IMF's Nolan upbeat on RP's growth prospects

The International Monetary Fund's (IMF) resident representative to the country, Sean Nolan, said yesterday the economy will still be able to achieve its gross domestic product (GDP) growth target of four to five percent this year despite a spate of negative developments lately.

![]() "In spite of recent negative events lately that tend to scare off investors,

the country's macroeconomic fundamentals remain strong," Nolan said, adding

that "the growth targets are achievable."

"In spite of recent negative events lately that tend to scare off investors,

the country's macroeconomic fundamentals remain strong," Nolan said, adding

that "the growth targets are achievable."

However, Nolan admitted the recent negative developments such as the ongoing stock market scandal have created a diversion from other positive developments.

He noted, "it's easy to get caught up in recent events, but all other indicators are okay." These include, Nolan said, the low inflation figure.

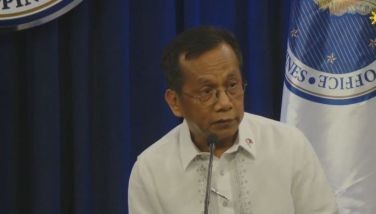

Even former Finance Secretary Edgardo B. Espiritu, who arrived from the US the other day, said that foreign investors are still bullish on the local economy despite some negative reports about the stock market.

According to Espiritu, one piece of good news that has been overshadowed by the recent spate of bad news was the recent passage of the retail trade liberalization law.

The passage of the law, Espiritu said, should attract foreign firms to the country which would, in turn, benefit local consumers who would now have access to better quality goods at competitive prices.

Local exporters, for their part, would be able to sell their products and have them showcased and sold by these foreign retailers, Espiritu said.

But while the IMF was generally upbeat about the economy, its recent report on the Philippines was critical of several areas and cited the need to do the following: Maintaining prudent macroeconomic policies, with emphasis on avoiding fundamental inconsistencies that risk disruptive shifts in capital flows; raising domestic savings and investment from current unsustainably low levels; further leveling the playing field through domestic and external liberalization, as well as effective programs to assist the poor and to enhance the opportunities of the disadvantaged; streamlining and strengthening the public sector which is a traditional "achilles heel " of the economy; further strengthening prudential, supervisory, and debt resolution frameworks in the financial and corporate sectors; accelerating rural development through agricultural modernization by encouraging the growth of small and medium-sized enterprises in the countryside; and improving further the investment climate by strengthening governance and economic security.

- Latest

- Trending