Coronavirus exposes vulnerabilities of China pivot as more infrastructure delays seen

MANILA, Philippines — In November 2016, when US President Donald Trump was elected, Socioeconomic Planning Secretary Ernesto Pernia fondly declared that with Trump’s protectionist tendencies, President Rodrigo Duterte’s pivot to China was a “safety net” for the Philippine economy.

"He foresaw this," Pernia said then.

Trump is vying for reelection in November, but the risks that supposedly associate with his nationalistic policies did not entirely manifest. Apart from exports getting pulled down by the US-China trade war, the dollar-making business process outsourcing continued to grow, albeit slower, foreign investments continued to enter, and remittances from overseas Filipinos—the bulk of which come from the US—have remained resilient.

In contrast, nearly two months into China’s scramble to contain Coronavirus Disease-19 (COVID-19), the local tourism sector already flagged potential losses of up to P23 billion, while exporters are already penciling in a slump in shipments during the first two months of the year.

The semiconductor industry, which accounted for nearly 42% of merchandise exports last year, is mulling plant closures if factories in China where parts from the Philippines are assembled do not re-open soon.

Chinese officials are too preoccupied with their response to the virus to discuss infrastructure deals with their Philippine counterparts.

“Our scheduled high-level meeting…in March has been postponed due to the coronavirus contagion,” Finance Secretary Carlos Dominguez III told Philstar.com.

The delay in meetings held quarterly to speed up development aid disbursement would entangle more than P300 billion in Chinese infrastructure funding under the “Build, Build, Build” program. Beyond the boardrooms, contractors are likewise bracing for project disruptions as the supply of raw materials like steel, of which China is a big exporter, begin to get depleted.

“If there will be a prolonged disruption, there will be consequential effects. We have not felt it yet, but with all uncertainties, everything will be vulnerable,” said Ibarra Paulino, executive director of the Philippine Constructors Association, an industry group.

Aid interrupted

In the face of public distrust, the Duterte administration strongly defended its abrupt China pivot when it took office in 2016.

Touting the need for the Philippines to develop new alliances, the government set aside a historic arbitral win against Beijing in exchange for supposed economic benefits, foremost of which are billions of pesos in infrastructure aid.

