Philippines climbs ranking in digital, financial inclusion

MANILA, Philippines — The global ranking of the Philippines in terms of providing digital and financial inclusion zoomed to sixth place this year from 15th last year amid the reforms being pursued by the Bangko Sentral ng Pilipinas (BSP), the latest report from Washington-based think tank Brookings Institution showed.

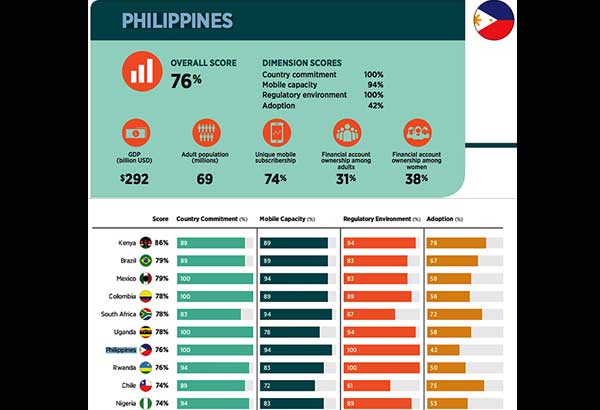

Based on the 2016 Financial and Digital Inclusion Project report titled Advancing Equitable Financial Ecosystems, Brookings said the Philippines got a score of 76 percent for sixth place this year from a score of 68 percent or 15th place last year.

“The biggest improvement in scores between 2015 and 2016 was made by the Philippines, which increased its overall score by eight percentage points,” the think tank stated in the report.

Brookings pointed out the increase was driven in part by the launch of the National Strategy for Financial Inclusion (NSFI) by the BSP as well as the strong performance in terms of mobile capacity as the Philippines has the highest rates of smartphone penetration.

The report noted mobile money interoperability arrangement between PayMaya Philippines of dominant carrier PLDT Inc. and GCash of Ayala-led Globe Telecom Inc. would further promote increased adoption of digital financial services in the country.

However, the report noted there remains a significant untapped opportunity for increased take up of digital and financial services in the Philippines.

The Philippines garnered a perfect score of 100 in country commitment and regulatory environment. It also received a score of 94 percent in mobile capacity and 42 percent in adoption.

Kenya topped this year’s list with 84 percent followed by Columbia with 79 percent, Brazil with 78 percent, and South Africa with 78 percent. Completing the top 10 were Rwanda with 76 percent, Chile with 74 percent, Mexico with 74 percent, and Nigeria with 72 percent.

The 2016 report acknowledged the work of the BSP in shepherding implementation of the Philippine NSFI and advancing the formalization of the high-level inter-agency Financial Inclusion Steering Committee (FISC).

It also recognized BSP’s past leadership role in the Alliance for Financial Inclusion (AFI) as well as its commitment to the AFI Maya Declaration to deepen financial inclusion in the Philippines.

The central bank was also commended for its support to the Better than Cash Alliance to pursue the shift from global use of physical cash to digital transactions.

In addition, Brookings also cited the BSP as a front-runner among central banks in establishing a dedicated financial inclusion unit for its work on financial inclusion data and reporting; and for the issuance of enabling and proportionate regulations.

- Latest