Santa comes in the nick of time

With December arriving and the market still weak, many investors gave up on waiting for Santa Claus to visit the stock market this year. But lo and behold, Santa Claus arrived just a few days before Christmas. It looks like old Saint Nick was just stuck in Manila traffic.

Back to 7000

In the last three trading days before the Christmas break, the PSEi managed to rise two percent, closing at the 7,000 level. At last Wednesday’s closing of 7,002.42, our stock market is also up 1.1 percent so far for the month of December. In fact, the PSEi may end up in the green for the year, if it can rise by 3.26 percent, or 229 points. However, we only have two trading days left before 2015 ends, so this is quite a stretch. On the other hand, the US stock market – with four trading days to go – has a better chance of eking out a gain for 2015. The Dow Jones index has to gain just 1.5 percent to breakeven, while both the S&P 500 and Nasdaq have reversed course in the past few days and are now up for the year.

Global stocks rally

Global stock markets also managed to rally just a few days before Christmas. For instance, US equity indices rose by 2.6 percent the week before they closed for the Christmas holidays. Europe’s FTSE 100 was also up 3.6 percent last week, while heavily battered Australia spiked by 6.1 percent ever since the Fed policy meeting.

Currencies strengthen against US dollar

Instead of weakening, major currencies actually rallied against the US dollar in the aftermath of the Fed decision. In fact, during the week after the Fed raised interest rates, the US dollar index, DXY, fell by 1.4 percent. Over the same time period, both the euro and Japanese yen appreciated by 1.3 percent and 1.8, respectively.

Buy the rumor, sell the fact

What can account for equities and currencies reversing their downward course? Remember investors have been waiting for the Fed rate hike for the past few years. As we have said in a previous article, this rate hike has been the most talked about, most telegraphed and most awaited rate increase (see Every Move You Make, Dec. 21). In anticipation of this, equities have been volatile, the dollar too strong and emerging market currencies weak. Thus, with the much awaited rate hike becoming “fact” on Dec. 16, we may have a classic case of buying the rumor and selling the fact.

Uncertainty removed

Since the 3rd quarter of this year, the PSEi has had difficulty staying above the 7,000 level. One reason behind this is the uncertainty over the US interest rate hike. The thing market participants hate most is uncertainty. With the US Fed finally raising interest rates, a key uncertainty was removed.

Gradual and accommodative

Moreover, Yellen continues to use words such as “gradual” and “data dependent” in her statements. In using these words, she explains the Fed’s policy is not preset and may change based on the information available at the time the decision has to be made. In addition, she said “the stance of monetary policy remains accommodative even after this increase.” Thus, it is clear she will be careful not to undo the benefits gained from previous Fed Chairman Ben Bernanke’s unconventional quantitative easing (QE) program.

(To understand what Bernanke did to save the US economy and create the bull market, see Chapter 4, Don’t Fight the Fed, of our book “Opportunity of a Lifetime,” pages 82-95.)

Seasons in the stock market

In Chapter 10 of the book “Opportunity of a Lifetime,” investor Education, a portion was allocated to explain seasons in the stock market. On page 195, there is a table showing that December and January are seasonally strong months. Using data since 1987, we discovered that during the months of December and January, the market has a 76 percent and 64 percent chance of giving investors a positive return, respectively. With the past week’s Santa Claus rally, it looks like December will be true to form. Hopefully, probability will be on our side again next month.

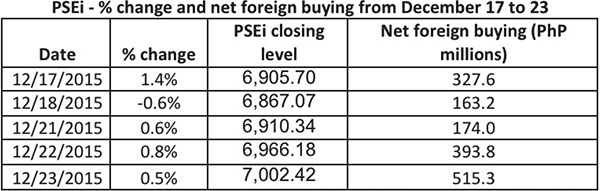

Santa brings foreign funds back

One of the reasons behind the market’s weakness this year has been heavy selling from foreign funds. From a net foreign buying balance of P48 billion at the start of April, our market has since witnessed foreign outflows of P80 billion. Thus, we are encouraged by the fact this Santa Claus rally was accompanied by five straight days of net foreign buying. From Dec. 17-23, foreign investors bought a net amount of P1.6 billion worth of Philippine stocks (see table below). This is a sharp contrast to the unabated foreign selling we have seen since April. We will continue to monitor foreign flows to see whether foreign funds have started returning to Philippine equities or the current foreign buying is just a blip. In a future article, we will enumerate catalysts that will trigger the continuation of our secular bull market.

Double bottom

For those who follow technical analysis, it is also important to note the PSEi also made a double bottom around the 6,600 level, a bullish signal. On the two occasions it touched the level, it rallied strongly and hit 7,000. If the PSEi can break out above 7,000, the next target will be 7,200. This is a formation that bears watching as it may signal the end of the current correction we are witnessing. This may be a reversal pattern that will usher in the resumption of our bull market.

Beauty with a heart

Last week, Pia Wurtzbach won the title of Miss Universe 2015. In the 2nd Q&A portion, she was asked why she should win the Miss Universe crown. In her answer, she said she wants “to show the world, the universe, rather, that I am confidently beautiful with a heart.” What she said is also true of Filipinos all over the world.

In a previous article (see Thanks to all Filipinos all over the world!, May 18), we said the Philippines’ greatest treasure is its people. Over the years, we have won the top titles in the major international beauty pageants, such as Miss Earth, Miss International and Miss World.

We have also won contests of all kinds all over the world, a testament to how talented we are.

The high demand for Filipino labor, as can be seen in our robust OFW remittances and fast-growing BPO revenues, reflects our desirable Filipino traits. Filipinos have beauty with a heart.

Congratulations, Miss Universe Pia Wurtzbach!!!

With that, there are many reasons to be happy this holiday season. Merry Christmas and a Happy New Year!

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending