What happens when the Fed raises rates?

The much awaited US interest rate lift-off is expected to be announced this week during the Fed policy meeting on Dec.15-16. With liftoff looming just over the horizon, a lot of questions arise in investors’ minds.

1) Is the US economy strong enough to handle higher interest rates?

2) Will higher interest push the US economy back into a recession?

3) Will the US dollar strengthen even further?

4) Will the interest rate hike bring stocks into a bear market?

In this article we will try to answer those questions by analyzing historical episodes of monetary policy tightening over the past three decades.

While conventional wisdom suggest monetary tightening will boost the US dollar and will be negative for the economy and stocks, it is not supported by historical evidence. On the contrary, we may likely see the opposite materializing as investors unwind expectations that have already been built in the markets.

Fed hiking cycles – the past 30 years

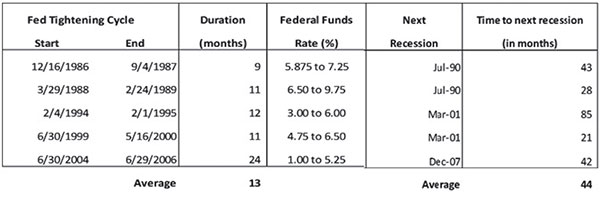

Over the past 30 years, there have been five interest rate hiking cycles by the Fed as shown by the chart below. These tightening cycles lasted for 13 months on average. The most recent cycle (2004-2006) was the longest, lasting for 24 months. It was also the time when the Fed funds rate saw its biggest increase of 425 basis points when the Fed jacked the rates up from one percent to 5.25 percent

Source: NBER, Wealth Securities Research

US economy expands even when the Fed is tightening

Looking back 30 years, the US economy experienced sustained growth even when the Fed was on a monetary tightening cycle. Rightly so, because the Fed makes sure the economy is strong enough and growth is sustainable before they commenced raising interest rates.

In fact, the recessions that followed appeared 44 months or roughly 3 ½ years, on average, after the Fed started raising rates. Hence, it was WAY AFTER the Fed had ended its Fed tightening cycle and clearly NOT AT THE ONSET.

Impact on the US dollar

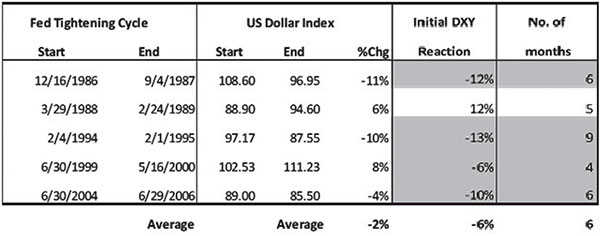

Data shows the effect on the US dollar index during the past five Fed tightening cycles is mixed with three episodes showing declines, while two episodes showed gains in the US dollar.

However, a closer look shows the initial reaction is more likely to be a decline in the dollar index. On average, the dollar pulls back 6% six months after the Fed starts hiking rates.

Source: NBER, Wealth Securities Research

Impact on US stocks

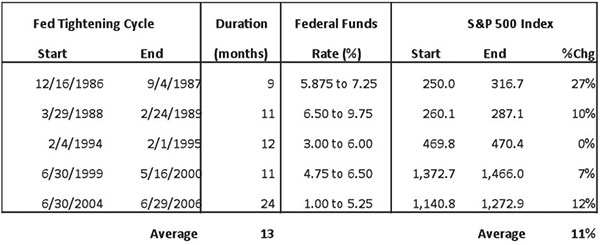

Meanwhile, the impact on US stocks is different from what a typical investor would expect (which is for stocks to decline during monetary tightening cycles). The expectations of a first rate hike has been negative for stock market performance. What is surprising is the US stock market continued to perform well throughout the Fed tightening cycle. Data shows the S&P 500 index had a positive tendency during the cycle, averaging a return of 11 percent in the past five instances.

Source: NBER, Wealth Securities Research

Only one episode (1994-1995) showed a flat return. In this occasion, while the Fed had already been hinting at a rate hike, the timing and the magnitude of the hike came as a surprise to the market. Poor communication by the Fed resulted in wilder market swings which included a couple of near 10 percent declines before ending the period flat.

Bull market continues during interest rate hikes

Based on past tightening cycles, the US stock market continued to rise even when the Fed started raising interest rates.

Below is the most recent example where one can see the Dow Jones Industrial Average rising for 1 ½ more years after the Fed stopped raising interest rates in July 2006. The big decline, which eventually resulted in a global bear market (not only in stocks but also in most other assets), appears to have coincided with the December 2007 – June 2009 recession.

Similarly, the market had their big declines at the onset of the 1990 and 2001 recession which were way after the end of their respective Fed tightening cycles.

Dow Jones Industrial Average

Source: Wealth Securities, Inc.

Fed language is important

This 1994 episode is the reason why the Fed is much more careful this time around as they prepare to raise rates after maintaining it at near zero for seven years. Because the move is so highly anticipated, what matters more to the market is for the Fed to succeed in communicating clearly and assure the market of a “gradual and cautious” tightening pace.

In any case, a move of 0.25% to 0.5% in fed funds rates means that, with rates still at ultra-low levels, there is still no alternative but for investors to continue having investment in equities. And if history proves right, the stock market may again be on its way to another positive run in this upcoming Fed hiking cycle.

Reversal on lift-off day?

Today, we have one of the most anticipated rate hike in history. This has been discussed for more than two years since Bernanke first talked about Fed tapering in May 2013. In fact, the US dollar has been strong and the stock market has been volatile ever since the talk of a Fed rate hike started. But based on our studies, we may actually see these trends reverse on D-Day (Lift off/Fed interest rate hike on Dec 16) which is typical of a “Sell on News” phenomenon

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending