Cheaper commodity prices, a blessing for Filipino consumers

In last week’s article, we wrote about how the strong US dollar has caused currencies around the world to weaken, including the Philippine peso (see It’s the strong dollar, stupid! Part II, Oct. 7, 2014). Many central bankers have recently raised their concerns about an overly strong dollar and its effect on their country’s economy. Even Federal Reserve Chairman Janet Yellen has expressed apprehension over the recent upward move of her country’s currency. In the recently released minutes of the Fed’s September meeting, the Fed cited an overly strong dollar as a threat to global growth.

Strong US dollar brings down most commodity prices

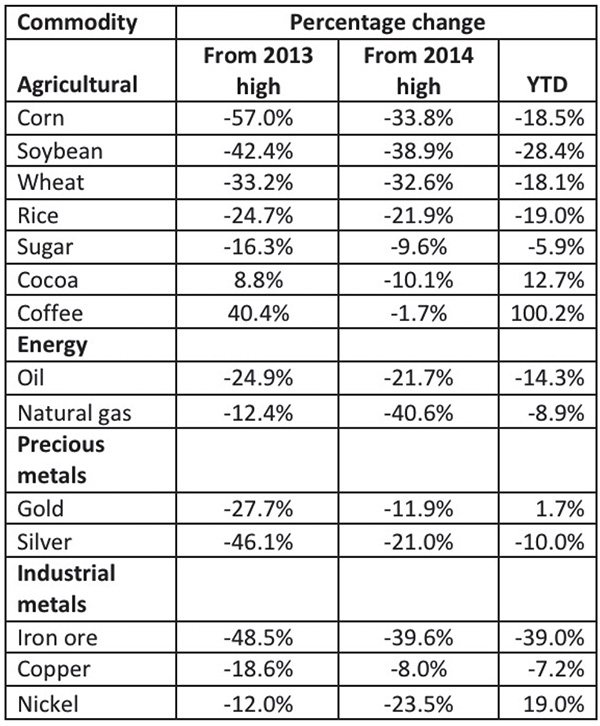

Indeed, the US dollar strength has many ramifications. One of these is weakness in another important asset class – commodities. Since most global trading is still done in US dollars, prices of major commodities have naturally dropped in US dollar terms. See below a table showing the price performance of various commodities since their 2013 and 2014 peaks, and their year-to-date (YTD) performance.

Most agricultural commodities fall on supply glut

As can be seen in the table above, many agricultural commodities have lost between 25-60 percent of their value in less than two years. However, it is not only dollar strength that is to blame. Some commodities have dropped more than others because of a supply glut, as is the case with most agricultural commodities. Record harvests in key markets have definitely weighed on corn, soybean and wheat prices.

Oil plunges on supply overhang from US shale

Just this past week, oil plunged to lows not seen since 2012. Weaker than anticipated demand from China and Europe, coupled with rising inventory brought about by record US shale oil production, have also caused oil prices to fall more than 10 percent this year. West Texas crude prices are now at $85/barrel, while Brent crude oil has fallen to $90/barrel, levels not seen in years. This descent to levels below 100 was further exacerbated by a slowing global economy and ever increasing oil supply coming from the US as it transforms into a net oil exporter.

Coffee and nickel rise on supply concerns

Some commodities did buck the trend though and moved higher. Coffee is the high flyer of the year, up a whopping 100 percent as of this writing. This is on the back of a drought and fungus afflicting crops in Brazil, the world’s largest producer and exporter of coffee. On the other hand, despite its sharp plunge in the past month, nickel is still up 19 percent for the year as the supply and demand balance is expected to swing into a deficit in 2015. The metal was up as much as 45 percent for the year. This goes to show that while dollar strength leads to lower commodity prices, supply and demand is still the key determinant of the price of commodities.

Of Ebola and chocolates

Many people are worried about the Ebola virus, especially workers in the health industry because they fear getting infected by this lethal illness. For those in Africa, this fear is even more real because they are in close proximity with the actual epidemic. However, this lethal virus has affected even commodities. Cocoa, the main ingredient of chocolate, has spiked as much as 25 percent for the year. The reason is that the two countries which account for 60 percent of the world’s cocoa production, Ghana and the Ivory Coast, are located in West Africa, the epicenter of the Ebola epidemic. We hope that this epidemic is contained as soon as possible and that no more lives will be taken by the Ebola virus.

Gold meltdown

Precious metals have also succumbed to US dollar strength. With subdued inflation, gold and silver plunged by 27 percent and 46 percent, respectively, since their 2013 highs. Neither the Russian conflict nor the repeated ISIS attacks were enough to lift gold prices. The slowing global economy is one of the primary reasons behind the weakness in precious metals. Even historically low interest rates were not enough to lure investors to buy gold and silver. In a previous article more than a year ago, we gave a long discussion on why it was no longer worthwhile to invest in gold (see Gold Meltdown, April 22,2013). With the US dollar continuing to strengthen, strong support levels for both gold and silver were broken, with both metals currently at multi-year lows.

One man’s bread is another man’s poison

While the dollar strength has a significant effect on commodity prices, let us not forget that this price drop will also have a profound impact on the global economy. That said, different countries will get affected in different ways. Raw material exporters will bear the brunt of weak commodity prices, such as Russia, Brazil, South Africa, Australia and Indonesia. Growth forecasts for commodity-exporting countries have already been downgraded and they continue to feel the pain. On the other hand, countries that import commodities will be able to buy these at a much cheaper price. As the saying goes, one man’s bread is another man’s poison.

Less value for Philippine mineral exports…

As for the Philippines, there is concern over the dollar value of our mineral exports. The country exports both precious and industrial metals, such as gold and copper. Thus, our export receipts from these will be much lower. Although the country has large amounts of mineral reserves, what is being mined and exported is just a miniscule portion of that. As a result, the mining sector comprises just one percent of our GDP, hence the impact is limited.

… but cheaper agricultural and oil imports bring down inflation

On the flipside, we also import large amounts of agricultural products, such as corn, wheat, soybean and rice. Another significant impact on our country comes from the drop in oil prices. A net oil importing country, the Philippines imports more than $15 billion of crude oil and petroleum products. This is one of the biggest components of inflation, affecting everything from food prices to transportation cost and our electricity bill. With both agricultural and oil prices dropping, we will be seeing lower inflation.

Lower commodity prices a boon

It is important to note that more benign inflation and the resulting lower prices will spur more consumer spending. Remember, since 75 percent of our GDP comes from domestic consumption, stronger spending will lead to higher GDP growth in the future.

A blessing for Filipino consumers

One of our fund manager’s investment criteria is to invest in companies that have good business models and whose long-term growth is intact or improving. Our research analysts then evaluate companies based on these metrics. The same thing can be said for countries. When our fund manager invests in countries, he applies the same criteria. The Philippines is a country with a good business model because of its OFWs, BPOs and demographics. Being a consumption-led economy, the recent weakness in commodity prices actually enhances and improves the country’s growth story as consumers have more money for domestic consumption. Thus, this drop in commodity prices is a blessing not only for the Filipino consumer, but a blessing for Philippine economic growth as well.

Please visit our online trading platform at www.wealthsec.com or call 634-5038 for detailed stock market research. You can also visit www.philequity.net to learn more about the Philequity Fund and view our archived articles. You can email us at feedback@philequity.net for feedback on the Philequity Corner articles.

- Latest

- Trending