Last two minutes

In basketball parlance, the phrase ‘last two minutes’ refers to the final stretch of the game. It is usually the most crucial period as it decides the outcomes of close games and tightly-fought matches.

Last three trading days

This week, the PSE will have only three trading days – Dec. 27 to 29. Similar to the last two minutes in basketball, the last few trading days are crucial for the stock market. The performance of fund managers, stock indices and specific stocks are all measured based on the yearend close which falls on Dec. 29. This drives the window dressing and Santa Claus rally that we witness whenever the year draws to a close.

The Santa Claus effect

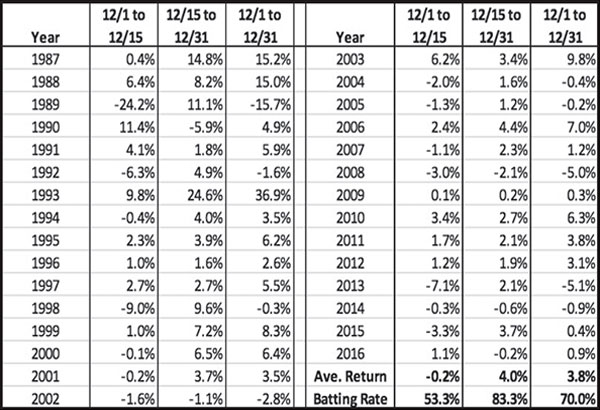

In our book “Opportunity of a Lifetime,” we discussed seasonality in the stock market and how December and January are seasonally strong months for stocks. Based on historical data of the past 30 years, December has an average return of 3.8 percent and a 70 percent chance of delivering a positive return.

PSEi – strongest between Christmas and New Year

Performance of PSE Index in December

Sources: Bloomberg, Wealth Research

As we will show in the table above, which is based on data collated from 1987-2016, the historical returns of December have been concentrated in the 2nd half the month. The latter half of December has an 83 percent batting rate and an average return of four percent. In fact, the performance of the PSEi is strongest during the period between Christmas and New Year.

Christmas gifts for investors

2017 has been a good year for the markets and investors are grateful for many things that have happened this year. Below, we enumerate the Christmas presents that investors have received this year.

1. PSEi finally breaks out past 8,000. After many failed attempts in 2015, 2016 and in the first nine months of the year (Breaking out is hard to do, Aug. 14), the PSEi finally staged a convincing breakout past 8,000.

2. PSEi reaches a new all-time high. The PSEi broke past its two-year high of 8,137 (All-time high, Sept. 25) and eventually touched an all-time intraday high of 8,605 on Nov. 3. Based on last Friday’s close of 8,432, the PSEi is up 23.3 percent year-to-date.

3. Passage of TRAIN. The first package of the government’s tax reform program (Tax Reform for Acceleration or Inclusion or TRAIN) was passed by Philippine lawmakers and signed by President Duterte into law (All Aboard, Dec. 18). Though the first package of TRAIN may fall short of the finance department’s target, the measure is still a positive catalyst for the stock market.

4. Net foreign buying for 2017. Despite the prevalence of many local risks, foreign investors have been net buyers in our stock market this year. Year-to-date net foreign buying has amounted to P51 billion (including block sales) and P6.4 billion (excluding blocks).

5. Global bull market. Led by the US, almost all stock markets moved higher this year. Most global indices are trading at new all-time or multi-year highs. This global bull market is underpinned by the synchronized global economic growth that we are currently witnessing (Synchronized global growth, June 13).

6. Strong performance of stocks despite various risks and challenges. There were several risks that emerged in the global political landscape. Similarly, political noise in the country continued to be a distraction this year. Bickering among local politicians intensified, while multiple impeachment threats to various government officials have been made. Aside from this, there was a devastating war in Marawi which caused some anxiety among investors. In addition, the market had to contend with the weakness of the peso on the back of current account and budget deficits. There were also natural disasters and calamities. Despite all these, stocks continued to move higher and the bull market remained strong.

We continue to be positive on stocks as the catalysts that drive this bull market are still present. Though it was not always smooth sailing, we are fortunate that investors were not disheartened by politics and other risks. Instead, investors have focused on the main drivers of the stock market which are corporate earnings growth and the broad-based global economic growth that we are currently witnessing.

As we celebrate the holidays with our loved ones, we are grateful for the blessings that we have received despite the presence of challenges and risks. We wish everyone a Merry Christmas and a Happy New Year!

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email ask@philequity.net.

- Latest

- Trending