Inflation not seen to be a big problem for most of emerging Asia, except the Philippines

MANILA, Philippines — Spiraling inflation is unlikely to become a big headache for most of the region’s central banks—except in the Philippines, where policymakers continue to wrestle with rising commodity prices that have been hitting the poor the most.

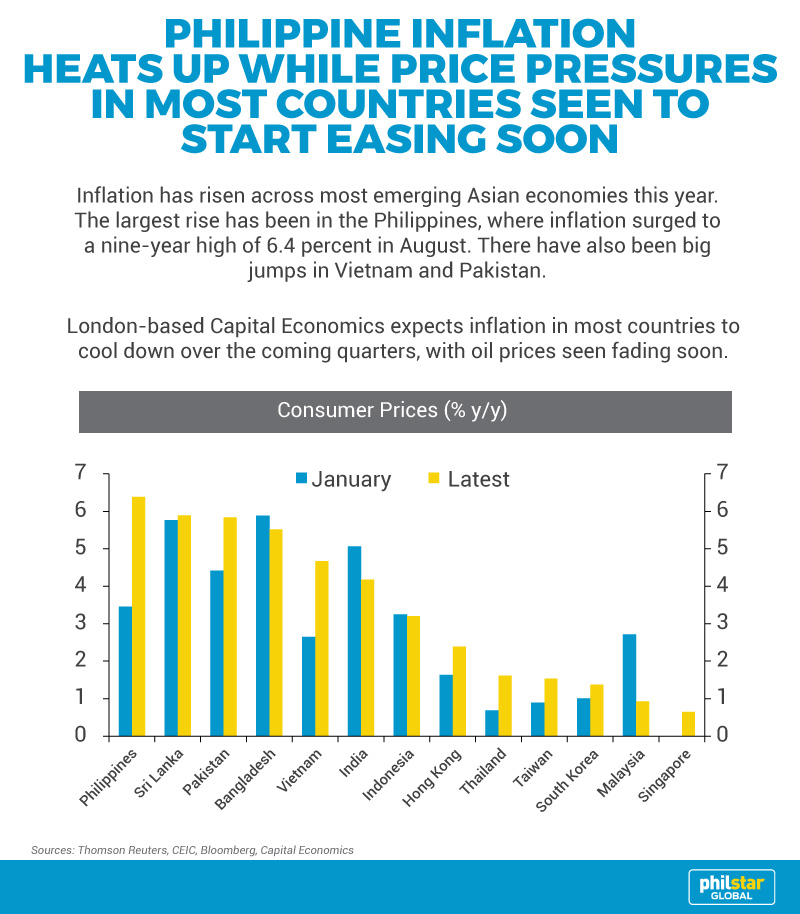

Philippine inflation jumped to 6.4 percent in August, the highest level in almost a decade, as oil and rice prices picked up. Higher excise taxes slapped on other goods have also fueled inflation.

The Bangko Sentral ng Pilipinas is now considering holding an extraordinary policy meeting to fight price spikes and strengthen the weakening peso.

READ: Philippine peso breaches P54:$1 level

According to London-based Capital Economics, most central banks are unlikely to follow the Philippines, which is seen to tighten monetary policy aggressively over the rest of the year to rein in inflation that is now higher than most emerging economies in Asia.

It added that the BSP might be building the case for another 50 basis-point rate hike that could possibly come even before the Monetary Board’s policy meeting on September 27.

Price pressures in most countries expected to ease

Although Indonesia has little to worry about on the inflation front, Capital Economics, meanwhile, expects Bank Indonesia to raise interest rates at least twice more before the end of the year, with the rupiah coming under renewed pressure.

“Looking ahead, we expect price pressures in most countries to start easing soon. For one thing, the pressure from higher oil prices should fade,” Capital Economics said in a report released Wednesday.

“If inflation starts to drop back over the coming quarters, as we expect, this will ease the concerns of policymakers and is a key reason why we don’t expect many more countries to hike interest rates in the quarters ahead,” it added.

The BSP has raised its policy rates by a cumulative 100 basis points from May to August to discourage bank lending and cool down consumer demand that could have pushed up inflation.

Philippine policymakers have been concerned over inflation this year after it slowed economic growth to a three-year low of 6 percent in the second quarter.

Socioeconomic Planning Secretary Ernesto Pernia recently said Malacañang will release an executive order directing the implementation of a number of measures to stem inflation.

- Latest

- Trending