Do you believe in ghosts?

The ghost month will start this Saturday, Aug. 11. The last day of the ghost month this year will fall on Sept. 9. In Chinese culture, the ghost month is believed to be a period when ghosts and spirits visit the world of the living. Thus, people who observe the ghost month abstain from implementing major changes or decisions such as constructing a new home, moving to a new office or getting married. Investments in new business ventures or in stocks are also put off for a later date.

Ghosts in the stock market

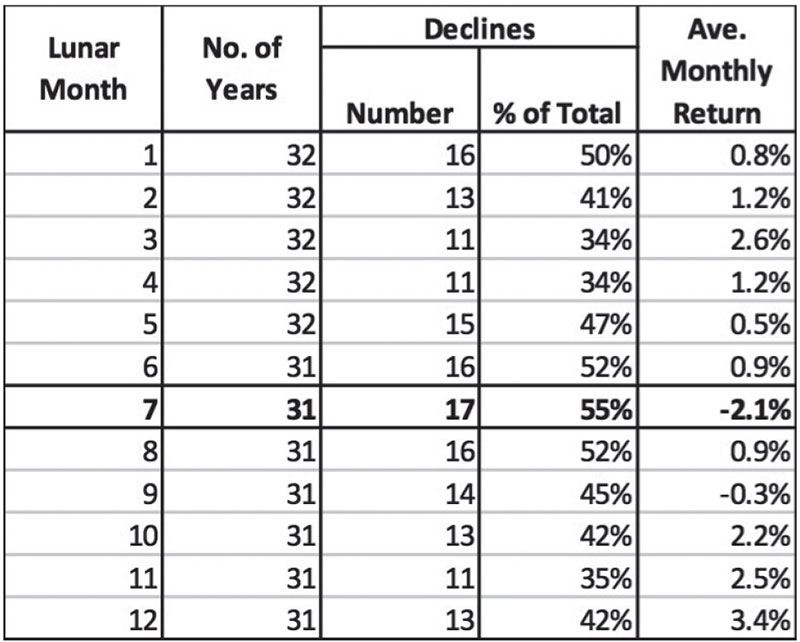

Whether one believes in ghosts or observes the ghost month, there must be some reason why people do not invest in the ghost month. As shown in the table below, the ghost month is the worst period of the year for stocks. It has the highest chance of declining and has the lowest average return among all the months in the lunar calendar. Based on data from 1987 to 2018, the PSEi has a 55 percent chance of declining and an average loss of 2.1 percent during ghost months.

PSEi returns during the months of the lunar calendar

Sources: Bloomberg, Wealth Research

Frightening returns during August, September

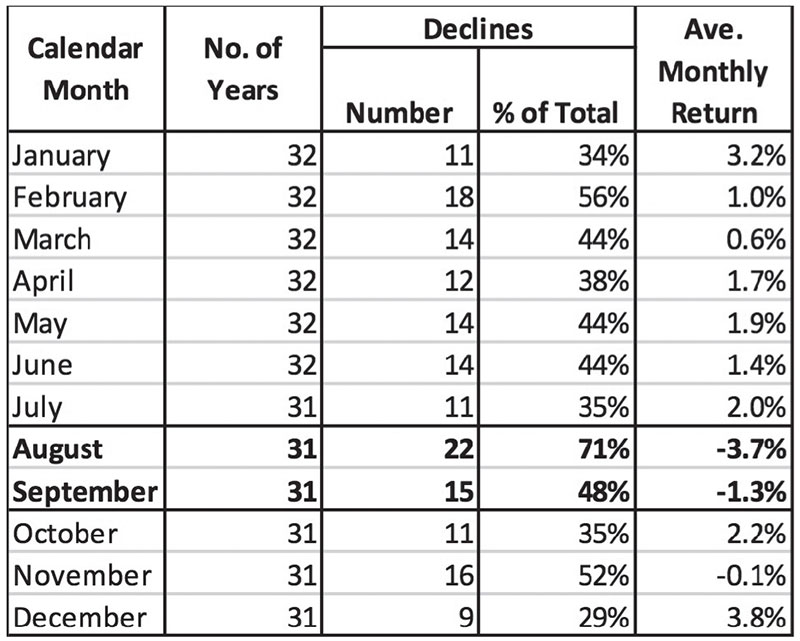

The seasonal weakness of the PSEi during the ghost month coincides with the poor historical performance of the stock market in the months of August and September. In the table below which is based on statistical data gathered from the past 31 years, the PSEi has a 71 percent chance of declining and an average loss of 3.7 percent in the month of August. Meanwhile, the index has an average loss of 1.3 percent for the month of September.

PSEi returns during the months of the Roman calendar

Sources: Bloomberg, Wealth Research

Risks that may exacerbate the ghost month effect

The PSEi has staged an impressive rally ahead of the ghost month. Despite this, we note the following risks should still be monitored as these may spook investors and upset the market’s rebound. These are 1) The ongoing trade war between the US and China. 2) Higher inflation. 3) Rising interest rates. And 4) Geopolitical risks, such as the impact of the ongoing US sanctions on Iran.

From ghost to cupid

Though some may believe in ghosts or religiously observe the ghost month, it would still be wise to look at empirical data and capitalize on seasonal patterns that the stock market exhibits. For instance, one can take advantage of the seasonal weakness during the ghost month to buy new stock positions or add to one’s equity portfolio ahead of the strong season for stocks.

In a previous article, we showed that the period from ghost to cupid, which takes place from the end of the ghost month up to Valentine’s day, has a 70 percent chance of turning positive and an average return of 9.7 percent (see From Ghost to Cupid, Aug. 31, 2015). This period captures the robust performance of the market during December and January, which are the strongest months for stocks in terms of probability and average returns.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending