The importance of a good president

4 years ago, before PNoy was elected president, our Philequity Fund was having a Board meeting. During that meeting, one of our directors, Washington Sycip, remarked that the Philippines will finally have a truly honest and popular President. Mr. Sycip said that this is a very significant development that can propel our country and stock market to new highs. Putting his money where his mouth is, Mr. Sycip increased his investment in the Philequity Fund. His words have proven to not only be prophetic, but profitable as well.

Pricing in a good leader

By the beginning of June, when it was imminent that PNoy would win, the stock market started rising. From that time until now, the PSEi rose by a whopping 103%. However, Mr. Sycip’s additional investment in the Philequity Fund did much better, rising by 125 percent over the same period. The same phenomenon is now happening in other countries, with various equity indices pricing in the victory of a leader who is perceived to be honest and capable of implementing much-needed policies and reforms.

Shifting tides

With a number of elections happening this year, 2014 will crown many leaders. Last April 9, Indonesia began its legislative elections as a prelude to the presidential elections that are to be held on July 9. India also held its month-long electoral process, which began April 7. Italy also recently concluded its own elections last May 25. While people vote for these leaders based on ideology, many are unaware that their choice of leader has a profound impact not only on their country’s well-being, but on their financial assets as well.

Historic elections in India

Let’s take the case of India’s elections, which were historic in many ways. Held from April 7 to May 12, it was the longest electoral process in the country’s history. A total of 814 million people were eligible to vote, with 66.38% of them actually going to the polls, the highest turnout ever. By the time the votes were counted, it became clear that former Gujarat Governor Narendra Modi had gained the most decisive mandate since 1984 – his party had won enough seats to govern the country without the need for a coalition. Modi’s victory had also done the impossible by ending the rule of the Nehru-Gandhi family which had dominated India’s political landscape for 67 years.

India’s Modi momentum

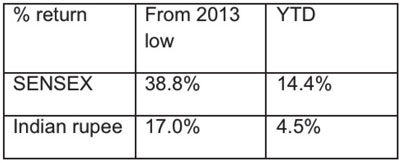

Many who voted for Modi were also voting for a new India not marred by corruption and policy paralysis. Therefore, when Modi promised that he would take decisive action to revive economic growth, business leaders flocked to his side to fund his campaign. With his victory, it is likely that badly needed investments in power, road and rail would be prioritized. Pro-business Modi also pledged to open India up to foreign investment. Over 3 days, India’s stock market had a 7% run while the rupee strengthened by 2%. Even before Modi’s unprecedented victory was announced, India’s SENSEX had been hitting all-time highs, a clear sign of investor confidence in Modi’s vision for India. See below a table showing the stellar performance of India’s SENSEX and rupee.

Indonesia’s Jokowi rally

Other than India, Indonesia also held its own set of elections last April. What is interesting is how a mere nomination could actually create a stock market rally, which is what happened on March 14. On that date, the main opposition party announced that Jakarta Governor Joko Widodo would be the party’s presidential nominee. From being down by more than 1% that day, the Jakarta Composite Index was electrified, sparking a rally that sent the market up by more than 4%. Popularly known as Jokowi, he is viewed as an honest leader who has veered away from the dirty, traditional politics that have pervaded Indonesia’s landscape for decades. Thus, his nomination was welcomed not only by voters clamoring for a new leadership but investors who support his pro-reform policies as well.

Rally loses its base

Unfortunately for Jokowi, his pro-reform stance was not enough to garner him 20 percent of the vote required to run solo. With only 19 percent of the vote, PDI-P had to form a coalition with other parties willing to give up their presidential aspirations. During the process, one of the parties they were counting on switched to another coalition, robbing Jokowi of the majority needed to push reforms forward. With the opposing coalition holding more seats in parliament than his coalition, even Jokowi’s victory in presidential elections will not ensure the passing of his reforms. With the Jokowi rally now baseless, the Indonesia’s stock market failed to follow through, currently lying a mere 0.3 percent above the close of March 14.

Italy’s Renzi Frenzy

Just like India, Italy’s elections last May 25 were unprecedented as well. Florence Mayor Matteo Renzi rode to thunderous victory, becoming the youngest ever Italian premier, with Italians handing him the country’s biggest electoral win in more than half a century. Voters endorsed his aggressive and disruptive approach, with Renzi telling reporters after his victory that “the demolition can now begin.†Renzi, who embraces the business community and vows to fight corruption in Italy, had a good track record modernizing Florence and privatizing businesses. Believing he could bring this to a national level, fund managers gave him their vote of confidence, causing the Italy’s equity index to rally by more than six percent in a week and sending 10-year bond yields to an all-time low of 2.88 percent. As of this writing, the Renzi frenzy in Italian assets continues.

The Importance of a Leader

As you can see from the election results in India, Indonesia and Italy, a leader has tremendous implications on a country’s fortune and destiny. Through his programs, a president or prime minister can either make or unmake a nation. His actions will impact both his country’s economy and stock market for years and decades to come.

Philippines – Investment grade and beyond

The same is also true in our own country. While PNoy is on the right track in weeding out corruption and spurring infrastructure spending, 6 years is not enough to complete all the reforms he has in mind. It is crucial that these policies continue, otherwise, the bull market in Philippine stocks might lose its legs. It is true that P-Noy’s policies cannot be undone overnight and we expect his reforms to continue, but much more effort is needed to take these to the next level. Not only have we gotten the much coveted investment grade rating, but the S&P even upgraded us to one notch above that. If our country continues on its upward trajectory, so will our stock market. That said, last week’s disappointing 1Q14 GDP figures are a reminder that neither the current nor future government can be complacent in running this country if they truly want the Philippines to progress.

Beyond 2016

Now that the path to progress has been laid out and the proper reforms instituted, what is crucial is the continuation of policies. The next president should not only continue these reforms, but improve on them in terms of efficiency and implementation. In our next article, we will be tackling this issue and explain why we believe that our bull market will continue beyond 2016.

Please visit our online trading platform at www.wealthsec.com or call 634-5038 for detailed stock market research. You can also visit www.philequity.net to learn more about the Philequity Fund and view our archived articles. You can email us at [email protected] for feedback on the Philequity Corner articles.

- Latest

- Trending