FDI surge 42%, breach $5B-mark in first half

MANILA, Philippines — Foreign direct investments to the Philippines rose by nearly a tenth in June, bringing first semester inflows to more than half the central bank target.

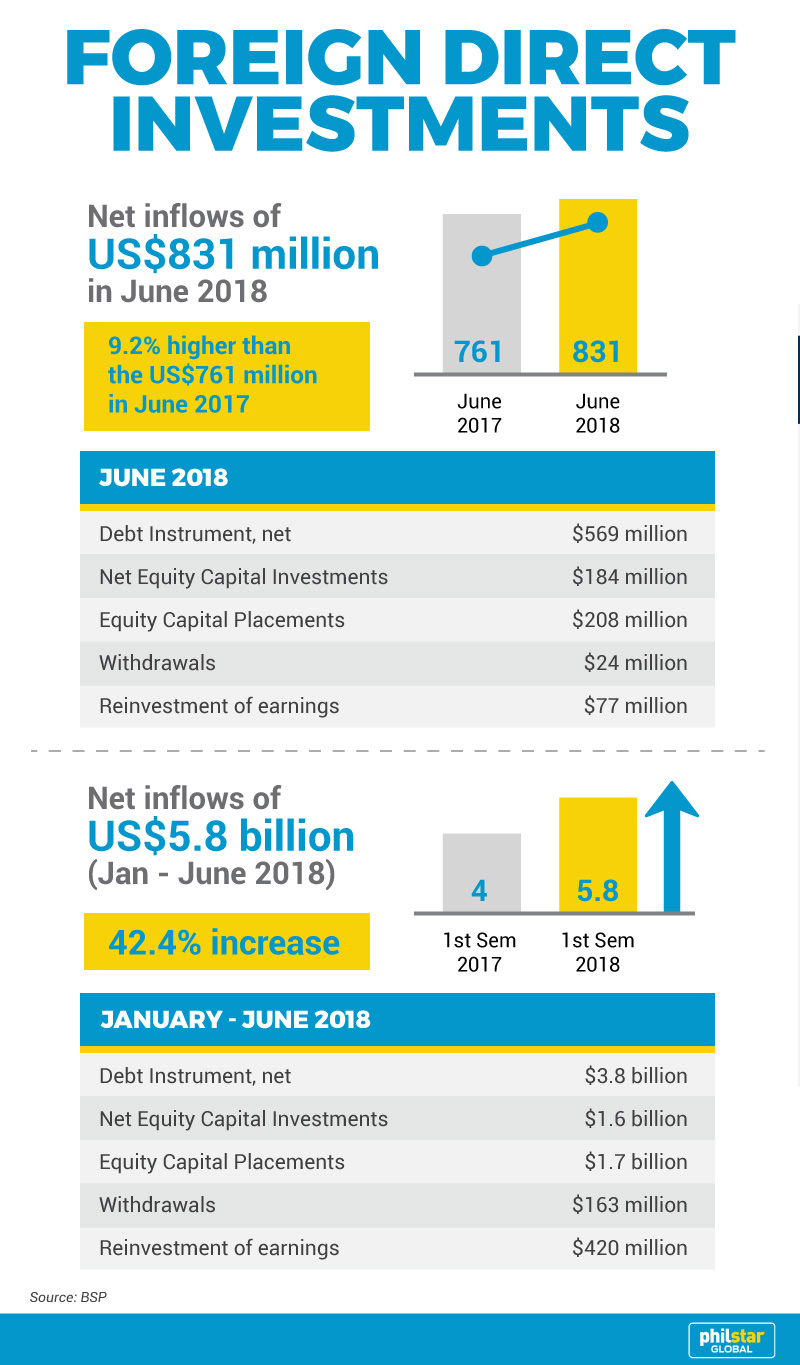

According to the Bangko Sentral ng Pilipinas on Tuesday, net FDI inflows amounted to $831 million in June, 9.2 percent up from $761 million in the same period a year ago.

The latest figure brought the year-to-date tally to $5.755 billion net inflow, up 42.4 percent year-on-year. Net inflow means more investments entered the country than left.

The Philippines has lagged behind its Southeast Asian peers in terms of attracting FDI, which is believed to help generate more quality jobs and spur economic and income growth, in the long run.

That said, the January-June FDI amount represents about 65 percent of the BSP's revised $9.2-billion forecast for the year. In 2017, FDI rose to a record high of $10 billion.

Broken down, equity placements or new FDI rose more than seven times to $1.585 billion in the first six months, data showed.

"Equity capital infusions during the first semester were sourced primarily from Singapore, Hong Kong, China, Japan, and the United States," the central bank said in a statement.

"These were invested mainly in manufacturing; financial and insurance; real estate; arts, entertainment and recreation; and electricity, gas, steam and air-conditioning supply activities," it added.

Meanwhile, reinvested earnings—representing income invested anew by existing foreign firms here—inched up 0.8 percent to $420 million, data showed.

On the other hand, the bulk of FDI came in the form of intercompany borrowings or funds borrowed by local-based firms among each other or from their mother company abroad to be used for expansion.

Intercompany debts increased 9.6 percent year-on-year to $3.751 billion from January to June.

- Latest

- Trending