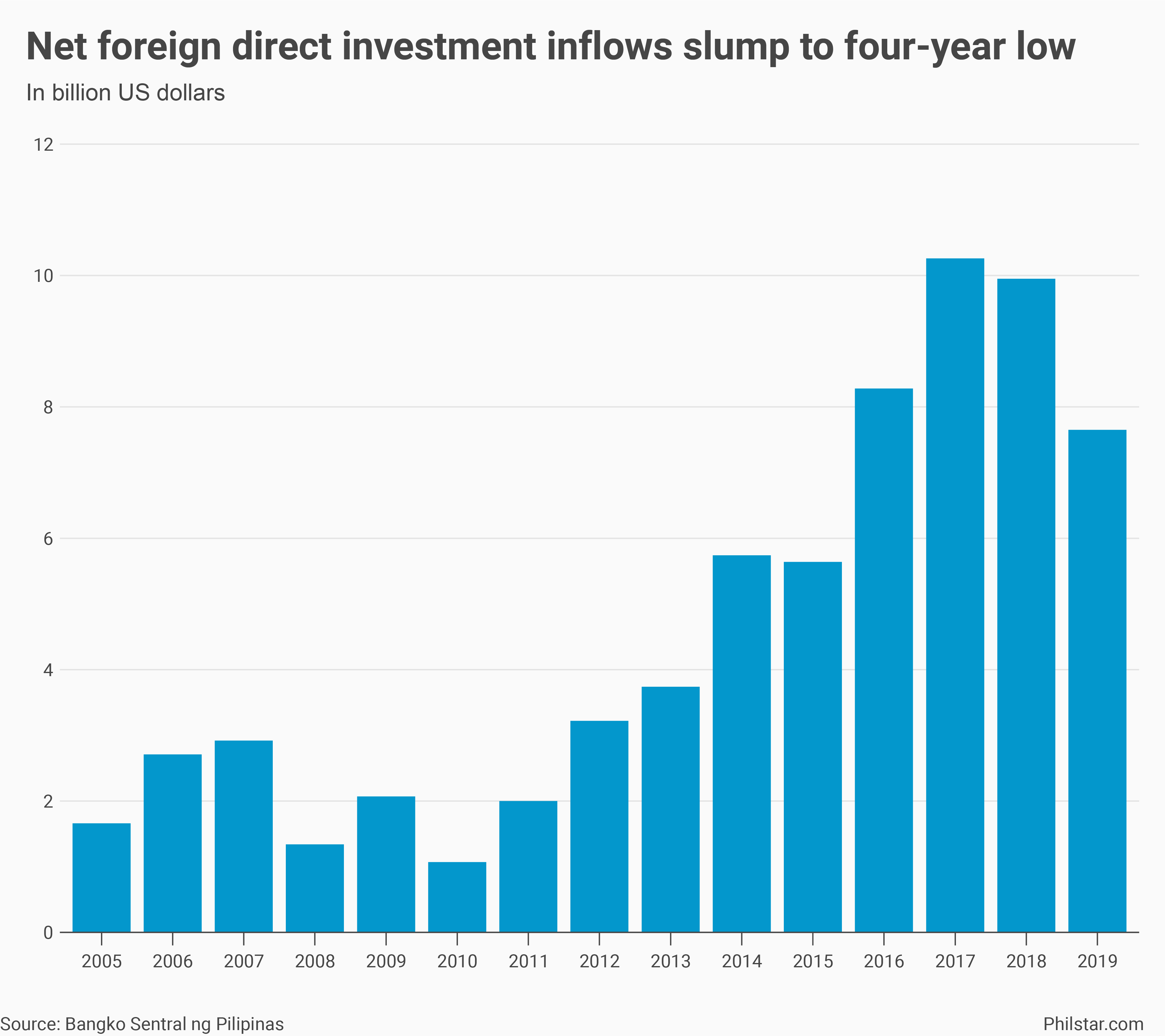

In a statement on Tuesday, Bangko Sentral ng Pilipinas (BSP) said net FDI inflows declined 23.1% year-on-year to $7.65 billion, the lowest since 2015 when net placements amounted to $5.64 billion.

Last year’s drop also marked the second consecutive year of decline since FDI hit a peak of $10.26 billion in 2017. Nevertheless, the total amount fell above the BSP’s downwardly revised projection of $6.8 billion for the year. Net FDI means more investments entered than left.

In explaining the FDI decline, BSP pointed to “global uncertainties” that tempered investor sentiment in the local economy, a reference to developments such as the US-China trade war and the Iran conflict that rattled investment confidence.

However, for Emilio Neri Jr., lead economist at Bank of the Philippine Islands, local developments likely played more in disappointing investors, especially as FDI elsewhere in the region, particularly in Vietnam and Indonesia, went up last year.

In Southeast Asia, the Philippines has long been a laggard in terms of FDI, considered by many policymakers as an indication of long-term investor interest in the country, which in turn, helps create jobs and support the economy.

“That means, the decrease in FDI is not just a global phenomenon. There must be some relatively better value seen by foreign investors in other countries,” Neri said in a phone interview.

For Neri, investors remained wary of the future status of their tax incentives as the Duterte government pushes for the removal of some of those, while slowly lowering corporate taxes, under the Corporate Income Tax and Incentive Reform Act (CITIRA) that remains pending in the Senate.

“Regulatory risks” were also factored in, after investors potentially avoided the uncertainties from President Duterte’s decision to revisit state contracts with private firms such as Manila Water Company Inc. and Maynilad Water Services Inc. “This came in the latter part of the year, but it may have had an impact for FDI in the first few months of 2020,” Neri said.

While CITIRA may finally get passed this year, thanks to President Duterte’s certification of the bill as urgent that allows it to be passed into second and third readings on same day, Neri said risks are compounded by the continued spread of the coronavirus disease-2019 (COVID-19), which has infected 33 in the Philippines as of Tuesday. “We will not be surprised if FDI will soften more this year because of the virus,” Neri said.

In the BSP’s report on Tuesday, FDI made a last-minute surge in December that saw it spiking 69% year-on-year to $1.15 billion, the biggest inflow for the year. The December uptick, however, was not enough to offset eight months of annual decrease that eventually led to a year-on-year slippage.

By country source, majority of FDI inflows in December emanated from Singapore, the Netherlands, Japan, and the United States, BSP said.The capital infusions in December were directed mainly to electricity, gas, steam and air-conditioning supply, and financial and insurance activities.

- Latest

- Trending