BIR tells companies: implement income tax cuts

During a public consultation for the implementing rules and regulations of the TRAIN act, BIR commissioner Caesar Dulay said payroll managers “should be ready” for the implementation of adjusted personal income tax rates now that the new withholding tax table is out.

MANILA, Philippines — As pay day nears, the Bureau of Internal Revenue on Thursday said there’s no reason for companies to delay the implementation of adjusted withholding tax rates, after the Duterte administration’s new tax reform law took effect last January 1.

On December 19, President Rodrigo Duterte signed into law Republic Act No. 10963, or the Tax Reform for Acceleration and Inclusion (TRAIN) Act, which aims to generate revenue to fund a multi-billion dollar infrastructure program key to the government's economic agenda.

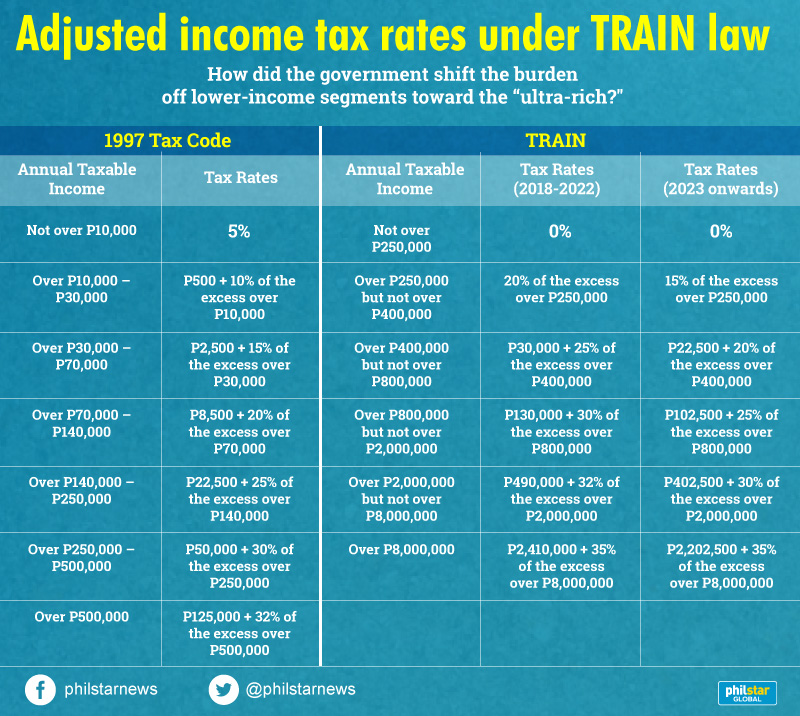

Under the fresh law, personal income tax rates will be reduced while projected revenues to be foregone will be offset by higher excise levies on petroleum and automobiles, among others.

Last December 28, the BIR issued Revenue Memorandum Circular No. 105-2017, which revised the withholding tax table on compensation in the Tax Code to reflect the changes under the TRAIN law.

During a public consultation for the implementing rules and regulations of the TRAIN act, BIR commissioner Caesar Dulay said payroll managers “should be ready” for the implementation of adjusted personal income tax rates now that the new withholding tax table is out.

Non-compliant companies will be penalized, Dulay warned.

“We have published the RMC (Revenue Memorandum Circular) — they should have checked that,” he said.

“They know the rates... They should be ready,” he added.

The TRAIN law exempts those earning an annual taxable income of P250,000 and below from paying personal income tax.

Meanwhile, those earning above P8 million annually will be slapped with 35 percent personal income tax, higher than the current 32 percent.

READ: Winners and losers: How the TRAIN law affects rich, poor Filipinos

- Latest

- Trending