The big driver

The past two weeks saw major moves in stock markets and currencies around the world. More importantly, after a volatile period brought about by the Ebola scare, US stocks, the leader in global equities, are now at new highs. The main impetus behind this is the Bank of Japan Governor Haruhiko Kuroda’s big drive.

Pitching out of the sandtrap

In a previous article, we wrote about how Kuroda pledged to pitch the Japanese economy out of the sandtrap it has been trapped in for the past 23 years (see Out of the Sandtrap, April 15, 2013). While many doubted whether he would succeed, Washington Sycip, one of Philequity’s directors who knows Kuroda personally, said that he believed that Kuroda would succeed in his mission.

True enough, as soon as Kuroda was appointed BOJ governor in March 2013, he hit the ground running and set a two-percent inflation target that he expects to be hit in two years. To do this, he announced a ¥60-to ¥70-trillion annual monetary stimulus program. This electrified Japanese stocks, with the Nikkei rising as much as 50 percent after the announcement.

A big drive from Kuroda

However, 18 months and one sales tax hike after, inflation remains around one percent. This caused many traders to doubt Abenomics and Kuroda’s plan. After rising 50 percent since the announcement of Abe’s three arrows and the first installment of Kuroda’s QE, the market has been meandering with the Nikkei not going anywhere for most of 2014. With many doubting the effectiveness of Abenomics and the resolve of Kuroda, the BOJ governor knew he had to act and make a big drive.

Surprise attack from Kuroda

On Oct. 31, Kuroda announced the expansion of his program, which he dubbed Quantitative and Qualitative Easing (QQE). He raised the annual target for enlarging the monetary base to ¥80 trillion ($724 billion). This surprised his members of the monetary board and even the Prime Minister himself, Shinzo Abe, who said that “I didn’t think they would take action.” With only Kuroda and handful of his men in the loop, everyone from the government to market participants were shocked by Kuroda’s surprise attack.

Halloween treat from Kuroda

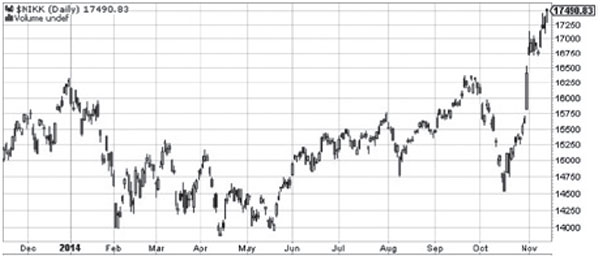

Thus, Oct. 31 became a memorable date for all those who were stock market bears. Kuroda’s surprise attack created the perfect moment for bulls to rush in. The Nikkei 225 rose more than four percent in one day and the yen plunged by three percent, squeezing short sellers and sending the bears back to their caves. See below a one-year chart of the Nikkei 225. Both the Dow Jones and S&P made new highs while European indices spiked more than two percent in one day on the back of this announcement. With this act, not only did Kuroda make good on his pledge, but he also gave global investors a Halloween treat.

Nikkei 225 – one-year chart

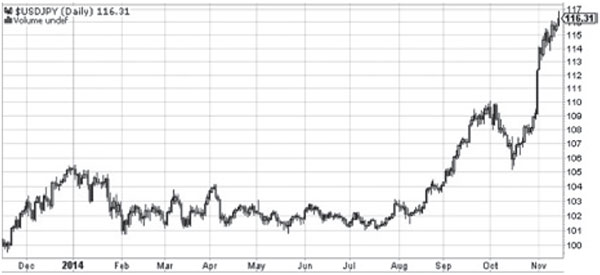

Yen plunges 11 percent in one month

As a result of Kuroda’s unprecedented easing measures, the Japanese yen staged a momentous 11-percent plunge. From the bottom of 105 in mid-October, the yen rose to 116 in just a month. These are levels not seen since 2007. See below a one-year chart of the Japanese yen versus the US dollar.

USDJPY – one-year chart

QE vs. QQE

In his statement, Kuroda said that he is now embarking on “a new phase of monetary easing both in terms of quality and quantity.” The main difference between Japan’s QQE and the US version of quantitative easing (QE) is the type of assets that the central bank is allowed to purchase. While the Federal Reserve can only purchase bonds and mortgages, Kuroda’s QQE program allows for the purchase of not only bonds, but also stocks, exchange traded funds (ETFs) and real estate investment trusts (REITs) as well. Thus, Japan’s QQE is unprecedented not only in size, but also in the type of assets it covers.

Central banks want stocks to go up

It is not only the Japanese central bank that wants stocks to go higher, but central banks around the world as well. The fact that most global central banks are giving a big assist to equities with different versions of QE is the central thesis of why we believe we are in a global bull market. Central banks are so afraid of a double-dip recession and

deflation that they are using everything in their armory to lift global economic activity, the effect of which is the global bull market we are seeing now, which includes even the Philippines.

Japan’s pension fund to buy stocks all over the world

After Kuroda’s surprise move, there was yet another surprise gift awaiting investors. Japan’s public retirement savings manager, the Government Pension Investment Fund (GPIF), announced that it will be implementing a new strategy to enhance its returns. It said that it is decreasing its asset allocation of domestic bonds from 60 percent to 35 percent, while increasing its allocation to Japanese equities from 12 percent to 25 percent. This sent Japanese equities rallying further. However, another portion of the announcement excited investors even more – the GPIF said that it will be increasing allocation to foreign equities to 25 percent from 12 percent as well. This sent equity markets around the world higher, with the US breaking out to new highs.

GPIF to buy Philippine stocks

According to some research firms, the GPIF will have to purchase ¥11.5 trillion ($101 billion) worth of equities around the world, including Philippine stocks. One investment house even estimates that the GPIF may have to triple its current exposure to Philippine stocks in order to meet its target asset allocation. While we do not know what stocks they will buy or when they will start, this large amount of foreign buying will be a boost to our stock market.

Please visit our online trading platform at www.wealthsec.com or call 634-5038 for detailed stock market research. You can also visit www.philequity.net to learn more about the Philequity Fund and view our archived articles. You can email us at [email protected] for feedback on the Philequity Corner articles.

- Latest

- Trending