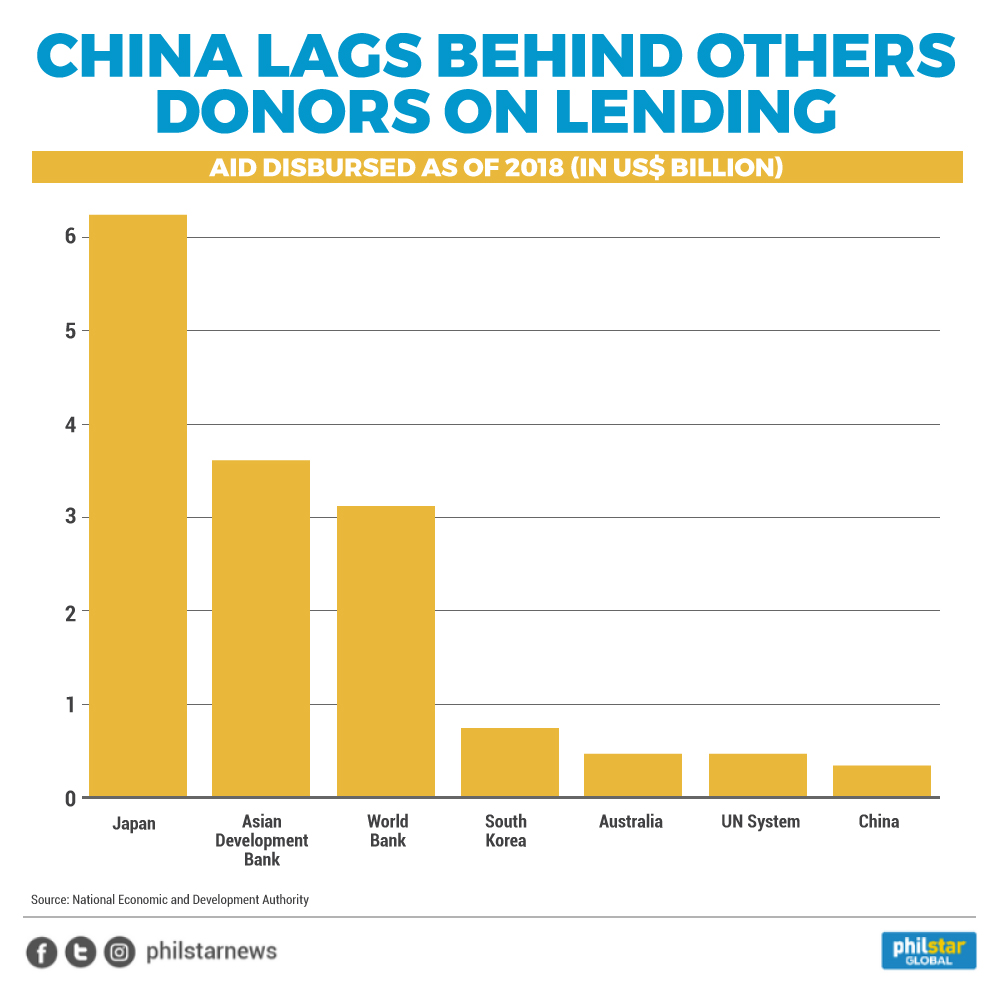

But with a little more than two years left into Duterte’s single six-year term, none of the P301.26 billion in China-funded outlays have been completed. In 2018, the latest year on which government data is available, only four Chinese grants and loans worth $365 million were disbursed, accounting for a measly 2.16% of total aid spent during the period.

Ruben Carlo Asuncion, chief economist at UnionBank of the Philippines, said the postponement of bureaucratic talks would worsen ODA take-up and have knock-on effects on actual groundwork.

“With China, and even now that the Xi government have their hands full with containment efforts against the COVID-19 spread, its ODA (official development assistance) loans processing may be disadvantaged with the Philippines’ unfamiliarity and, to some extent, its cautiousness in approaching these Chinese loans,” he said in an e-mail.

This is a reality long recognized by economic officials like Pernia, but, for some reason, the Duterte administration has failed to activate some of its contingencies. One of those, as Pernia had stated, would be to redirect some slow-moving China-funded projects to other donors like Japan.

The funding shift did not happen, with big projects bankrolled by China like the P50.03-billion Subic-Clark Railway already delayed, and some such as the P71.53-billion Mindanao Railway Phase 2, essentially just taken out of the list of flagship infrastructures.

Ronald Mendoza, dean of Ateneo School of Government, said it is never too late for the government to revert projects to other aid partners to speed up outlays, similar to how it decided last year to increase the number of public-private partnerships (PPP) to 29 from just nine on its first and shorter list of 75 projects.

The Duterte government had initially shunned PPPs as a financing scheme supposedly because bidding processes are too slow, but “right now, ODA-financed—particularly from China—has largely failed to deliver on its promise to accelerate the country’s infrastructure pipeline,” Mendoza said in an e-mail.

“Any further delays caused by COVID-19 creates a convenient additional excuse for the delays—but those were already there to begin with,” he added.

Supply shock

The problem is not limited to state-funded projects. As factory shutdowns in China limit raw material processing, private contractors are facing a shortage of construction inputs like steel, a key component on infrastructure building.

