FINTQ offers sachet insurance for sari-sari store owners

MANILA, Philippines — FINTQnologies Corp., the financial technology arm of Voyager Innovations, recently launched a “sachet” or “tingi-tingi” microinsurance product to help “sari-sari” store owners protect their businesses.

Dubbed as the KasamaKA Negosure, the product enables microenterpreneurs to safeguard their livelihood just by filling out a form and availing of microinsurance package, eliminating heavy paperwork and documentation which are usually required by insurance companies.

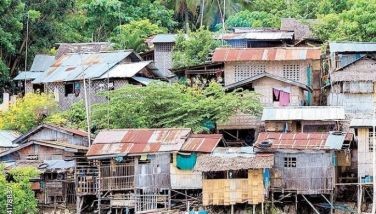

“The sari-sari store is the social pantry of every village across the country, yet majority of the one-million strong neighborhood stores are outside the reach of the financial system,” FINTQ managing director Lito Villanueva said in a statement.

“With this sachet insurance, we are effectively bringing access to affordable financial products to microentrepeneurs through their most ubiquitous device, their mobile phone,” he added.

The product was initially offered to sari-sari store owners at the 10th Anniversary of Unilever’s Super!Store program. Around 500 Unilever’s Super!Store owners were provided with Negosure coverage.

In the coming months, FINTQ will announce the full commercial availability of the product to the market.

FINTQ said Negosure would be made available to all types of sari-sari stores, from big stores with 500 pieces of canned and bottle goods to small stores carrying below 199 pieces of goods.

The sachet product covers the reconstruction of the store in case of a fire accident, and provides coverage for the store owners in case non-fire-related accidents.

Under Negosure, sari-sari store owners will be able to choose from three options. These include Plan 1200 with P100,000 reconstruction benefit and P200,000 personal accident benefit for one year; Plan 480 with P40,000 reconstruction benefit and P80,000 personal accident for one year; and Plan 25 with P20,000 reconstruction benefit.

Villanueva said the product supports Voyager and FINTQ’s “Road to 20 by 2020” goal of bringing 20 million Filipinos into the formal financial system by 2020, in line with the government’s national strategy for financial inclusion objectives.

“FINTQ is introducing Negosure to the market with a simple yet profound goal in mind: ensure that the unbanked and underserved will finally be able to protect their business from any accident and thus grow their business without being burdened by the heavy cost of financial products,” Villanueva said.

He said the company rolling out Negosure as part of its commitment to include the unbanked and underserved population into the formal financial system through its broader movement KasamaKA.

Launched at the Bangko Sentral ng Pilipinas last year, KasamaKA is a “grassroots-based, self-help, and digital-enabled” social intervention and last-mile solution to promote financial literacy and inclusive growth.

Under the KasamaKA, Filipinos can earn additional income through referral, as well as gain wider access to a savings account and microinsurance for a minimal fee and affordable loans with the use of their mobile phones.

- Latest

- Trending