It’s the strong dollar, stupid! – Episode 3

The turmoil in stocks, commodities and currencies continued last week with US stocks registering the worst 10-day start in history. As we have explained in the past, one of the primary reasons for the decline and extreme volatility in risk assets is the strong US dollar. Last week we showed how stocks were pummeled by recent moves of China to depreciate its currency (see China Pummels Global Markets, Jan. 11, 2016). This week we show the rout that happened in currencies.

Episode 3 of the Strong Dollar Saga

Recall that as early as 2013, we wrote about the strong resurgence of the US dollar and the consequent topping out of emerging market currencies, including the Philippine peso. In fact, we have written about this in Chapter 7, The Peso Tops Out, of our book “Opportunity of a Lifetime,” as well as in numerous articles in Philequity Corner.

With sequels and trilogies gaining popularity in movies recently (e.g. in Star Wars, The Avengers, The Hunger Games, etc.), we are following up with our own sequel on the US dollar. Hence, we now have Episode 3 of this three-year long saga (see It’s the Strong Dollar, Stupid!, June 24, 2013 and It’s the Strong Dollar, Stupid!, Part 2, Oct. 6, 2014).

“R” currencies rumble

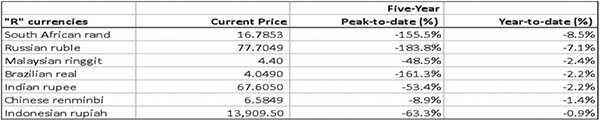

In the past, we wrote about the “Fragile 5” and the “Troubled 10” currencies. Today, we have the “Rumbling R-currencies.” Most of these currencies which start with the letter “R” suffered the most vicious losses this year against the US dollar.

The South African rand which is down 8.5 percent year-to-date against the dollar hit an all-time low last week. The Russian ruble which dropped 7.1 percent since the start of the year is back to the record low levels it reached in 2014.

The South African rand, the Russian ruble and the Brazilian real are now down more than 150 percent from their respective peaks. The persistently falling oil and commodity prices, together with high current account deficits and high inflation have exacerbated the fragility of these currencies.

Meanwhile, the renminbi which caused the rout in stocks and currencies this year has dropped 8.9 percent from its peak. While the drop is not much, it has caused much chaos because it has been pegged to the dollar for the longest time. It also shows the growing importance of China to the world economy and to the financial markets.

Source: Bloomberg, Wealth Research Research

Emerging Market currencies crash

Emerging market currencies crashed in the first two weeks of 2016 led by the Nigerian naira which slumped to a record low of 305 against the US dollar in the black market. While the Central Bank of Nigeria has pegged the naira to 199 to the US dollar since March 2015, the shortage of foreign currency has led to the weakening of the naira in the black market in recent months. Among all currencies, the naira is the worst performing since the start of the year with a 53.2 percent decline.

The Mexican peso and the Kazakh tenge, which are both trading at historic lows against the US dollar, are down 6.1 percent and 6.0 percent year-to-date, respectively.

Source: Bloomberg, Wealth Securities Research

Largest decline in oil price history

Exacerbating the downward slide in EM currencies is the plunge in oil prices. Both WTI and BRENT crude prices fell toward 30 dollar per barrel level, their lowest in 12 years. THE 75 PERCENT DECLINE IN CRUDE PRICES IS NOW THE LARGEST DECLINE IN HISTORY.

Source: Stockcharts.com

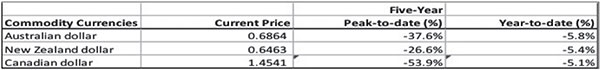

Commodity currencies free-fall

Currencies of commodity-exporting countries such as the Australian dollar, Canadian dollar and New Zealand dollar continued to free-fall. The Canadian dollar dropped 11 straight days to register a 13-year low against the US dollar. Meanwhile Aussie dollar declined to its lowest since 2009. Together with the New Zealand dollar, these commodity currencies are down more than 5 percent year-to-date.

Source: Bloomberg, Wealth Securities Research

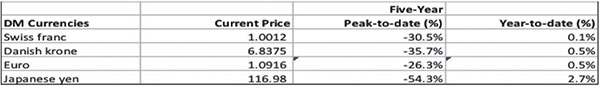

Yen rises on “safe-haven” buying

The Japanese yen is the only major currency that have risen against the US dollar as investors looked for a safe haven among developed market currencies. While the euro, Swiss franc and Danish krone have dropped substantially from their peaks, they are relatively flat this year.

Source: Bloomberg, Wealth Securities Research

Philippine peso, down but not out

Many were caught off-guard by the swift decline of the peso this year. But as we explained in the past, the peso is down because of the drop in other emerging market currencies. The peso is down by 1.9 percent year-to-date and down 17.7 percent peak-to-date.

In comparison, many emerging market currencies are down between 2 to 6 percent year-to-date and down over 50 percent from their respective peaks.

In order to understand the weakness of the peso you have to understand why the dollar is strengthening. Please read our archived articles Peso Tops Out (May 27, 2013) and Best House in a Bad Neighborhood (Sept. 2, 2013), and our book Opportunity of a Lifetime. Our book was published for our readers not only as a guide for reading past archived articles but also as a learning tool for their investment strategies.

Peso’s next support at 48-48.50, followed by 50

The Philippine peso closed at 47.78 vs. the US dollar last week, its lowest level in 6 years. Technical analysis points at 48-48.50 as the next major support for the peso, followed by 50.

Source: Fxtop.com

Philequity Annual Investors’ Briefing

We invite all our shareholders to Philequity’s Annual Investors’ Briefing on January 30, 2016 (Saturday) at the Meralco Theater to discuss strategies during this turbulent time. The briefing starts at 9am, with doors opening at 8am. Please register ahead of time at [email protected] or call our office if you wish to attend. Seats are limited and attendance are on a first come, first served basis.

Copies of our book Opportunity of a Lifetime, which are available at National Bookstore, Fully Booked branches and at the Philequity office, will also be available for sale at the investors briefing.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending