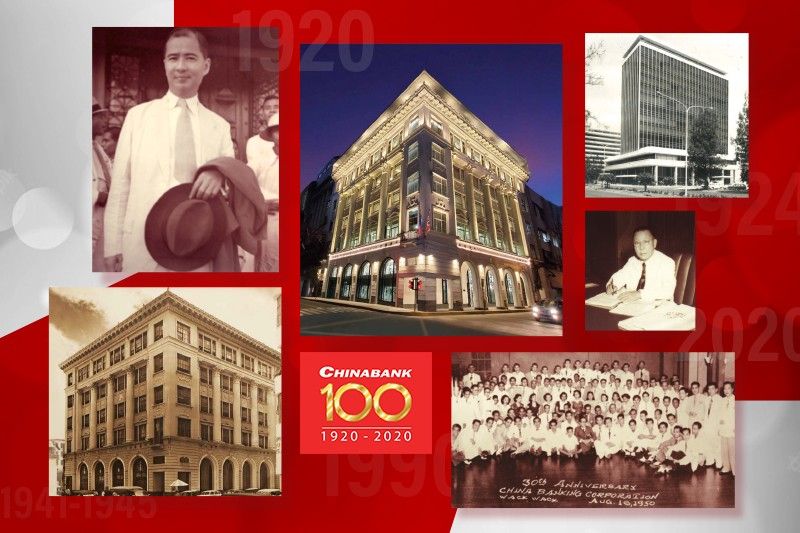

China Bank in the last 100 years: A true testament to resilience and unchanging values

MANILA, Philippines — The banking industry in the Philippines spans almost two centuries and among the pioneers, few has stood the test of time. Marking its 100th year in August 2020, China Bank is is as solid and enduring as the client partnerships it has built.

In the last century, the Bank has become a pillar of society, a driver of economic development, and a champion of corporate governance and sustainability.

Founded in 1920 with just a few employees headquartered in Binondo, Manila, China Bank has grown to be one of the biggest banks in the country with 637 branches, 1,037 ATMs and 9,747 employees.

Surviving multiple crises—The Great Depression, World War II, several financial crises, and now a pandemic—China Bank has remained steadfast in providing support and services to its customers and other stakeholders.

As the times continue to change, China Bank sets its sights into the future, unshaken and deeply rooted in its values. Until the next 100 years, go back in time with China Bank’s rich history and heritage.

For China Bank to endure a century and mark its centennial amid a pandemic is a testament to its resilience, fiscal strength and unchanging values.

“China Bank survived a number of crises in the last 100 years, from World War II to the Financial Crisis of 2007 to 2008, and had done so by helping our customers weather the storm. We are committed to do the same. Our customers depend on us, and we depend on them—we are in this together,” China Bank Chairman Hans Sy said.

Amid the challenges, the Bank posted consistent year-on-year growth in quarterly net income since the start of the global pandemic. In 2021, China Bank sustained its strong performance, posting 25% increase in net income to P15.1 billion.

“Our 2021 results reflect our disciplined execution of strategies and commitment to supporting our customers and employees. As we increasingly automate and digitize to navigate the continuing challenges of this pandemic, we are focusing on actions and investments that will redound to superior banking experiences and improved financial outcomes,” said China Bank President William Whang.

As such, China Bank emerged as the second strongest bank in the Philippines and among the top 20% in the Asia Pacific region, according to The Asian Banker’s 2021 ranking.

On the other hand, Hong Kong-based financial publication, The Asset, named China Bank as the Best Bank in the Philippines, besting even the country’s largest banks.

All these are testaments to the Bank’s strong financial performance and proven expertise in corporate and institutional banking, advisory and transaction banking, as well as its environmental, social and governance initiatives.

In the new normal era due to COVID-19 and onward to the next normal, China Bank commits to accelerate its digital progress. It bravely joins the increasingly competitive future of neobanks, fintechs and non-financial tech firms—while always keeping true to the values handed down by its founders.

- Latest