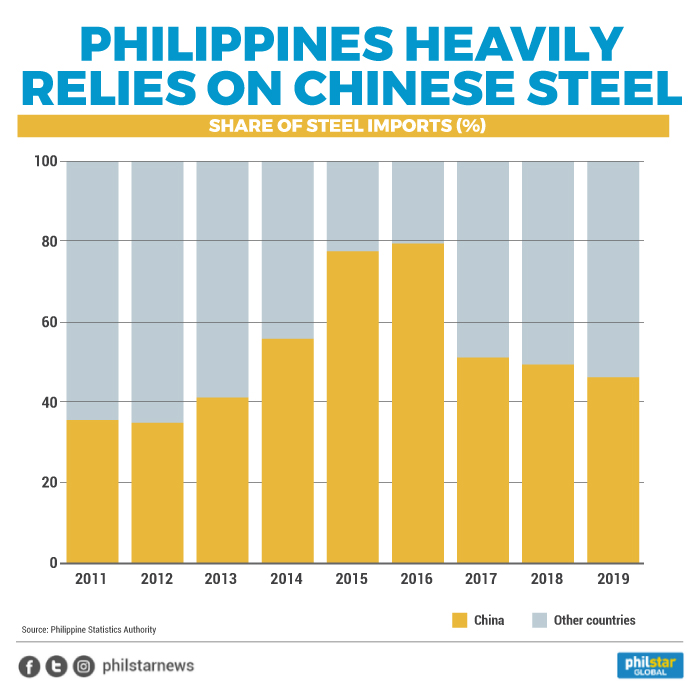

The mainland is the world’s biggest steel supplier, accounting for 16% of total exports in 2017, according to the latest Global Steel Trade Monitor report.

In the Philippines, China’s share of steel supply was bigger at 46.2% of local steel imports, equivalent to 3.49 million metric tons last year. The figure was down from a record 79% share in 2016, but the size of shipments had remained otherwise elevated.

“The concern now is really prices. High demand for Chinese steel in the mainland has pushed up import prices in recent months, and this situation on the coronavirus is not helping,” Sergio Ortiz-Luis, president of the Philippine Exporters Confederation, an industry group, said in a phone interview.

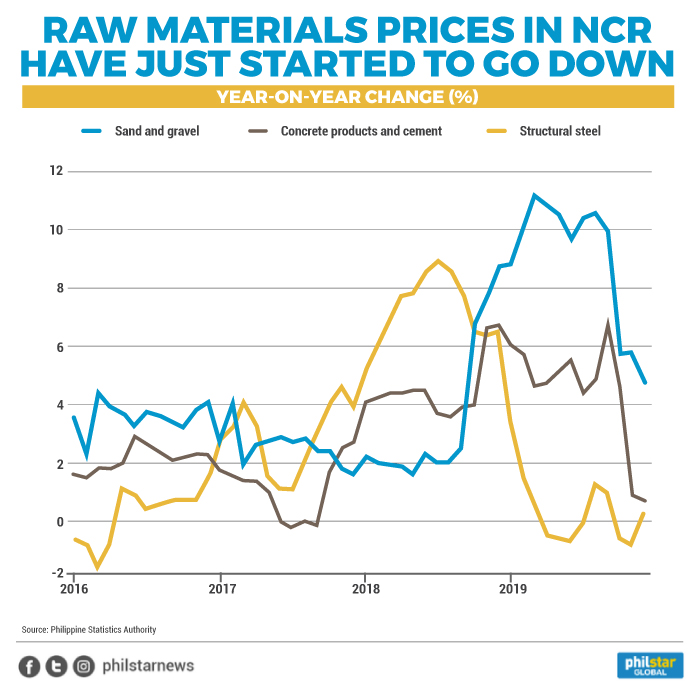

The looming steel crunch threatens to cut short the reprieve contractors are getting from easing price pressures on other raw materials like sand and gravel as well as cement.

In Metro Manila, sand and gravel costs surged by more than a tenth in the middle of last year after local governments stopped quarrying activities in response to the Duterte government’s crackdown on mining. Elevated cement prices have also just started to come down amid sufficient domestic production despite new tariffs imposed last year.

“Iron and steel and industrial machinery and equipment form part of our imports from China. If the outbreak is prolonged, there will definitely some delays and disruptions in the supply of these important infrastructure development inputs,” Asuncion said.

Roberto Cola, president of indutsry group Philippine Iron and Steel Institute was more optimistic. He said that as local demand for China’s steel dries up, prices for the metal would drop and benefit Filipino importers.

“China will be ramping up their exports to compensate the decrease in their domestic steel demand,” Cola said in a separate text message.

However, even as steel prices go down, Filipino contractors would have to wait for Chinese factories to re-open before they benefit from lower input costs.

Ortiz-Luis estimates that inventories can supply local demand for only about three months. “But if the outbreak goes beyond that, we will have a problem,” he warned.

- Latest

- Trending