Technicals point to a stable, stronger Phl peso

Last week, we wrote about the Philippine peso and discussed fundamental reasons why it has appreciated the past year (see The strong Philippine peso, Oct. 21). In this article, we show why it remains strong based on technical analysis.

USD/PHP rate

Since October 2018, the USD/PHP rate has been trading on a downward trend. The recent spike towards 52.80 in August (following the Chinese yuan’s break above 7.00 vs. the US dollar) failed to break the upper boundary of the trend. It has since traded back below 51.50, targeting 50.50 to 51.00.

Source: Tradingview.com, Wealth Securities Research

EUR/PHP rate

Similarly, the EUR/PHP rate has been trading on a downward trend for the past 12 months. The spike towards 59.00 in August fell short of the upper boundary of the trend. The downward trend has since resumed, and the chart is now pointing to a move towards 56 – 56.50.

Source: Tradingview.com, Wealth Securities Research

JPY/PHP rate

Against the Japanese yen, the peso has been stable and has traded in a rectangle pattern for the past 12 months. The upper boundary of the rectangle at around 0.50 acted as resistance when the JPY/PHP rate spiked in August. The lower boundary support of the rectangle pattern is at the 0.46 levels.

Source: Tradingview.com, Wealth Securities Research

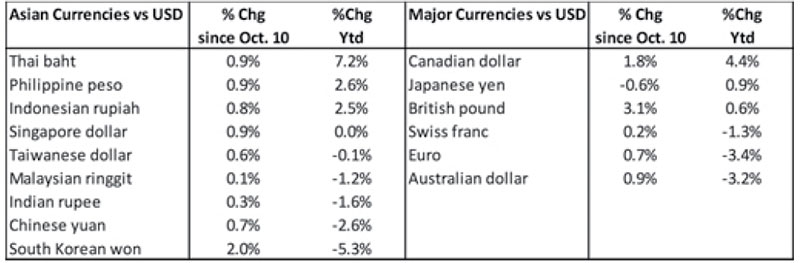

Currencies rally vs. US dollar after US-China Phase-1 agreement

The announcement of a Phase-1 deal between the US and China following a two-day meeting on Oct. 10 and 11 triggered a rebound in most currencies against the US dollar. Weak currencies such as the South Korean won and the British pound had the biggest rallies. The Thai baht, Asia’s best-performing currency, posted a new six-year high, up 7.2 percent year-to-date.

Source: Bloomberg, Wealth Securities Research

Search for yield spurs demand for Phil bonds, peso

In our article last week, we said that one of the significant reasons for the strength of the peso is the global search for yield. With more $17 trillion of bonds carrying zero to negative returns worldwide, investors have taken an interest in emerging market bonds to earn additional income from positive carry trades. This search for yield, coupled with easing trade tensions following the Phase-1 US-China deal, has sustained the high demand for Philippine bonds and supported the strong peso.

BSP cuts RRR by 100bp

Last week, the Bangko Sentral ng Pilipinas (BSP) surprised the market by cutting banks’ reserve requirement ratio (RRR) by 100 basis points. The BSP’s move has caused the peso to soften to 51.24 from an intraday high of 50.92 against the US dollar last Thursday. Despite this, the peso remains stable and still managed to register gains for the week. This points to the stability and strength of the Philippine peso.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email ask@philequity.net.

- Latest

- Trending