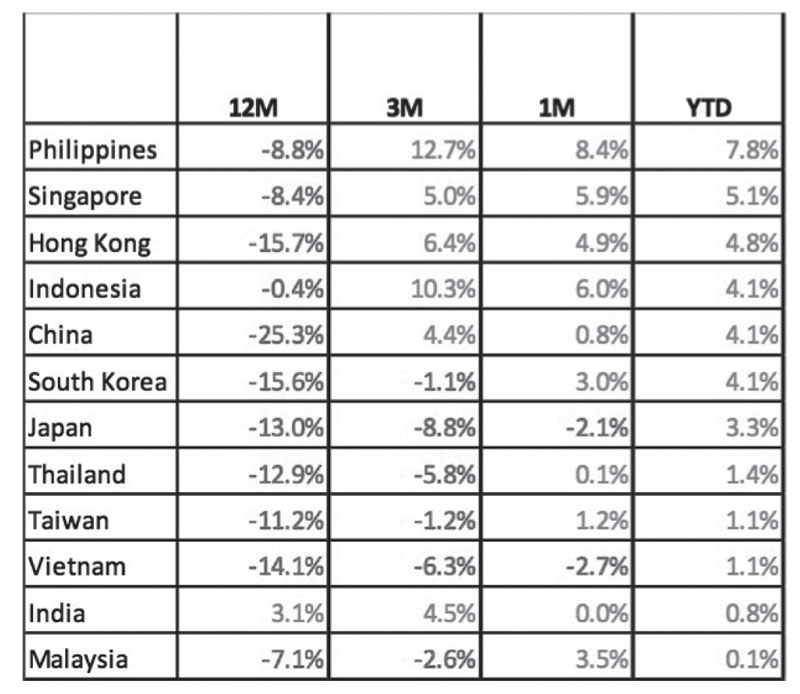

Philippines – Best stock market in Asia

The Philippine stock market has been one of the top markets in the world for the year 2019. In fact, it is the best stock market in Asia with a return of 7.8 percent in just three weeks. The PSEi also delivered the highest returns among Asian markets on a one month and three month time frame.

Stock market returns in Asia

Sources: Bloomberg, Wealth Research

Optimism in 2019 replaces last year’s fears

The extreme investor pessimism and bearishness in 2018 was replaced by hope, optimism, and bullishness in 2019. Below, we explain the developments which caused market sentiment to turn from negative last year to positive this year.

The Powell pop

After being called ‘tone deaf’ and ‘data independent’, Fed chair Jerome Powell said the central bank would be ‘patient’ and ‘flexible’ with policy. Powell, likewise, hinted about a slower pace of rate hikes and balance sheet tightening. This doused fears that the Fed’s policy tightening will exacerbate the slowdown that many major economies are experiencing. Powell’s statement addressed a major overhang for the market and triggered a global rally in stocks.

Another stimulus package for China

After announcing a cut in reserve requirements for banks, China signaled more stimulus measures to support faltering economic growth. Recent data showed a contraction in trade and factory activity as the Chinese economy was clearly hampered by the trade war.

Progress in US-China trade talks

A round of trade talks between the US and China were concluded in early January. China promised to purchase agricultural, energy and manufactured products from the US. The progress in the latest trade talks were followed by conciliary statements from Trump and Xi Jinping. In addition, China Vice Premier Liu He is scheduled to meet with US Trade Representative Robert Lighthizer and US Treasury Secretary Steven Mnuchin later this month.

EM stocks outperform in January

Many emerging market indices have outperformed in the first three weeks of January as concerns receded. The recent statement by Powell may halt the steep rise in interest rates and stem fund outflows from emerging markets. Meanwhile, EM countries should benefit if China’s stimulus can stabilize its slowing economy. Lastly, progress on the trade talks and an eventual resolution of the trade war bodes well for emerging markets, as these can prop up international trade and global economic growth. Favorable developments on these fronts should sustain the gains in EM stocks and the PSEi’s strong momentum in the first three weeks of the year.

Cautious optimism

Despite the strong performance of global markets, investors should remain mindful of risks that may upset the ongoing stock market rally. This includes a pronounced economic slowdown and a breakdown in trade talks between the US and China. In the local front, investors should be cognizant of the risk posed by future overnight placements such as the ones conducted by Ayala Corp (AC) and Puregold Price Club, Inc (PGOLD) last week. As we have seen in the past, an avalanche of overnight placements may sap liquidity from the market and trigger a correction in the PSEi.

A brighter 2019 for Philippine stocks

Philippine stocks have outperformed in the last three months, benefiting from a slowdown in inflation, lower oil prices and a recovering peso. In addition, election-related spending may further stimulate economic activity this year. These catalysts should support domestic consumption which accounts for two-thirds of the country’s economy.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 250-8700 or email [email protected].

- Latest

- Trending