China pummels global markets

A number of factors knocked global financial markets to its worst start in history. These were the turmoil in the Middle East between Saudi Arabia and Iran, the detonation of a hydrogen bomb by North Korea, but the most far-reaching is the sharp depreciation of the yuan and the collapse in Chinese stocks.

Every global equity index were beaten down, while a multitude of currencies hit new all-time lows against the US dollar. Oil and commodity prices registered multi-decade lows.

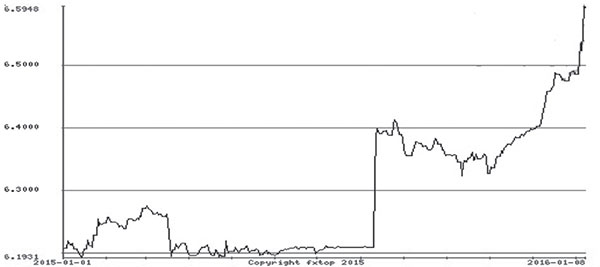

Yuan’s abrupt and sharp decline

While we were having a holiday, China let the yuan depreciate quickly and sharply, which caught everyone off-guard. The PBOC has set the yuan lower against the dollar for nine straight days since Dec. 25, 2015.

Since China devalued the yuan last August, their currency has already lost 6.4 percent against the US dollar. The yuan has been under pressure to depreciate as part of China’s currency liberalization process and their bid to establish the yuan as a global currency reserve.

USDCNY Rate (Jan. 2015 – Jan. 2016)

Source: Fxtop.com

Circuit breaker short-circuits

China’s stock market triggered the circuit breaker and was halted twice this week. The Shanghai stock market stopped trading last Monday and Thursday when the Shanghai Stock Exchange Composite Index declined seven percent on those days.

But in an ironic twist, it was the circuit breaker mechanism that was halted last Friday. The mechanism itself caused a world-wide panic in global markets.

The Shanghai index ended the week down 10 percent. This is the biggest first week loss ever for a major stock market index in history.

Source: Stockcharts.com

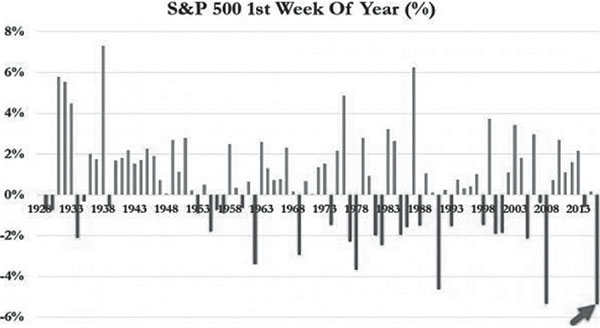

Worst first week in stocks

Global equities sold off sharply in unison last week. All markets were in the red during the first week of trading in 2016. Moreover, many markets (such as the US, Germany, China) suffered their worst start in history.

In the US, S&P 500 Index was down six percent, the Dow Jones Industrial Average lost 6.2 percent, while the Nasdaq Composite index declined 7.3 percent.

Source: Zerohedge.com

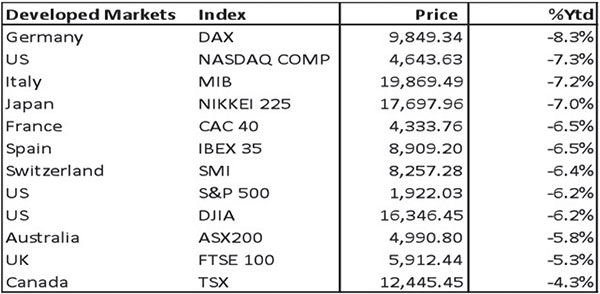

Historic 1st week drops for developed markets

The German DAX led the declines in developed markets with an 8.3 percent loss in the first week of 2016. Italy’s MIB index and Japan’s Nikkei 225 were down 7.2 percent and seven percent, respectively.

Source: Bloomberg, Wealth Sec. Research

Historic 1st week drops for Asian indices

China’s SSEC was the worst performer not only in Asia, but also globally, with a 10 percent decline. Other Asian indices such as the Hang Seng and the PSEi were down 6.7 percent and 5.4 percent, respectively.

Source: Bloomberg, Wealth Sec. Research

Currencies and commodities collapse to historic lows

Currencies such as the Russian ruble, the South African rand and the Mexican peso have hit all-time lows against the US dollar. A multitude of other currencies are either near record-lows or multi-year lows. Both Brent and WTI crude prices are below their 2008 lows. Copper broke below $2 a pound for the first time since 2009.

The final trigger to a perfect storm

With the dollar becoming strong because of the Fed hike, divergent policies of central banks and global economies still weak, China’s apparent decision to depreciate the yuan appears to be the final trigger to this perfect storm.

At the same time, this also proves China’s influence on the world economy is far more extensive than most investors previously imagined. Given the size of China’s economy and its importance to global trade, the spillover to economies and financial markets has more impact than Greece, Portugal, Spain, Italy or even Europe.

Navigating thru turbulent waters

We have seen historic drops in many assets. Many stock markets registered their worst-ever start to a year.

Indeed, these are difficult times to invest in almost all classes.

Philequity will hold an investors briefing on Jan. 30 (Sat), 9am at the Meralco Theater. We hope to give investors a guide in these turbulent times.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending