Currency wars 2015

In our article last Monday (see Is the peso weak?, Aug. 10, 2015), we wrote about the weakening peso. While the peso depreciated against the US dollar, it has fared well against major and regional currencies except for the Chinese yuan which is “basically pegged to the dollar.”

But that has changed. Last Tuesday, the yuan-dollar peg finally succumbed to the pressures of a steadily rising dollar.

The People’s Bank of China (PBOC) shocked the markets when it allowed the yuan to weaken by three percent last week. Although this move may seem modest compared to the moves in other currencies this year, last week’s drop was still the yuan’s biggest decline in 20 years.

Competitive devaluation

Many view this move as a case of “competitive devaluation” or deliberately weakening the currency to subsidize exporters. Note that China may be keen on boosting its exports which has been slumping for most of 2015. Exports constitute 30 percent of China’s GDP. It recently dropped 8.3 percent year-on-year in July, widening from a 6.6 percent decrease in June.

Slowest growth in a quarter of a century

In addition to falling exports, recent data also showed that the Chinese manufacturing sector unexpectedly stalling in July with Chinese PMI registering 50 from 50.2 in June. The Chinese government is expecting its GDP to grow seven percent for 2015 which will be the lowest level in nearly a quarter century. Hence, the devaluation is seen as a means to boost both exports and GDP.

Commodity producers feeling the pressure

Alongside slowing GDP growth, imports have also been faltering. China’s imports declined 6.1 percent in July, following a sharp fall of 15 percent in June. This is the reason why commodity producers are feeling a lot of pressure not only from the strong dollar but also from weak demand coming from China.

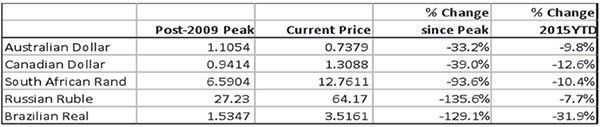

Hence, countries which export commodities to China such as Brazil, Australia, Canada and South Africa, have depreciated the most this year as prices of oil, nickel, aluminum and zinc reached multi-year lows.

Commodity currencies vs. the US Dollar (since post-2009 peak)

Source: Bloomberg, Wealth Securities Research

Still a long way to go?

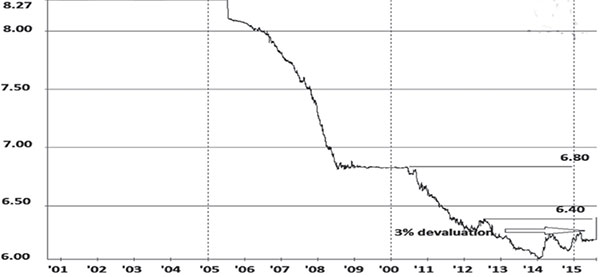

Japan has allowed the yen to devalue the past couple of years and has so far dropped 64 percent against the greenback. While the yen is weakening, the yuan has actually appreciated from 8.27 against the US dollar to a peak of 6.04. In fact, despite the recent devaluation move, the yuan is still up 22 percent against the dollar from 8.27. Since China’s currency has even appreciated against the dollar while others have sharply weakened, it is not surprising that its economy (particularly its export sector) has suffered.

Towards a more “market-oriented” system

Chinese authorities were quick to defend that their move is a policy shift towards a more “market-oriented” and transparent system for setting exchange rates. At the same time, some analysts view this as a reform that would bring China closer to floating rate. The ultimate aim is for the yuan to be included in the IMF’s basked of reserve currencies known as Special Drawing Right (SDR).

No surprise at all

Many investors may have been by stunned by China’s move. However, looking at the 15-year chart below shows the yuan topping out in early 2014. And the fact that a dollar bull market has been unfolding globally as we have written many times these past three years, there really is no surprise at all (please see our book, Opportunity of a Lifetime: Chapter 7 – The Peso Tops Out).

Note that the yuan has been gaining against the US dollar steadily the past 15 years. Last week’s three percent devaluation brought the yuan right at the 6.40 resistance. Longer-term, the yuan may target 6.80 or 12.5 percent decline from peak.

USD/CNY (2000 to 2015)

Source: Fxtop.com

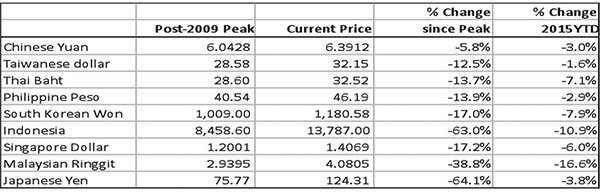

Regional currencies succumb further

Currencies of top Asian exporters like South Korea and Singapore have both weakened considerably this year. The Korean won has lost 7.9 percent while the Singapore dollar has declined by six percent year-to-date. Previously, the Singapore dollar has been one of the more stable currencies in the region, together with the peso. However, the slowdown in China which is Singapore’s top export destination has caused the Singapore dollar to deteriorate sharply in recent months.

The Malaysian ringgit has fallen by 39 percent from its peak and 16.6 percent year-to-date. It reached a new all-time low of 4.08 against the dollar last week which is even lower than the 1997-Asian crisis levels.

Meanwhile, the Indonesia rupiah has lost 63 percent from its peak and 10.9 percent year-to-date. It hit 13,787 last Friday, its lowest level since 1998.

Regional currencies vs. the US Dollar (since post-2009 peak)

Source: Bloomberg, Wealth Securities Research

Drop in regional currencies affects ASEAN stock markets

The yuan devaluation has caused the most volatility in ASEAN as their stock markets also dropped together with their currencies. The Singapore Strait Times Index (STI) dropped as much as 4.2 percent last week before recovering to close the week down 2.6 percent. The Jakarta Composite Index (JCI) declined by as much 6.1 percent and was down 3.9 percent by the end of the week. Meanwhile, the Kuala Lumpur Stock Exchange Index (KLSE) plunged 14.3 percent for five straight days without recovering.

Corruption scandals compound problems in Malaysia & Brazil

Lower commodity prices has affected the economies of Malaysia and Brazil which are heavily dependent on commodity exports. But on top of that, the corruption scandals faced by Malaysian Prime Minister Razak and Brazilian President Dilma Rousseff (who is now at risk of being impeached) have compounded their countries’ woes. The scandals have clearly accelerated the deterioration of their respective economies, their currencies and their stock markets.

Phl equities dragged down by the region

The Philippine economy is least affected by the devaluation in China. The Philippines’ imports from China are much larger than its exports. It is also a domestic consumption-led economy rather than an export-led economy.

The Philippines, likewise, is not affected as much by the drop in commodity prices. In fact, the Philippines has big benefits from the drop in oil prices. It has also no corruption scandal like in the case of Malaysia and Brazil.

But nevertheless, the weakness in Asean currencies especially in the case of the Malaysian ringgit and the Indonesian rupiah, plus the poor sentiment in emerging market and Asean equities has affected Philippine equities as well.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, call (02) 689-8080 or email ask@philequity.net.

- Latest

- Trending