Dollar strength re-accelerates after Trump win

Last week we discussed the winners and losers for 2016 especially in light of Trump’s victory in the recently concluded US elections (see Winners and Losers, Nov. 28, 2016). One clear winner is the US dollar.

The big picture – Major upward trend in US dollar since 2013

Note that the US dollar index (DXY) has been on a major uptrend since 2013. In fact, we have written a trilogy of articles about it (see It’s the Strong Dollar Stupid, June 24, 2013, It’s the Strong Dollar Stupid, Part 2, Oct. 6, 2014, It’s the Strong Dollar Stupid - Episode 3, Jan. 18, 2016). The main narrative has been the divergent central bank policies. Whereas the US Fed has been looking at tightening since Bernanke’s “tapering” speech in May 2013, the BOJ and the ECB have been easing.

US dollar resumes upward trend

Below shows the US dollar index breaking out of its 21-month consolidation after it breached 100 last November. Trump’s victory may have been the catalyst that led the US dollar index (DXY) to break out of its consolidation.

Source: Stockcharts.com

De-facto rate hike

Note that even prior to elections, the US dollar has started to move up when US interest rates rose sharply. US 10-year Treasury yields rose 50 basis points from a low of 1.35 percent in July to 1.85 percent a day before the elections. This sharp move in US Treasury yields is like a de-facto rate hike, making the US dollar more attractive. The US dollar has resumed its strength against major currencies as interest rate differentials between US and European & Japanese debt widened since July.

Trump’s victory means higher inflation

In addition, Trump’s victory also means higher inflation. Speculation that Trump will go on a spending spree sent US treasuries and other global bond yields shooting higher. Trump promised tax reforms, deregulation and major infrastructure spending to spearhead the US economy. This sent bank stocks and the industrial metal complex higher. As of last week, the 10-year US yield rose further to a one-year high of 2.39 percent or 104 basis points higher from its low in July.

Protectionist policies?

Trump is also seen as implementing what many perceive as protectionist policies which he espoused during his campaign. He threatened to renegotiate and even possibly scrap trade deals such as North American Free Trade Agreement (NAFTA) and the Trans Pacific Partnership (TPP) which he views as detrimental to American interests. Trump’s seemingly protectionist policies may mean a reduction in global trade and consequently less US dollar flowing to the global financial system.

Dollar shortage?

With Trump’s economic policies coupled with the rising US interest rates, there is increasing risk of a dollar shortage once these dollar-debt holders scramble to pay their debts in a rising US dollar environment. According to the Bank of International Settlements (BIS), emerging market nations and companies have increased their amount of debt denominated in dollars from $1.9 trillion at the end of the global financial crisis in 2009 to $3.3 trillion as of 2015.

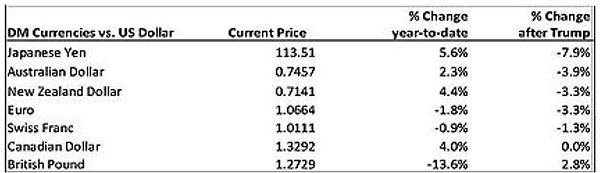

Major currencies performance after Trump

The US dollar index has risen three percent since Trump won the US elections. Among major currencies, the Japanese yen weakened the most depreciating by 7.9 percent since Nov. 8. This is followed by the Aussie dollar, the New Zealand dollar and the Euro, each depreciating more than three percent over the same period.

Source: Bloomberg

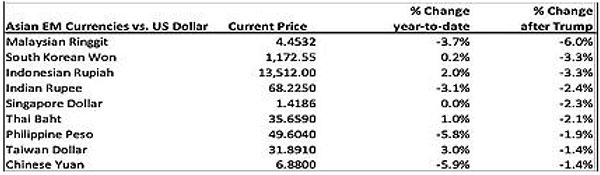

Asian currencies performance after Trump

Among Asian currencies, the Malaysian ringgit fell the most since Nov. 8, depreciating by six percent against the US dollar. The South Korean won and the Indonesian rupiah are each down by 3.3 percent against the greenback.

Year-to-date, the worst performing Asian currency is the Chinese yuan which has weakened 5.9 percent against the US dollar, followed by the Philippine peso which has depreciated by 5.8 percent.

Source: Bloomberg

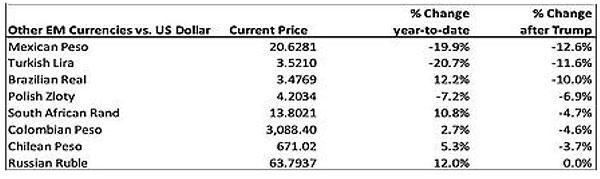

Mexican peso, Turkish lira & Brazilian real worst hit

The worst-hit emerging market currency, however, following Trump’s victory are the Mexican peso, the Turkish lira and the Brazilian real which are all down by more than 10 percent against the US dollar.

Year-to-date, the Turkish lira has depreciated 20.7 percent due to the worsening political situation and weakening economic indicators. Meanwhile, the Mexican peso is down 19.9 percent against the US dollar on increased trade risks, threats of deportation of illegal Mexican immigrants and the repatriation of tax receipts following Trump’s victory.

Source: Bloomberg

Philippine peso support at 50 holds

In one of our articles in October, we discussed two possible scenarios for the peso (see Possible Scenarios for the Peso, October 24, 2016). Since then, our first scenario of a confirmed breakout at 48 materialized and the peso has already hit our measured target of 50 last month. Short-term, the peso appears to have stabilized after finding support at the 50/$1 level. The peso has since strengthened to 49.60 as of Friday.

US dollar - Sell on news following a rate hike?

Given the almost 100 percent chance of a Fed hike this December according to Fed Fund futures, we may actually see a “sell-on-news” phenomenon.

Since much of this US dollar strength may already been priced-in, we may actually see a pullback or consolidation in the US dollar similar to what happened when the US Fed hiked last year. This should then provide respite to EM currencies, including the Philippine peso which is now trading near its resistance level of 50/$1.

On the other hand, if the Philippine peso convincingly breaks above 50 following a much stronger US dollar due to Trump’s economic policies, we may then see it heading towards the 51 to 52 range.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles.

- Latest

- Trending