A closer look at the 'darling' Philippine economy

MANILA, Philippines — In an attempt to fire back at Vice President Leni Robredo, who advised President Rodrigo Duterte to pay attention to the economy instead of hurling tirades against her or God, presidential spokesman Harry Roque claimed: “all economies in the world will agree that we are a darling economy.”

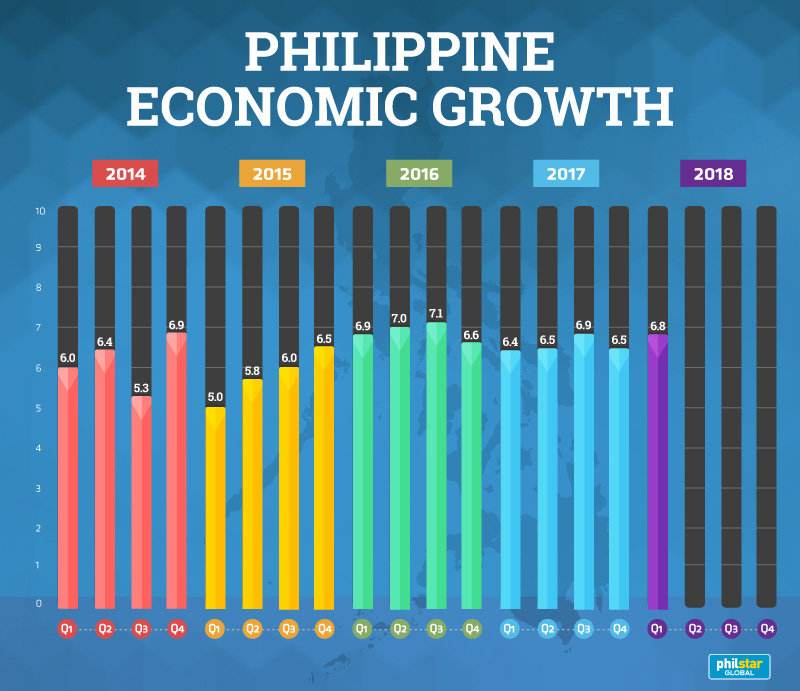

The Philippine economy has, in fact, enjoyed uninterrupted growth for the past quarters, thanks to benign inflation in the previous years that had given the central bank enough room to keep interest rates low.

But some economists recently flagged some concerns that might dent the country’s bullish growth story.

To supercharge economic growth, the Duterte administration plans to spend more than P8 trillion to upgrade the nation’s dilapidated infrastructure and aging ports.

In the first quarter of 2018, the Philippines remained one of the best performing economies in the region after it grew 6.8 percent, faster than the preceding three month’s 6.5 percent and the 6.4 percent pace in the comparable period last year.

However, the first quarter economic growth figure fell below the government’s 7-8 percent target range for 2018, which Socioeconomic Planning Secretary Ernesto Pernia attributed to “spoiler” inflation.

Inflation reaches five-year high

Inflation jumped to a fresh five-year high of 5.2 percent in June, beating both government and market expectations. Year-to-date, inflation averaged 4.3 percent, above the Bangko Sentral ng Pilipinas’ 2-4 percent target band.

People have blamed soaring prices on the Duterte administration’s Tax Reform for Acceleration and Inclusion law, which lowers personal income taxes while raising excise levies on fuel and “sin” products, among others. Supply-side factors like higher global oil prices—worsened by the continuing depreciation of the peso—are also pushing up commodity prices.

The government plans to release subsidies, in the form of fuel vouchers and cash transfers, to help cushion TRAIN's impact on prices.

The BSP expects inflation to peak in the third quarter of 2018, or “earlier” than its previous projection. Meanwhile, analysts at Nomura said headline inflation will likely peak only around August or September, before gradually easing from there.

Independent think tank IBON, which is critical of TRAIN, has meanwhile said the government "should stop hyping TRAIN’s cash transfers because when they are ended by 2020, the higher prices of goods and services due to TRAIN will remain."

To rein in inflation, the BSP has introduced back-to-back rate hikes this year. Higher interest rates discourage people from borrowing money and spending, causing a decline in demand which, in turn, tempers inflation and can even slow down the country’s economic growth.

The latest round of policy tightening is also expected to lend some strength to the peso, which has been hovering at 12-year lows and has weakened by more than 7 percent against the US dollar year-to-date, making it one of Asia's worst performing currencies so far this year.

Concerns over rising domestic inflation, weaker peso, trade tensions and ongoing normalization of monetary policy in advanced economies have battered the country’s financial markets.

RELATED: Inflation, weaker peso stoke hot money outflow in June

Meanwhile, the Philippines’ trade deficit—wherein the country's imports exceeds its exports—rose to a five-month high of $3.70 billion in May, as the government’s aggressive infrastructure drive continues to push up imports while exports slump despite relief from the peso’s depreciation. Some economists believe the persistent trade deficit could have a negative impact on the economy.

Jobs and wages

In June, the government said that unemployment had eased slightly in April at 5.5 percent — around 2.36 million Filipinos — from 5.7 percent recorded in April 2017.

Underemployment—which the government defines as the proportion of those already working but still seeking more work or longer working hours— however jumped to 17.0 percent or 6.9 million in April from 16.1 percent or 6.4 million a year ago.

IBON, in a statement in June, said that "official unemployment figures do not reflect discouraged workers or those who have dropped out of the labor force after failing to find work after six months."

It added that although employment grew, the agriculture sector saw a drastic drop in employment. It said employment in agriculture dropped by 723,000 to 9.8 million in April from 10.5 million in April 2017.

The think tank also pointed out that the "hunting and forestry subsector lost 558,000 jobs, while fisheries lost 134,000."

It added the job statistics do not reflect "poor quality work or jobs that are insecure, lack benefits and have low wages." It said the growth in underemployment indicate that, for many, "full-time work still does not give enough income for the employed to meet their basic needs."

“Madam Vice President, there is no problem with the economy,” Roque stressed in his comments to Robredo on Thursday. — Ian Nicolas Cigaral

- Latest

- Trending