Winners and losers: How the TRAIN law affects rich, poor Filipinos

President Rodrigo Roa Duterte leads the Ceremonial Signing of the 2018 General Appropriations Act (GAA) and Tax Reform Acceleration and Inclusion (TRAIN) in Malacañan Palace on December 19, 2017. ALBERT ALCAIN/Presidential Photo

MANILA, Philippines — During his first state of the nation address, President Rodrigo Duterte promised a “simpler” and “fairer” tax reform program, and he delivered after he signed a new law that overhauls the country’s 20-year-old tax regime.

On Tuesday, December 19, Duterte signed into law Republic Act No. 10963, or the Tax Reform for Acceleration and Inclusion (TRAIN) bill, which aims to generate revenue to fund a multi-billion dollar infrastructure program key to the government's economic agenda.

The TRAIN law is the first package of the administration’s much-awaited Comprehensive Tax Reform Program. It takes effect 15 days after it is published in the Official Gazette or publications of general circulation.

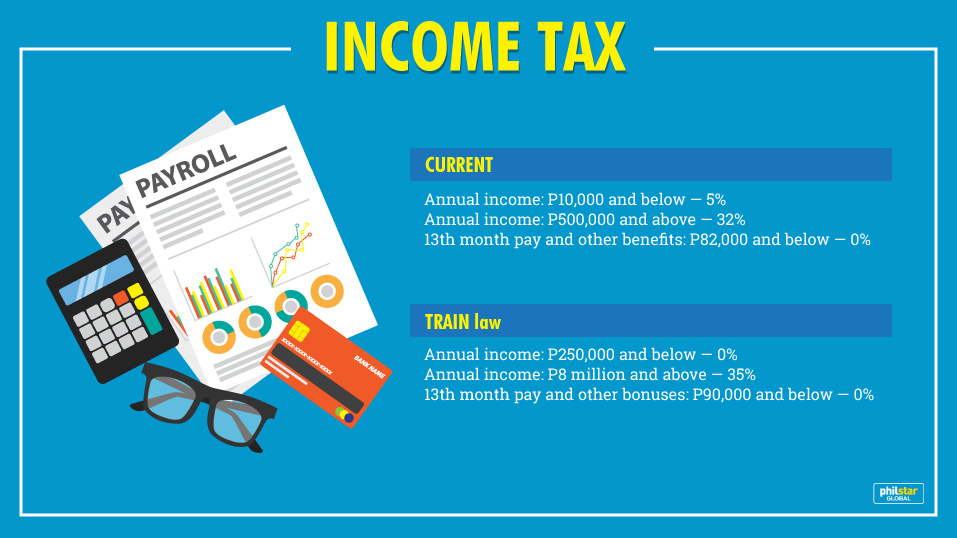

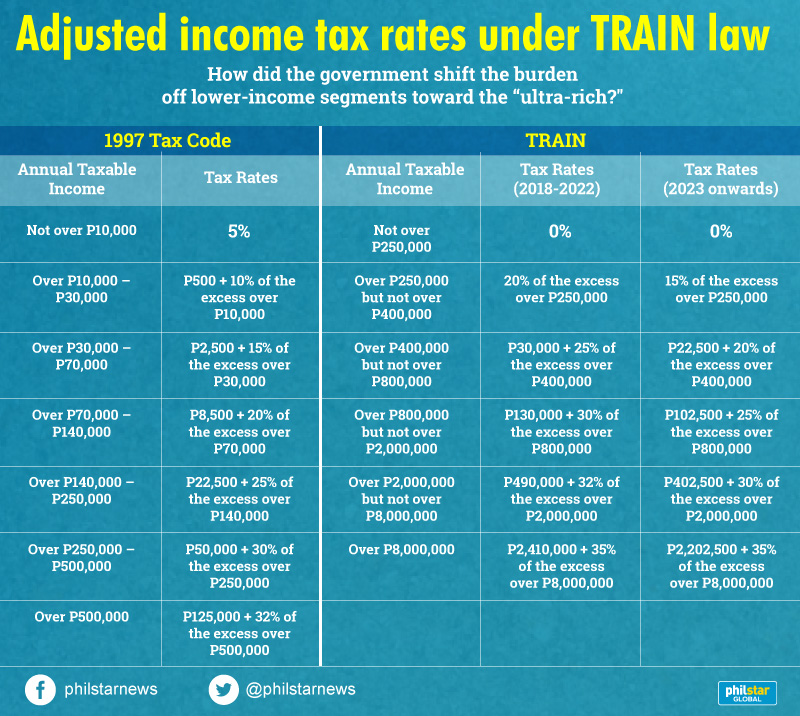

Under the fresh law, personal income tax rates will be reduced while projected revenues to be foregone from lower personal income tax will be offset by higher excise levies on petroleum and automobiles, among others.

According to the DOF, the first tax reform package was “designated to shift the tax burden from the lower 99 percent of the community to the wealthiest 1 percent.”

It would also end the country’s complex tax system that has become vulnerable to evasion and leakages by transforming it into a “simple, just and efficient” structure, the DOF added.

But before this major victory of the Duterte government, the bill, according to the president himself, had met “rough sailing” before it reached his desk. Despite the maverick leader’s huge popularity and Congress being dominated by his allies, Duterte’s tax reform program had encountered some resistance, with some lawmakers criticizing certain “anti-poor” provisions of the bill.

Some sectors also warned that imposing higher excise taxes on cars, coal, fuel, mining, among others, could hurt the robust growth of certain industries.

In that regard, is the TRAIN law really a boon or a bane for both rich and poor Filipinos?

Winners, losers

In an opinion piece published on BusinessWorld on December 19, Raymond Abrea, founder of the Abrea Consulting Group, said the “real big winners” are Filipinos making an annual taxable income of P250,000 and below as they no longer need to pay income tax come 2018.

Meanwhile, those earning above P8 million annually will be slapped with 35 percent personal income tax, higher than the current 30 percent.

Small business are likewise expected to benefit from the TRAIN law, which offers an optional flat 8 percent tax based on gross sales or receipts in lieu of business and income taxes, Abrea also said.

“Part of the tax package is an administrative reform to allow annual and quarterly filing and payment of income and business taxes in lieu of the monthly, even bi-monthly compliance under the current system,” Abrea explained.

“The bigger bonus are the ease-in-tax payment provisions from slushing the 12-page income tax return (ITR) to 2-page ITR to simplified bookkeeping requirements among others,” he added.

“This is exactly what the comprehensive tax reform package means — a simpler, fairer and more efficient tax system.”

Despite these gains, Abrea, citing the looming surge in commodity prices due to hikes in excise taxes, noted that “it’s not all good news” as people would have to “endure some sacrifices to make the system work.”

EXPLAINER: How Duterte's new tax law can affect you

According to IBON Foundation, a non-profit development organization, the TRAIN law would be a big blow to the country’s poorest, arguing that poor families will bear the brunt of higher prices on basic goods and services without getting any income tax exemptions.

IBON also pointed out that the country's rich would be the "biggest gainers" from the TRAIN act "especially when income taxes are lowered further in 2023."

“Most of the country’s total 22.7 million families do not pay income tax because they are just minimum wage earners or otherwise in informal work with low and erratic incomes,” IBON said.

“Even if TRAIN reduces income taxes paid by most of the reported 7.5 million personal income taxpayers, this still leaves as much as 15.2 million families without any income tax gains,” it added.

In a bid to allay concerns over the act’s impact on prices of basic goods, Bangko Sentral ng Pilipinas Monetary Board member Felipe Medalla said there is no need for any response from the central bank as inflationary effects of the TRAIN law would be “transitory.”

Medalla estimated inflation to go up by 1 percent next year and 0.5 percent in 2019 because of the tax reform law. But over the long-term, he said the TRAIN law should temper inflation as more infrastructures will be built.

He also said the government’s cash grant program and the lifting of quantitative restrictions on rice imports, which could slash rice-retail price by P7, would shield the poor from the sting of higher commodity prices.

“You must remember that the long-term effect of TRAIN is different from short-term effect,” Medalla told a press conference on Friday.

“The long-term effect is actually anti-inflationary to the extent that the infrastructure will reduce transportation costs and increase productivity... In the long run, TRAIN should reduce the inflation rate,” he added.

- Latest

- Trending